FTSE FRIDAY #FTSE #GOLD

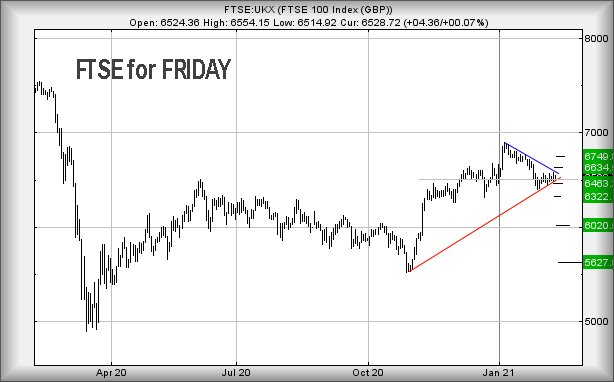

It’s time to talk about ‘our friend, the horizontal trend’. Few folk will be unaware of the dangers of sleeping on the job, something the FTSE has managed to accomplish pretty convincingly since the start of February. Essentially, the UK index has trapped itself within a (roughly) 100 point range, creating something we’re fond of calling a Horizontal Trend around the 6,500 point level.

Usually, when this sort of nonsense occurs following a market high, such as the spike on January 7th, it’s just a matter of patience while awaiting the market lemmings to rush over a cliff. In the case of the FTSE, we’d normally be privately confident the index intends shed around 500 points, eventually reversing down to the 6,000 point level, perhaps even 5,627 points if things get really serious. Visually, certainly there’s a strong argument favouring a rebound at the 5,600 level.

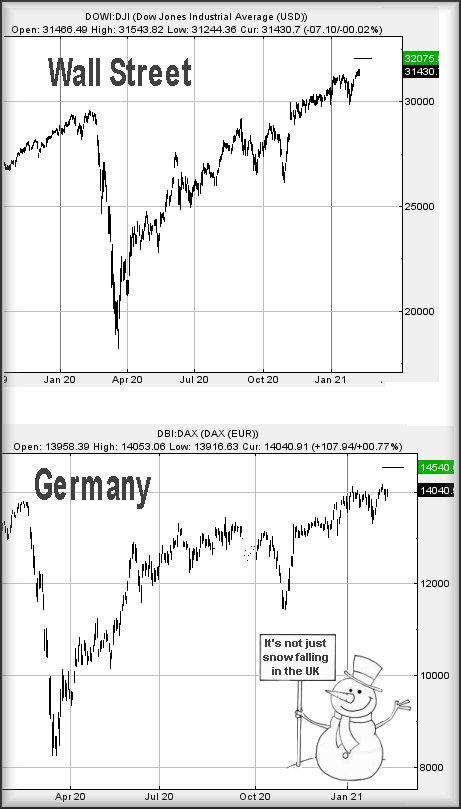

In the wider world, something else is happening. Both Germany and the US quite cheerfully created “Horizontal Trends” this year, the DOW JONES once residing at 31,000 points and the DAX finding favour with around 14,000 points. The absolutely critical difference with these markets is the “Horizontal Trend” line created generally can be thought of as a glass ceiling, a level we anticipate breaking when an upward rush occurs. For instance, once the DOW breaks free of its ceiling, an uninhibited rise to 32,000 points is expected. For Germany, we are looking for a 500+ point rise.

Alert readers, not yet asleep due to the onslaught of numbers above, will notice the conflict. The FTSE essentially wants to drop, the rest of the world wants to go up!

As for Friday and the FTSE, we’re understandably nervous expressing any optimism. The UK index needs exceed 6,585 points to suggest the potential of some serious gains. Such a movement will suggest the market attempting to jump clear of the thin ice upon which it currently stands, calculating with an initial hope of 6,634 points with secondary, if exceeded, a more inspiring 6,749 points. Perhaps positive news is needed.

This writer received the Astrazeneca jag today, developing no side effects (it was a doddle), and with 12 hours gone since the vaccine was given, I’ve not caught Covid-19! Perhaps the markets need better news than a story about a wee, fat, hairy, Scottish bloke…

Closing the session at 6,528 on Thursday, London needs slither below 6,497 points to indicate trouble. This risks triggering reversal to an initial 6,463 points with secondary, if broken, at 6,322 points.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:45:56PM | BRENT | 60.73 | 60.52 | 60.335 | 61.3 | 61.4 | 61.765 | 60.52 | |||

| 10:48:00PM | GOLD | 1825.94 | 1820 | 1815.5 | 1828 | 1835 | 1836.5 | 1825 | ‘cess | ||

| 10:49:26PM | FTSE | 6525 | 6504 | 6487 | 6541 | 6556 | 6565 | 6513 | |||

| 10:52:53PM | FRANCE | 5670 | 5654 | 5637.5 | 5672 | 5687 | 5695.5 | 5658 | |||

| 10:54:54PM | GERMANY | 14013 | 13913 | 13844 | 13973 | 14051 | 14138.5 | 13975 | |||

| 10:56:34PM | US500 | 3909 | 3888 | 3880 | 3916 | 3925 | 3937 | 3895 | |||

| 11:03:25PM | DOW | 31409 | 31377 | 31249.5 | 31451 | 31515 | 31553 | 31420 | Shambles | ||

| 11:05:21PM | NASDAQ | 13712 | 13628 | 13600.5 | 13702 | 13750 | 13790 | 13687 | |||

| 11:13:26PM | JAPAN | 29484 | 29302 | 29251 | 29395 | 29497 | 29529 | 29302 | ‘cess |