#Gold #Wall_St Just because something has potentials doesn’t mean it will fulfil them. Long time ago, we designed an earpiece/microphone assembly suitable for mobile phones. It cost a fortune to patent and the idea of seeking investors simply never occurred, especially as Motorola had first dibs on the product. During the period when cell phone design changed from analogue to digital, Motorola discovered their flip phone could not longer cope with our gizmo and pulled out.

Eventually, we let the patents lapse as the alternative was selling the house and living in a cave. It was a shock one evening, in a Chinese takeaway, seeing someone chatting away on their Nokia with an earpiece design strikingly familiar to ours from 5 years previously. It took digital to make Bluetooth headsets a reality! As can be assumed, since that particular horror story, a great deal of care has been taken to avoid spending serious amounts of money on an “good ideas”, the event leaving just a hint of sour grapes – and a few nice design awards. However, the recent gift of a 3D Printer has accidentally kicked open the door marked “Good Ideas”. The thing has been a nightmare to get our head around, simply due to everything happening in three dimensions. As software designers, it took a while for the penny to drop 3D printing was really about writing very basic programs in an old fashioned language style as, from a Windows PC basis anyway, there’s no software capable of being operated by normal folk. It’s not a case of drawing something simple like a 3d cube in Paint, then pressing the print button. In fact, our 3d Printer isn’t even connected to a PC, instead lazing around on the wireless network in case any updates are released for its core software.

To cut to the chase, a recent visit from a plumber/electrician/boiler engineer, had the bloke mesmerised by the 3D machine quietly groaning away while it printed a batch of designs which had been knocked up. He asked what the peculiar bits of plastic were for, immediately understanding when it was demonstrated, and I could see our bill increasing when he exhaled; “That’s Genius! Can you sell me some for my parents AND grandparents”. As with most folk who’ve never wandered down the path of innovation, he was focussed on the “Potential” market size, swiftly realising anyone who takes regular pills needs this sort of thing. When it was explained there are extreme dangers, if one innovates something which doesn’t exist, as there’s an entire world out there you need to personally meet, one by one, if you’re to have any hope of success, he thankfully conceded the point but still wants 28 of the things for his family! (We’re being a little circumspect and misdirectional, something we are good at.) It’s one thing to design something which does the job better than existing products – we’ve plenty experience of that with software – but a quite different set of circumstances if you’ve just invented something like a Showjumping Hoverboard For Untrained Cats! (we’d all love to watch…)

We’re still discussing whether to take the plastic gizmo’s outside, along with the printing code, and bury them in a pit filled with lime. But in case this approach may be wrong, tomorrow a coffee has been booked with our local drug dealer (pharmacologist) for her opinion as we’re anxious to avoid the investor route from the brilliant movie “The Producers”, one unfortunately adopted by many new starts. (You sold 7 x 30% shares of the company!)

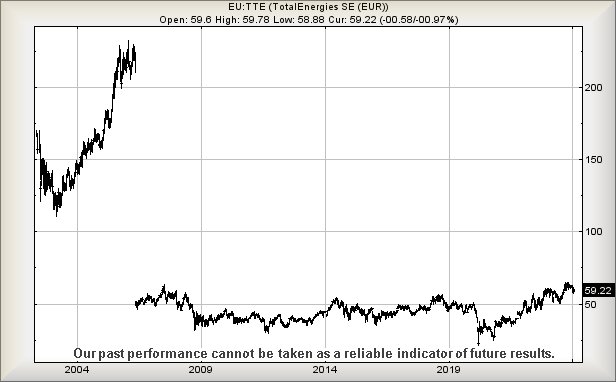

And this brings us, neatly, to TotalEnergies. We previously reviewed the company is 2022 and the price has since successfully achieved our initial and secondary targets without a great deal of fuss. Like our little bit of blue plastic, this share price is currently showing some potentials and thanks to a couple of emails, we decided it was worth revisiting. There’s an immediate problem and it’s shown on the chart below.

