#DAX #SP500 Unusually, we must admit to an interest with Astrazeneca (AZN). In the middle of January, a nice text from Nicola Sturgeon advised the jag was coming mid-Feb. Last week, the local GP called, telling me to attend tomorrow morning at 9.10am. As a result, if the vaccine doesn’t work, an axe will be ground. And if it does work, there will always be the suspicion I wouldn’t have caught Covid (again) anyway!

While being guilty of returning to this subject matter, as someone with a trashed immune system, the concept of being out and about while feeling “safer” will be quite exciting but with only one drawback. Apparently there’s a chance our grandchildren will visit again…

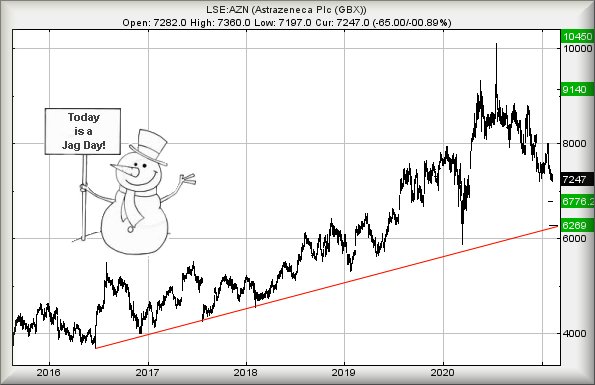

Astrazeneca share price is actually on the edge of trouble, closing 10th Feb at 7,247p. This, we feel, dangerous thanks to prior closing prices at the end of 2020 at 7,223p, especially as the difference between the two numbers is negligible. Despite the final nail remaining unhammered, we’re inclined to warn movement next below 7,223p risks reversal toward an initial 6,776 with secondary, if (when) broken at a bottom of 6,269 and hopefully a proper bounce.

The historic chart highlights something important. While the flourish above 10 quid last year illustrated a FTSE 100 component could perform with similar breathless abandon to an AIM share, the reality shows AZN has been steady, reliable, climbs since the low of the 2009 Financial Crisis. In spite of their Covid-19 vaccine, share price growth has proven strong over the years and we’re curious whether any reversal shall indeed “just” bonk the Red trend, resuming recovery thereafter.

To convince us the immediate relaxation cycle is an aberration, the share price needs strong recovery above 8,750p as this should prove capable of a fairly dull 9,140 with our longer term secondary, if exceeded, at 10,450 and a new all time high.

We suspect this shall prove worth watching in case 6,269p makes an appearance.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:09:31PM | BRENT | 60.97 | |||||||||

| 10:11:18PM | GOLD | 1843.72 | |||||||||

| 10:14:19PM | FTSE | 6520.13 | ‘cess | ||||||||

| 10:21:39PM | FRANCE | 5660.7 | |||||||||

| 10:24:34PM | GERMANY | 13933.58 | 13894 | 13846 | 13731 | 14035 | 14077 | 14139.5 | 14244 | 13956 | Success |

| 10:26:24PM | US500 | 3912.42 | 3883 | 3869.5 | 3848 | 3920 | 3934 | 3940 | 3959 | 3912 | Success |

| 10:28:49PM | DOW | 31442 | Success | ||||||||

| 10:30:25PM | NASDAQ | 13669 | |||||||||

| 10:33:16PM | JAPAN | 29279 | ‘cess |