#BrentCrudePrice #DAX An interesting aspect of this ‘Lockdown and Work from Home’ business stinks a bit. Quite literally, it turned out. The problem was an 18 month old computer, a device normally house trained for domestic use but instead, now seeing service daily for remote tuition, turned on from 8.30am. The particular PC also serves as the place a cat sleeps, traditionally for a few hours in the evenings but now, the animal will cheerfully spend 12 hours a day on its heated computer perch.

With home computers, there’s no-one from IT visiting to give machines their annual checkover, along with a quick vacuum for dust build-up around the fans. Instead, the first sign of trouble was apparently the cat unable to get comfortable, grudgingly opting to visit its expensive basket where it’s supposed to sleep. Once the cat vacated its computer spot, there was a grudging admission of a ‘bit of a smell’, the previously suspected source now sound asleep in a different room. In addition, the top of the computer tower was indecently hot, demanding an emergency shutdown.

Once the side was removed from the PC case, dust accumulation was quite impressive, the big fan where the machine plugs into the mains totally obscured behind what looked like lint from a tumble drier filter. It was time for a mini vacuum to finally earn its keep and it occurs, rather a lot of folk will doubtless discover the joys of hardware failures due to domestic technology attempting to function for prolonged hours in an environment quite different from nice clean offices. Regardless whether it’s a computer or laptop, machines with fans are going to become gummed up and fail while we adjust to the new lifestyle forced upon society by Covid-19. As a result, it’s likely computer hardware manufacturers shall enjoy a surprise surge in sales in the year ahead.

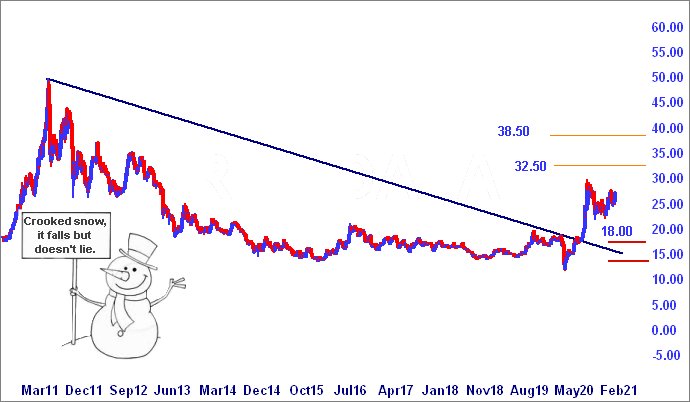

This public safety announcement is supposed to distract readers from the reality of Lloyds Bank. When we last reviewed the share 3 weeks ago (link), we were pretty confident a break of 34p would drive reversal to an initial 30p with secondary, when (if) broken at an eventual bottom of 26p. The share price broke below our trigger level 5 days ago and it moving down to our target level as grudgingly as the aforementioned cat. The share price needs exceed 38p simply to escape the immediate reversal cycle, something we’re not inclined to hold our breath for.

Visually, it’s still the case an eventual 26p makes quite an attractive entry point, if the price ever gets there! The pace of reversal, so far this year, has been steady but very, very, slow.

It’s probably important to remember things risk speeding up fairly soon. US Earnings season reports risk provoking trouble with companies issuing repeated Profit Warnings, due to earning squeeze during 2020. The coming week has results from BP, Exxon, Otis, ScottsMiracleGro, alongside a bunch of scientific and online retailers. The obvious question, will negative reports be balanced by positive reports from Ebay, Pfizer, Alphabet positive earnings?

For Lloyds to exceed 38p, it would break the immediate Blue downtrend, placing the share at grave risk of recovering to an initial 44.5p with secondary, if bettered, a fairly cheerful 50p. As mentioned previously, moves this year tend suggest 26p shall prove irresistible

.

FUTURES

| Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

| 10:38:26AM |

BRENT |

55.07 |

54.89 |

54.74 |

54.25 |

55.4 |

56.02 |

56.27 |

56.73 |

55.2 |

‘cess |

| 10:41:20AM |

GOLD |

1848 |

|

|

|

|

|

|

|

|

Success |

| 10:45:01AM |

FTSE |

6372 |

|

|

|

|

|

|

|

|

Success |

| 10:58:05AM |

FRANCE |

5391.2 |

|

|

|

|

|

|

|

|

Success |

| 11:01:42AM |

GERMANY |

13392 |

13367 |

13288.5 |

13008 |

13563 |

13642 |

13746 |

13892 |

13492 |

Success |

| 11:04:26AM |

US500 |

3703.97 |

|

|

|

|

|

|

|

|

|

| 11:35:09AM |

DOW |

29931 |

|

|

|

|

|

|

|

|

Success |

| 11:37:17AM |

NASDAQ |

12889 |

|

|

|

|

|

|

|

|

Success |

| 11:41:30AM |

JAPAN |

27698 |

|

|

|

|

|

|

|

|

|

29/01/2021 FTSE Closed at 6407 points. Change of -1.82%. Total value traded through LSE was: £ 6,807,283,964 a change of 10.19%

28/01/2021 FTSE Closed at 6526 points. Change of -0.62%. Total value traded through LSE was: £ 6,177,631,505 a change of -22.29%

27/01/2021 FTSE Closed at 6567 points. Change of -1.31%. Total value traded through LSE was: £ 7,950,046,552 a change of 35.23%

26/01/2021 FTSE Closed at 6654 points. Change of 0.24%. Total value traded through LSE was: £ 5,878,949,067 a change of -1.5%

25/01/2021 FTSE Closed at 6638 points. Change of -0.85%. Total value traded through LSE was: £ 5,968,206,921 a change of 9.52%

22/01/2021 FTSE Closed at 6695 points. Change of -0.3%. Total value traded through LSE was: £ 5,449,476,112 a change of 6.46%

21/01/2021 FTSE Closed at 6715 points. Change of -0.37%. Total value traded through LSE was: £ 5,118,625,468 a change of -7.11%