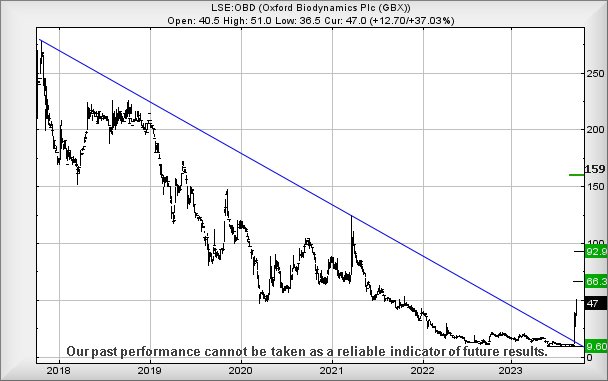

#FTSE #NASDAQ Once again, we’re doing a “readers request” report, this time on Oxford Biodynamics thanks to a bunch of folk emailing about them. Share price movements since 2017 have certainly been interesting and we were able to calculate an “Ultimate Bottom” at 9.6p, a price level where the value has lingered for the last few months.

Obviously, with this “Ultimate Bottom” calculation, there is never a certainty of a bounce. It simply represents a price level below which we cannot calculate but with Oxford Biodynamics, the share has described some truly impressive movements, due to reports of their prostate cancer analysis being approved for the US market. Given once you pass 50, the medical profession was to test annually for everything they can think of, it’s probably safe to speculate Oxford now find themselves as a supplier to a regular massive market, especially due to their claim of a 94% diagnosis success rate.

It’s certainly very reassuring share price movements with the company are backed by solid news. From our perspective, at first glance it looked like a share enjoying a campaign from internet chat rooms, essentially being ramped to the heavens. But with positive news flow, it’s understandable and now, we can calculate some useful potentials for the future.

The immediate scenario allows for strength bettering 51p to provoke further gains to the 66p level. Our secondary, if such a point is exceeded, works out at 92p and a price level where we’d normally anticipate some hesitation, due to historical movements displaying a fascination for the 100p level. However, in this instance, we can present a scenario where if the price actually closes a session above 92p, there’s a lot of free air between this level and a future 159p and a need for us to once again review the tea leaves.

To end with the best we can scrape up as a note of warning, the share price needs slump below 17p to introduce panic. Hopefully the company don’t have some bad news hiding away.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:37:44PM | BRENT | 9063 | |||||||||

| 9:41:11PM | GOLD | 1824.11 | ‘cess | ||||||||

| 9:44:36PM | FTSE | 7477.75 | 7457 | 7439 | 7405 | 7490 | 7522 | 7545 | 7574 | 7486 | |

| 9:47:39PM | STOX50 | 4100.8 | ‘cess | ||||||||

| 9:50:01PM | GERMANY | 15082.95 | |||||||||

| 10:00:32PM | US500 | 4228.38 | ‘cess | ||||||||

| 10:05:03PM | DOW | 32980 | Success | ||||||||

| 10:07:36PM | NASDAQ | 14583 | 14519 | 14465 | 14318 | 14603 | 14680 | 14723 | 14791 | 14578 | Success |

| 10:10:43PM | JAPAN | 30718 | Success |

3/10/2023 FTSE Closed at 7470 points. Change of -0.53%. Total value traded through LSE was: £ 4,282,549,883 a change of -23.79%

2/10/2023 FTSE Closed at 7510 points. Change of -1.29%. Total value traded through LSE was: £ 5,619,099,797 a change of 6.15%

29/09/2023 FTSE Closed at 7608 points. Change of 0.09%. Total value traded through LSE was: £ 5,293,726,748 a change of 0.59%

28/09/2023 FTSE Closed at 7601 points. Change of 0.11%. Total value traded through LSE was: £ 5,262,711,869 a change of -1.95%

27/09/2023 FTSE Closed at 7593 points. Change of -0.42%. Total value traded through LSE was: £ 5,367,119,674 a change of 0.5%

26/09/2023 FTSE Closed at 7625 points. Change of 0.01%. Total value traded through LSE was: £ 5,340,510,819 a change of -24.76%

25/09/2023 FTSE Closed at 7624 points. Change of -0.77%. Total value traded through LSE was: £ 7,097,867,582 a change of -9.65%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BLOE Block Energy PLC** **LSE:CEY Centamin** **LSE:FOXT Foxtons** **LSE:JET Just Eat** **LSE:NG. National Glib** **LSE:OXIG Oxford Instruments** **LSE:SBRY Sainsbury** **

********

Updated charts published on : Block Energy PLC, Centamin, Foxtons, Just Eat, National Glib, Oxford Instruments, Sainsbury,

LSE:BLOE Block Energy PLC Close Mid-Price: 1.1 Percentage Change: -4.35% Day High: 1.15 Day Low: 0.98

If Block Energy PLC experiences continued weakness below 0.98, it will in ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:CEY Centamin Close Mid-Price: 81.35 Percentage Change: -0.25% Day High: 81.8 Day Low: 80.55

If Centamin experiences continued weakness below 80.55, it will invariabl ……..

</p

View Previous Centamin & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 36.05 Percentage Change: -0.55% Day High: 36.9 Day Low: 35.7

Weakness on Foxtons below 35.7 will invariably lead to 34p next. If broke ……..

</p

View Previous Foxtons & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 946 Percentage Change: -4.40% Day High: 979.5 Day Low: 932

Target met. In the event Just Eat experiences weakness below 932p it calc ……..

</p

View Previous Just Eat & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 932 Percentage Change: -1.87% Day High: 947.8 Day Low: 921.2

Target met. If National Glib experiences continued weakness below 921.2, ……..

</p

View Previous National Glib & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2070 Percentage Change: -3.72% Day High: 2200 Day Low: 2075

Target met. Weakness on Oxford Instruments below 2075 will invariably lea ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 248.4 Percentage Change: + 0.24% Day High: 250 Day Low: 244.1

Continued weakness against SBRY taking the price below 244.1 calculates a ……..

</p

View Previous Sainsbury & Big Picture ***