Essentially, since 2006, this has been a share price which has flatlined. Regardless of the reasons, folk invested prior to 2006 now need the share price to climb above 240€ if the want to break even.

However, from a relatively near term perspective, some hope is possible. Above just 63 Euro calculates with the potential of a lift to an initial 67 and a new high. Our secondary, with closure above such a level, works out at a longer term 92€.

If things intend go wrong, below Red (Currently 56 Euro) calculates with the potential of reversal to an initial 54€ with secondary, if broken, down at 49€ and hopefully yet another bounce. Our inclination is to anticipate Total Energy as heading toward somewhere between the 67 and 92 Euro levels. Somehow, achieving 92€ seems like too much of a good thing.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:28:48PM | BRENT | 7790 | |||||||||

| 9:35:16PM | GOLD | 2024.02 | 2014 | 2005 | 1997 | 2025 | 2032 | 2035 | 2042 | 2021 | ‘cess |

| 9:37:51PM | FTSE | 7624 | Shambles | ||||||||

| 9:41:01PM | STOX50 | 4660.4 | ‘cess | ||||||||

| 9:44:30PM | GERMANY | 16913 | |||||||||

| 9:46:33PM | US500 | 4937 | |||||||||

| 10:36:51PM | DOW | 38352 | 38237 | 38163 | 37956 | 38425 | 38702 | 38902 | 39130 | 38542 | ‘cess |

| 10:39:36PM | NASDAQ | 17613 | |||||||||

| 10:41:27PM | JAPAN | 36359 |

5/02/2024 FTSE Closed at 7612 points. Change of -0.04%. Total value traded through LSE was: £ 6,001,091,520 a change of -6.39%

4/02/2024 FTSE Closed at 7615 points. Change of 0%. Total value traded through LSE was: £ 6,410,714,874 a change of 39.22%

2/02/2024 FTSE Closed at 7615 points. Change of -0.09%. Total value traded through LSE was: £ 4,604,656,485 a change of -16.86%

1/02/2024 FTSE Closed at 7622 points. Change of -0.1%. Total value traded through LSE was: £ 5,538,356,181 a change of -5.22%

31/01/2024 FTSE Closed at 7630 points. Change of -0.47%. Total value traded through LSE was: £ 5,843,417,633 a change of 22.29%

30/01/2024 FTSE Closed at 7666 points. Change of 0.45%. Total value traded through LSE was: £ 4,778,161,303 a change of -12.39%

29/01/2024 FTSE Closed at 7632 points. Change of -0.04%. Total value traded through LSE was: £ 5,453,884,268 a change of -16.87%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CNA Centrica** **LSE:FOXT Foxtons** **LSE:ITM ITM Power** **LSE:LLOY Lloyds Grp.** **LSE:RR. Rolls Royce** **

********

Updated charts published on : Centrica, Foxtons, Lloyds Grp., Rolls Royce,

LSE:CNA Centrica Close Mid-Price: 133.85 Percentage Change: -0.52% Day High: 136 Day Low: 132.6

If Centrica experiences continued weakness below 132.6, it will invariabl ……..

</p

View Previous Centrica & Big Picture ***

LSE:FOXT Foxtons. Close Mid-Price: 56 Percentage Change: + 1.27% Day High: 57 Day Low: 54.5

Further movement against Foxtons ABOVE 57 should improve acceleration tow ……..

</p

View Previous Foxtons & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 65.92 Percentage Change: + 6.87% Day High: 70.68 Day Low: 62.56

Above 71 now calculates with the potential of a lift to an initial 80 with ……..

</p

View Previous ITM Power & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 41.89 Percentage Change: -1.00% Day High: 42.6 Day Low: 41.04

Weakness on Lloyds Grp. below 41.04 will invariably lead to 40.1p with se ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 309.8 Percentage Change: -0.13% Day High: 317.8 Day Low: 308.8

Target met. All Rolls Royce needs are mid-price trades ABOVE 317.8 to imp ……..

</p

View Previous Rolls Royce & Big Picture ***