#Brent #Dax Lockdown inspires some strange behaviour. When my wife suggested we use our privacy to video something we’ve never, ever, done, the concept was only approached with the support of a decent amount of rum. What sort of bloke lets his wife sing while he plays guitar! It proved quite funny, wife suffering from crushing shyness over her (rather impressive) singing voice, me similarly inhibited with my guitar work.

Somehow or other, we’ve gone through nearly 3 decades of marriage without trying this but a “good idea” to video record something funny for her Mum (in Care Home isolation) ensured an entire weekend was spent, rehearsing something which lasted just 2 minutes 16 seconds***. The jury is pretty firmly out as to whether we shall ever do the same again but the event spawned another idea. What if the FTSE were looked at with optimism, rather than the usual misery it deserves?

It would be true to say the constant rehearsals caused a bored mind to wander but the results, after taking quite a different view of the FTSE, were to prove interesting.

Of course, we’d be remiss if we ignored the glaringly obvious.

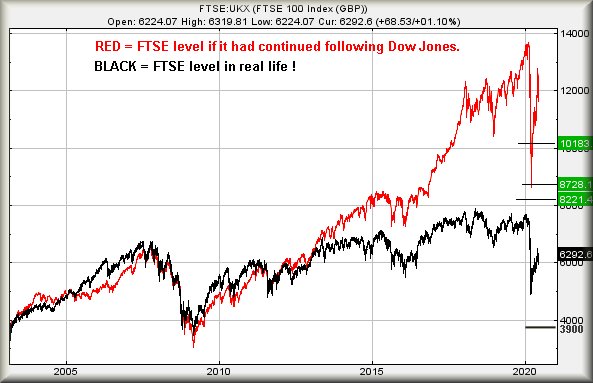

The Red line on the chart highlights where the FTSE would be, had it continued to copy Dow Jones movements but in 2013 everything changed. Wall Street continued heading upward with incredible strength. The FTSE didn’t. Had the UK market remained following the US market, the FTSE would have nearly reached 14,000 points before Covid-19 hit. In reality, the FTSE managed 7,500 points before the collapse.

In the period since the Covid-19 drop, the Nasdaq and S&P have exceeded their pre-drop levels. The Dow Jones has not and neither has the FTSE. The DOW has certainly been trying its best to recover but we’ve a couple of alarm bells ringing due to some recent dance steps.

However, should the FTSE manage to exceed 6,750 points, it enters a cycle where we are supposed to plan for recovery to 8,221 points initially with secondary, if bettered, at 8,728 points. Such movement will take the index into a region where 10,180 presents itself as a major point of long term interest. These figures are based entirely on FTSE movements since 2013, utterly ignoring how Wall Street behaves. It’s clear the last seven years has seen the two index’s execute a pretty solid divorce, making us wonder if the two markets had tried to sing and play guitar together!

We’ve a pretty solid suspicion the UK market closing a session above 6,750 shall prove improbable, resulting in the situation where there’s an attraction coming from a bottom of 3,900 points or so, just requiring negative sentiment to force a drop.

*** We recorded a tune called Caledonia, apparently one of her mothers favourites.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 6:05:16PM | BRENT | 41.93 | 41 | 40.355 | 39.5 | 41.62 | 42.92 | 43.235 | 43.55 | 41.74 | Success |

| 6:07:28PM | GOLD | 1744 | ‘cess | ||||||||

| 6:09:06PM | FTSE | 6210 | ‘cess | ||||||||

| 6:10:35PM | FRANCE | 4927.2 | Success | ||||||||

| 6:12:48PM | GERMANY | 12116 | 12104 | 12009 | 11864 | 12266 | 12335 | 12473 | 12770 | 12185 | |

| 6:15:28PM | US500 | 3070.02 | Shambles | ||||||||

| 6:31:16PM | DOW | 25639 | Shambles | ||||||||

| 6:34:58PM | NASDAQ | 9938 | Success | ||||||||

| 6:37:13PM | JAPAN | 22317 | Success |

19/06/2020 FTSE Closed at 6292 points. Change of 1.09%. Total value traded through LSE was: £ 11,536,633,427 a change of 155.43%

18/06/2020 FTSE Closed at 6224 points. Change of -0.46%. Total value traded through LSE was: £ 4,516,542,486 a change of -22.67%

17/06/2020 FTSE Closed at 6253 points. Change of 0.18%. Total value traded through LSE was: £ 5,840,674,157 a change of -3.28%

16/06/2020 FTSE Closed at 6242 points. Change of 2.94%. Total value traded through LSE was: £ 6,038,997,708 a change of 21.55%

15/06/2020 FTSE Closed at 6064 points. Change of -0.67%. Total value traded through LSE was: £ 4,968,429,954 a change of -16.12%

12/06/2020 FTSE Closed at 6105 points. Change of 0.48%. Total value traded through LSE was: £ 5,923,571,843 a change of -4.84%

11/06/2020 FTSE Closed at 6076 points. Change of -4%. Total value traded through LSE was: £ 6,224,767,909 a change of 0.67%