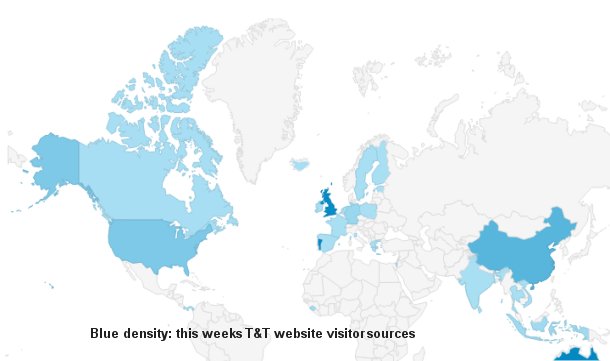

#FTSE #GOLD A probably unhealthy addiction to Google statistics continues, primarily driven by the fact the 2nd greatest number of visitors to our website in the last week apparently came from China. Each visitor remained for less than a second! Whereas folk from the UK average 47 minutes on site, Singapore 31 minutes, and even the Maldives taking 12 minutes on average browsing, per visitor. Thankfully, the nice folk from Reunion Island remain on our list of international visitors.

The China puzzle is a real head scratcher as Google doesn’t count ‘bots’. Perhaps our negative mention of China Evergrande a few weeks merited attention but we note trading in the company shares has now been suspended, probably one of the least surprising market movements recently. Obviously, there is a risk of this impacting the markets again.

This week on the FTSE could be fairly described as boring, the market comprehensively failing to show direction with a trading range of around 50 points. It almost feels like the market has been in shock at achieving a new high since the pandemic plunge of March last year. We’d hoped the “surge” to 7244 a week ago would be significant, inspiring confidence in the marketplace. But unfortunately, the last 4 sessions were utterly lame and lacking in any commitment.

If we opt to fear the worst, the FTSE needs fall below 7156 points to justify some slight near term concern. We can calculate the potential of this triggering reversals to an initial 7116 points with secondary, if broken, at a painful looking 7048 points. If triggered, the tightest stop loss level looks like a tempting 7186 points, almost too tight to be trusted given the reversal potentials.

More likely, we suspect movements above 7216 points should prove interesting, calculating with a fairly useless potential of 7232 points. If bettered, our secondary is a more alluring 7275 points and yet another high for the period since last years pandemic drop.

Have a good weekend. Here in Scotland, we’ve had the first snow of winter, along with the first frosts!

Again, a massive thank-you to those who find adverts on the page of sufficient interest to visit. We appreciate the top-up to the coffee fund!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:11:30PM | BRENT | 84.25 | 82.8 | 82.095 | 83.65 | 84.82 | 85 | 84.06 | Success | ||

| 10:13:13PM | GOLD | 1783.24 | 1774 | 1770 | 1786 | 1789 | 1798 | 1778 | |||

| 10:15:24PM | FTSE | 7200.16 | 7179 | 7158 | 7211 | 7212 | 7220 | 7184 | ‘cess | ||

| 10:17:27PM | FRANCE | 6715.5 | 6655 | 6647 | 6689 | 6715 | 6738 | 6675 | |||

| 10:19:50PM | GERMANY | 15482 | 15455 | 15443 | 15490 | 15533 | 15563 | 15480 | Success | ||

| 10:22:13PM | US500 | 4540 | 4521 | 4515 | 4531 | 4552 | 4558 | 4537 | ‘cess | ||

| 10:23:54PM | DOW | 35614 | 35442 | 35377.5 | 35575 | 35657 | 35682 | 35460 | |||

| 10:25:52PM | NASDAQ | 15400 | 15380 | 15364 | 15463 | 15499 | 15530 | 15409 | Shambles | ||

| 10:28:34PM | JAPAN | 28521 | 28403 | 28341 | 28696 | 28844 | 28943.5 | 28619 | Success |

21/10/2021 FTSE Closed at 7190 points. Change of -0.46%. Total value traded through LSE was: £ 5,323,076,986 a change of 2.72%

20/10/2021 FTSE Closed at 7223 points. Change of 0.08%. Total value traded through LSE was: £ 5,182,365,180 a change of -1.88%

19/10/2021 FTSE Closed at 7217 points. Change of 0.19%. Total value traded through LSE was: £ 5,281,678,962 a change of 1.68%

18/10/2021 FTSE Closed at 7203 points. Change of -0.43%. Total value traded through LSE was: £ 5,194,650,270 a change of -14.83%

15/10/2021 FTSE Closed at 7234 points. Change of 0.37%. Total value traded through LSE was: £ 6,099,387,832 a change of 10.37%

14/10/2021 FTSE Closed at 7207 points. Change of 0.92%. Total value traded through LSE was: £ 5,526,155,922 a change of -16.32%

13/10/2021 FTSE Closed at 7141 points. Change of 0.15%. Total value traded through LSE was: £ 6,604,225,806 a change of 15.2%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BLOE Block Energy PLC** **LSE:CAR Carclo** **LSE:CEY Centamin** **LSE:EZJ EasyJet** **LSE:ITM ITM Power** **LSE:QFI Quadrise** **LSE:TLW Tullow** **

********

Updated charts published on : Asos, Block Energy PLC, Carclo, Centamin, EasyJet, ITM Power, Quadrise, Tullow,

LSE:ASC Asos. Close Mid-Price: 2715 Percentage Change: + 2.03% Day High: 2741 Day Low: 2620

In the event of Asos enjoying further trades beyond 2741, the share shoul ……..

</p

View Previous Asos & Big Picture ***

LSE:BLOE Block Energy PLC Close Mid-Price: 1.57 Percentage Change: -1.56% Day High: 1.6 Day Low: 1.52

Continued weakness against BLOE taking the price below 1.52 calculates as ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:CAR Carclo. Close Mid-Price: 38 Percentage Change: + 5.56% Day High: 40.1 Day Low: 36.5

Continued trades against CAR with a mid-price ABOVE 40.1 should improve t ……..

</p

View Previous Carclo & Big Picture ***

LSE:CEY Centamin Close Mid-Price: 96.68 Percentage Change: -2.17% Day High: 98.28 Day Low: 96.56

Above 105 should give hope, along with movement to an initial 114p. If exc ……..

</p

View Previous Centamin & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 599.8 Percentage Change: + 1.45% Day High: 606.2 Day Low: 576

If EasyJet experiences continued weakness below 576, it will invariably l ……..

</p

View Previous EasyJet & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 479.8 Percentage Change: + 8.40% Day High: 481.8 Day Low: 437.8

In the event of ITM Power enjoying further trades beyond 481.8, the share ……..

</p

View Previous ITM Power & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 3.56 Percentage Change: -1.25% Day High: 3.5 Day Low: 3.5

This doesn’t feel very happy as weakness below 3.5 points to reversal to a ……..

</p

View Previous Quadrise & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 50.38 Percentage Change: -3.85% Day High: 52.12 Day Low: 49.91

Continuing to let folk down, Tullow now need only better 56p to suggest a ……..

</p

View Previous Tullow & Big Picture ***