#Brent_Crude #Dax Fuel prices in the UK continue to explore new highs, a fact brought sharply home when filling a couple of cans of diesel for our little tractor. The thing has a spiteful fuel tank, pretending to run out of fuel when below 5 ltrs. This only happens when cutting the lawn from left to right, otherwise it’s fine heading up and down. The lawn, you see, slopes and few things are more irritating than spluttering to a halt with a fuel gauge reading 1/4 full. Maybe this winter will be the one when I remember to reposition the fuel valve…

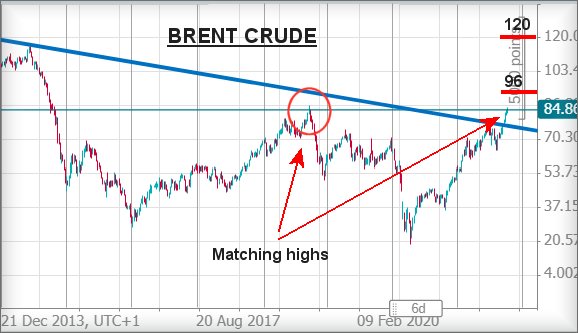

The price to fill the two diesel cans was nearly 15 quid. When I last filled the cans earlier this year, I remember handing over a 10 pound note and a single 1 pound coin! It’s annoying to report I probably bought fuel for the tractor (grudgingly, surely the last cut of the year) at the lowest and highest prices of 2021. This suspicion is due to the price of Brent Crude. We keep calculating the $86 level as a potential point of hesitation on the current rising cycle. Visually, this is also borne out by the high back in 2018 as there are few things the market likes more than invent a reason for hesitation in price movements. As the chart below highlights, Brent Crude now has every excuse to experience some hesitation, regardless of Big Picture growth characteristics. In the event the product discovers a reason to drip below $77, all bets are off for the longer term.

Barclays Plc (LSE:BARC) As for Barclays, when we reviewed the share 3 weeks ago, we gave criteria for a climb to 198.7p. The share closed Friday at 198.86p, so this ambition can be successfully crossed off. The important detail, from a software perspective, is our initial target was exceeded, creating a set of circumstances where some optimism for the future is possible. Now above 202p looks important, calculating with an initial target level at 216p next. If exceeded, our longer term secondary works out at 222p.

Despite it being true the “Big Picture” now demands we admit a longer term 240p should be regarded as the driving hope, our inclination is for caution, simply due to the retail banks dreadful performance in the last 7 years. Our real problem surfaces, if we concede the share is entering a true recovery cycle, thanks to the Big Picture also giving a target above 240p as an astounding leap to 407p.

If Barclays opts to explore reasons to destroy hope, the share price needs move below 161p. Ideally, the share should now only need infinite patience, world peace, universal health, and competent UK governments. Perhaps ‘infinite patience’ shall be a realistic hope.

Our thanks to the nice people who effectively “buy us a coffee” by discovering adverts on this page worthy of a visit.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:19:53PM | BRENT | 85 | 83.3 | 83 | 82.24 | 84.5 | 85.28 | 85.61 | 86.38 | 83.4 | ‘cess |

| 9:22:11PM | GOLD | 1793.32 | Success | ||||||||

| 9:23:59PM | FTSE | 7215.41 | Success | ||||||||

| 9:26:19PM | FRANCE | 6748 | Success | ||||||||

| 9:29:19PM | GERMANY | 15548 | 15488 | 15484 | 15440 | 15544 | 15618 | 15648 | 15688 | 15550 | ‘cess |

| 9:32:20PM | US500 | 4545.22 | ‘cess | ||||||||

| 9:35:34PM | DOW | 35675 | Success | ||||||||

| 9:38:19PM | NASDAQ | 15356 | Success | ||||||||

| 9:43:28PM | JAPAN | 28686 | ‘cess |

22/10/2021 FTSE Closed at 7204 points. Change of 0.19%. Total value traded through LSE was: £ 4,669,794,204 a change of -12.27%

21/10/2021 FTSE Closed at 7190 points. Change of -0.46%. Total value traded through LSE was: £ 5,323,076,986 a change of 2.72%

20/10/2021 FTSE Closed at 7223 points. Change of 0.08%. Total value traded through LSE was: £ 5,182,365,180 a change of -1.88%

19/10/2021 FTSE Closed at 7217 points. Change of 0.19%. Total value traded through LSE was: £ 5,281,678,962 a change of 1.68%

18/10/2021 FTSE Closed at 7203 points. Change of -0.43%. Total value traded through LSE was: £ 5,194,650,270 a change of -14.83%

15/10/2021 FTSE Closed at 7234 points. Change of 0.37%. Total value traded through LSE was: £ 6,099,387,832 a change of 10.37%

14/10/2021 FTSE Closed at 7207 points. Change of 0.92%. Total value traded through LSE was: £ 5,526,155,922 a change of -16.32%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:DGE Diageo** **LSE:EMG MAN** **LSE:FRES Fresnillo** **LSE:IGAS Igas Energy** **LSE:POG Petrop etc** **LSE:TLW Tullow** **LSE:ZOL Zoldav** **

********

Updated charts published on : Asos, Barclays, BALFOUR BEATTY, Diageo, MAN, Fresnillo, Igas Energy, Petrop etc, Tullow, Zoldav,

LSE:ASC Asos. Close Mid-Price: 2773 Percentage Change: + 2.14% Day High: 2782 Day Low: 2699

Target met. Further movement against Asos ABOVE 2782 should improve accel ……..

</p

View Previous Asos & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 198.86 Percentage Change: + 1.00% Day High: 201.1 Day Low: 196.66

Further movement against Barclays ABOVE 201.1 should improve acceleration ……..

</p

View Previous Barclays & Big Picture ***

LSE:BBY BALFOUR BEATTY Close Mid-Price: 257.2 Percentage Change: -0.16% Day High: 258.8 Day Low: 256.6

In the event BALFOUR BEATTY experiences weakness below 256.6 it calculate ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3639.5 Percentage Change: + 0.92% Day High: 3660.5 Day Low: 3603.5

Continued trades against DGE with a mid-price ABOVE 3666 should improve t ……..

</p

View Previous Diageo & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 236.3 Percentage Change: + 1.37% Day High: 236.3 Day Low: 232.9

Target met. All MAN needs are mid-price trades ABOVE 236.3 to improve acc ……..

</p

View Previous MAN & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 916.6 Percentage Change: + 1.98% Day High: 920 Day Low: 897.6

Target met. Further movement against Fresnillo ABOVE 920 should improve a ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 15.35 Percentage Change: -6.97% Day High: 16 Day Low: 15.35

This is dangerously confusing as weakness below 15 suggests the potential ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:POG Petrop etc. Close Mid-Price: 25.1 Percentage Change: + 3.04% Day High: 25.28 Day Low: 24.4

Further movement against Petrop etc ABOVE 25.28 should improve accelerati ……..

</p

View Previous Petrop etc & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 48.84 Percentage Change: -3.06% Day High: 50.7 Day Low: 48.25

In the event Tullow experiences weakness below 48.25 it calculates with a ……..

</p

View Previous Tullow & Big Picture ***

LSE:ZOL Zoldav. Close Mid-Price: 30 Percentage Change: + 15.38% Day High: 30.5 Day Low: 26.5

Target met. In the event of Zoldav enjoying further trades beyond 30.5, t ……..

</p

View Previous Zoldav & Big Picture ***