#FTSE_futures With US Payrolls Friday, we’ve almost gotten to the point of ignoring the day as exuberant market swings have declined over the last few years. The “fun” of trying to make sense of a fistful of darts being thrown by the markets is now mostly absent yet we suspect this is what “they” want us to think.

After all, when the stock markets stop doing stupid things, it’s generally a sign they’re really gearing up toward something really offensive and when we step back and review some recent triggers which have been hit, things could go silly quite swiftly now. Brent Crude is a case in point.

We reviewed Brent a few weeks ago, warning of the risks should the $86 level break. This price level was toasted a couple of days ago and now, from an immediate perspective, we can report continued weakness below 83.4 looks capable of promoting a visit to 82.8 with secondary, if broken, calculating down at 80.4 dollars. But it may be worth remembering our threat of real danger, when the $86 dollar barrel sprung a leak, came from a Big Picture perspective as the stuff is now seen as trading in a zone where a cycle down to 75.8 is now suspected with secondary, if broken, at an eventual $57. The nicest thing about all this potential calamity comes from the tightest stop loss level, the product needing above $86 to greatly negate current weakness potentials or above $88.7 to cancel our calculations.

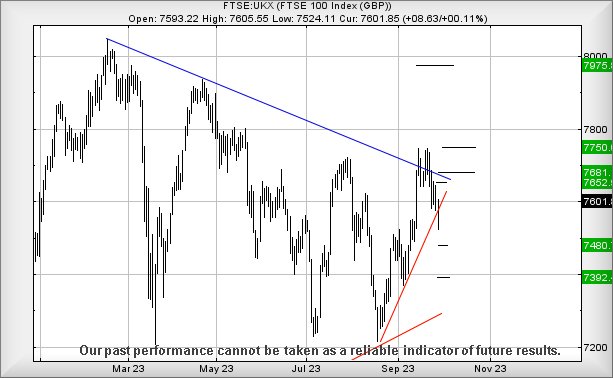

FTSE for FRIDAY. Last Friday, we presented a scenario where the FTSE risks a trip down to 7392 points. On Monday, the FTSE indeed hit the trigger level and on Wednesday it hit our target, even exceeding it slightly before bouncing from 7384 points. For a few minutes, we even thought our target level was going to be exact but the FTSE had other ideas. This created a bit of a problem as the FTSE closed the day in dangerous territory and now risks the immediate future becoming unpleasant.

Now below 7384 points risks forcing a visit down to 7264 points with our secondary, if this level breaks, working out at an eventual 7103 points. Visually, neither ambition makes much sense but we’re a little worried as the last few weeks has seen the FTSE ‘stepping down’ in 100 point increments, pausing briefly at 7600, then 7500, and most recently, the 7400 point level. This makes our calculation giving the potential of an eventual bottom at 7103 points believable.

Our alternate, less grim scenario, is certainly easier on the eye.

Above 7478 points should hopefully trigger index recovery to an initial useless 7491 points with our secondary, if bettered, working out at 7565 points. If triggered, the tightest stop loss level looks like 7410 points.

Have a good weekend and enjoy the Grand Prix.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:26:57PM | BRENT | 8379 | 8335 | 8272 | 8182 | 8495 | 8599 | 8650 | 8755 | 8501 | |

| 10:34:28PM | GOLD | 1819.82 | 1812 | 1788 | 1690 | 1835 | 1834 | 1848 | 1863 | 1814 | |

| 10:36:19PM | FTSE | 7469 | 7409 | 7370 | 7327 | 7458 | 7498 | 7519 | 7565 | 7444 | |

| 10:40:33PM | STOX50 | 4113 | 4085 | 4070 | 4051 | 4117 | 4122 | 4147 | 4176 | 4084 | |

| 10:42:41PM | GERMANY | 15108 | 15039 | 14989 | 14928 | 15099 | 15152 | 15171 | 15215 | 15094 | |

| 10:44:41PM | US500 | 4255.18 | 4227 | 4220 | 4203 | 4250 | 4271 | 4287 | 4307 | 4245 | |

| 10:47:34PM | DOW | 33098.9 | 32925 | 32847 | 32738 | 33043 | 33174 | 33262 | 33413 | 33070 | |

| 10:50:44PM | NASDAQ | 14717.98 | 14579 | 14483 | 14372 | 14674 | 14817 | 14906 | 15015 | 14740 | |

| 10:54:02PM | JAPAN | 31027 | 30851 | 30015 | 28685 | 31148 | 31213 | 31576 | 32004 | 30945 | ‘cess |

5/10/2023 FTSE Closed at 7451 points. Change of 0.53%. Total value traded through LSE was: £ 4,377,671,479 a change of -22.43%

4/10/2023 FTSE Closed at 7412 points. Change of -0.78%. Total value traded through LSE was: £ 5,643,867,508 a change of 31.79%

3/10/2023 FTSE Closed at 7470 points. Change of -0.53%. Total value traded through LSE was: £ 4,282,549,883 a change of -23.79%

2/10/2023 FTSE Closed at 7510 points. Change of -1.29%. Total value traded through LSE was: £ 5,619,099,797 a change of 6.15%

29/09/2023 FTSE Closed at 7608 points. Change of 0.09%. Total value traded through LSE was: £ 5,293,726,748 a change of 0.59%

28/09/2023 FTSE Closed at 7601 points. Change of 0.11%. Total value traded through LSE was: £ 5,262,711,869 a change of -1.95%

27/09/2023 FTSE Closed at 7593 points. Change of -0.42%. Total value traded through LSE was: £ 5,367,119,674 a change of 0.5%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:EME Empyrean** **LSE:ITV ITV** **LSE:MMAG Music Magpie** **LSE:OXIG Oxford Instruments** **LSE:SPT Spirent Comms** **LSE:TSCO Tesco** **

********

Updated charts published on : Aston Martin, Empyrean, ITV, Music Magpie, Oxford Instruments, Spirent Comms, Tesco,

LSE:AML Aston Martin Close Mid-Price: 244.4 Percentage Change: -7.56% Day High: 263.8 Day Low: 243.8

Continued weakness against AML taking the price below 243.8 calculates as ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:EME Empyrean Close Mid-Price: 0.75 Percentage Change: -4.57% Day High: 0.74 Day Low: 0.72

In the event Empyrean experiences weakness below 0.72 it calculates with ……..

</p

View Previous Empyrean & Big Picture ***

LSE:ITV ITV. Close Mid-Price: 66.54 Percentage Change: + 0.27% Day High: 67.24 Day Low: 65.08

If ITV experiences continued weakness below 65.08, it will invariably lea ……..

</p

View Previous ITV & Big Picture ***

LSE:MMAG Music Magpie. Close Mid-Price: 25 Percentage Change: + 7.53% Day High: 25 Day Low: 22

Target met. All Music Magpie needs are mid-price trades ABOVE 25 to impro ……..

</p

View Previous Music Magpie & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 1976 Percentage Change: -3.84% Day High: 2045 Day Low: 1950

Target met. In the event Oxford Instruments experiences weakness below 19 ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SPT Spirent Comms. Close Mid-Price: 93.8 Percentage Change: + 4.11% Day High: 95.3 Day Low: 91

This is almost interesting as above 96 now suggests some recovery to 109p ……..

</p

View Previous Spirent Comms & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 280.4 Percentage Change: + 3.58% Day High: 281.9 Day Low: 272.9

Target met. In the event of Tesco enjoying further trades beyond 281.9, t ……..

</p

View Previous Tesco & Big Picture ***