#FTSE #Nasdaq The amusing case of the “tank” parked at Wickes, Basingstoke, for some weeks, a protest due to an apparently sub-standard kitchen installation, has come to an end. The bloke has caved in to a legal demand it be moved, neatly proving he wasn’t ‘slightly ignorant’ and could rise above the moniker used by a Wickes executive last year, damaging their own share price slightly. The puzzle over the whole affair is why it happened. The chap had the remedy of the Small Claims Court, yet chose not to use it despite the cost of repairs being within the courts ability. And Wickes also chose to enjoy international TV coverage over a dispute which would have been relatively easily cleared up. The affair reeks of being a battle of ego’s on each side, one which is doubtless not finished.

However, there’s now the hope Wickes shall experience a surge in their share price, given their Basingstoke branch is no longer threatened by a 60 year old military vehicle!

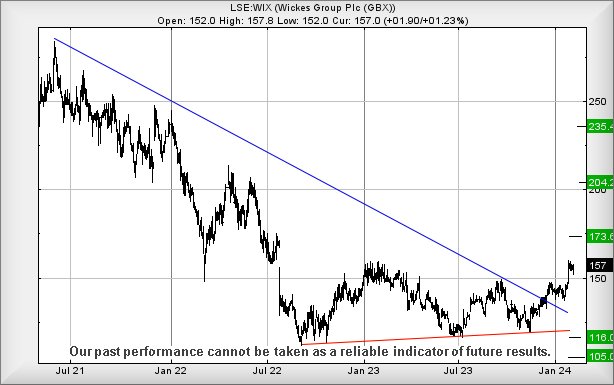

From a charty perspective, some hope is indeed possible for the share. It broke a downtrend in December last year, enjoyed an initial surge followed by an inevitable fallback. The price to which it fell back was at 137.5p, just above the level of trend break at 137p. This implies some genuine strength may in fact be evident.

Currently trading around 157p, it looks like above 160p should next trigger price recovery to an initial 173p. Visually, there’s a vague threat of some hesitation at the 173p level but given previous hiccups at this point only lasted a short time, we’re not inclined to expect real dramatics. In the event the 173p level is exceeded, our longer term secondary calculates at a future 204p along with almost certain stutters in the price cycle.

If Wickes intend any attempt at self immolation, below 137p would be a problem, risking triggering reversal to an initial 116p with secondary, if broken, at 105p and hopefully a bottom.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:38:20PM | BRENT | 7860 | ‘cess | ||||||||

| 9:42:46PM | GOLD | 2035.48 | ‘cess | ||||||||

| 9:45:47PM | FTSE | 7690.6 | 7621 | 7598 | 7563 | 7653 | 7703 | 7720 | 7738 | 7683 | Success |

| 9:48:02PM | STOX50 | 4690.9 | Success | ||||||||

| 9:50:32PM | GERMANY | 17018.2 | Success | ||||||||

| 9:54:31PM | US500 | 4949.8 | |||||||||

| 9:58:09PM | DOW | 38477 | |||||||||

| 10:00:55PM | NASDAQ | 17558 | 17476 | 17422 | 17336 | 17567 | 17582 | 17617 | 17664 | 17546 | |

| 10:04:12PM | JAPAN | 35975 | Success |

6/02/2024 FTSE Closed at 7681 points. Change of 0.91%. Total value traded through LSE was: £ 5,595,046,133 a change of -6.77%

5/02/2024 FTSE Closed at 7612 points. Change of -0.04%. Total value traded through LSE was: £ 6,001,091,520 a change of -6.39%

4/02/2024 FTSE Closed at 7615 points. Change of 0%. Total value traded through LSE was: £ 6,410,714,874 a change of 39.22%

2/02/2024 FTSE Closed at 7615 points. Change of -0.09%. Total value traded through LSE was: £ 4,604,656,485 a change of -16.86%

1/02/2024 FTSE Closed at 7622 points. Change of -0.1%. Total value traded through LSE was: £ 5,538,356,181 a change of -5.22%

31/01/2024 FTSE Closed at 7630 points. Change of -0.47%. Total value traded through LSE was: £ 5,843,417,633 a change of 22.29%

30/01/2024 FTSE Closed at 7666 points. Change of 0.45%. Total value traded through LSE was: £ 4,778,161,303 a change of -12.39%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BT.A British Telecom** **LSE:HSBA HSBC** **LSE:IHG Intercontinental Hotels Group** **LSE:RR. Rolls Royce** **LSE:SDY Speedyhire** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Aston Martin, British Telecom, HSBC, Intercontinental Hotels Group, Rolls Royce, Speedyhire, Zoo Digital,

LSE:AML Aston Martin Close Mid-Price: 176.6 Percentage Change: -3.86% Day High: 185.6 Day Low: 173.9

Now below 173 looks capable of a visit down to 163 with secondary, if brok ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 107.05 Percentage Change: -2.50% Day High: 110.3 Day Low: 106.3

Weakness on British Telecom below 106.3 will invariably lead to 102p and ……..

</p

View Previous British Telecom & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 632 Percentage Change: + 2.07% Day High: 633.9 Day Low: 626.1

Target met. All HSBC needs are mid-price trades ABOVE 633.9 to improve ac ……..

</p

View Previous HSBC & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 7570 Percentage Change: + 0.72% Day High: 7628 Day Low: 7542

In the event of Intercontinental Hotels Group enjoying further trades bey ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 317.8 Percentage Change: + 2.58% Day High: 320.6 Day Low: 312.4

Continued trades against RR. with a mid-price ABOVE 320.6 should improve ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SDY Speedyhire Close Mid-Price: 27.05 Percentage Change: -4.59% Day High: 28.5 Day Low: 25.9

Weakness on Speedyhire below 25.9 will invariably lead to 23p with second ……..

</p

View Previous Speedyhire & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 37.5 Percentage Change: -2.60% Day High: 38.5 Day Low: 37.5

If Zoo Digital experiences continued weakness below 37.5, it will invaria ……..

</p

View Previous Zoo Digital & Big Picture ***