We examined Direct Line in September last year, speculating on movement from 184p to 210p. All it took was a takeover approach from a Belgian company and a bunch of emails received to force us to issue an update. Perhaps naively, we’d always assumed the UK had the insurance market tied up, the cartel keeping things under control. However, Belgian company AGEAS made what sounds like a reasonable offer but Direct Line describe the offer in quite disparaging terms.

Whilst the cynic within suspects the Board were not being offered sufficient Belgian chocolate to line their own pockets, perhaps requiring better severance packages to reduce any uncertainty about their own futures. However, the share price soared quite usefully, smacking against out prior 210p target in a day with a near 24% rise. By a stunning 0.6p, the price event exceeded our target, opening the door for further movements in the future. Maybe it’s the case AGEAS are expected to provide a further offer and, if we’re blunt, be exceeding our initial target, now above 211p calculates with the potential of a lift to 240p next with secondary, if bettered, a pretty impressive looking 283p.

So, the question is, will Ageas offer sufficient packages of Belgian chocolate to provoke Direct Line share price managing to recover, perhaps even representing a reasonable result for the company shareholders. From our perspective, share price closure above our current secondary of 283p shall prove significant, given the option of movement to 333p in the future, perhaps even an amazing 423p and a challenge against the prior all time high 9 years ago.

Of course, there is always the very, very, real risk of a company withdrawing interest, effectively causing inevitable sharp share price reduction. In such an instance, below 155p calculates with the potential of reversal to an initial 148p and maybe a bounce, given prior behaviour. Our secondary, with closure below such a level, works out at a silly looking 80p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:57:11PM | BRENT | 8180 | 8149 | 8098 | 8029 | 8202 | 8305 | 8340 | 8448 | 8237 | |

| 10:00:22PM | GOLD | 2034.49 | |||||||||

| 10:58:17PM | FTSE | 7604.2 | Success | ||||||||

| 11:03:24PM | STOX50 | 4865.2 | |||||||||

| 11:08:26PM | GERMANY | 17587 | |||||||||

| 11:11:14PM | US500 | 5062.9 | |||||||||

| 11:14:03PM | DOW | 38880 | 38739 | 38617 | 38395 | 38894 | 39000 | 39058 | 39165 | 38860 | |

| 11:19:53PM | NASDAQ | 17836 | ‘cess | ||||||||

| 11:24:09PM | JAPAN | 38999 | ‘cess |

28/02/2024 FTSE Closed at 7624 points. Change of -0.77%. Total value traded through LSE was: £ 6,375,065,167 a change of 28.06%

27/02/2024 FTSE Closed at 7683 points. Change of -0.01%. Total value traded through LSE was: £ 4,978,135,688 a change of -13%

26/02/2024 FTSE Closed at 7684 points. Change of -0.29%. Total value traded through LSE was: £ 5,722,289,036 a change of 8.14%

23/02/2024 FTSE Closed at 7706 points. Change of 0.29%. Total value traded through LSE was: £ 5,291,710,334 a change of -10.94%

22/02/2024 FTSE Closed at 7684 points. Change of 0.29%. Total value traded through LSE was: £ 5,941,569,029 a change of 3.14%

21/02/2024 FTSE Closed at 7662 points. Change of -0.74%. Total value traded through LSE was: £ 5,760,836,180 a change of 16.25%

20/02/2024 FTSE Closed at 7719 points. Change of -0.12%. Total value traded through LSE was: £ 4,955,387,121 a change of 38.92%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:BARC Barclays** **LSE:FRES Fresnillo** **LSE:ITV ITV** **LSE:OCDO Ocado Plc** **LSE:RR. Rolls Royce** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Avacta, Barclays, Fresnillo, ITV, Ocado Plc, Rolls Royce, Zoo Digital,

LSE:AVCT Avacta Close Mid-Price: 74.7 Percentage Change: -1.45% Day High: 78.5 Day Low: 67.5

Target met. If Avacta experiences continued weakness below 67.5, it will ……..

</p

View Previous Avacta & Big Picture ***

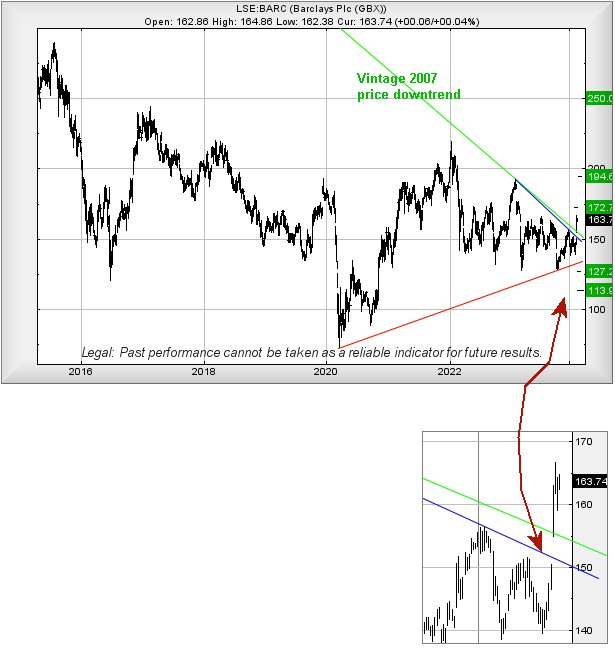

LSE:BARC Barclays. Close Mid-Price: 168.9 Percentage Change: + 1.22% Day High: 169.9 Day Low: 166.18

In the event of Barclays enjoying further trades beyond 169.9, the share ……..

</p

View Previous Barclays & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 451.6 Percentage Change: -3.48% Day High: 468.5 Day Low: 452.7

In the event Fresnillo experiences weakness below 452.7 it calculates wit ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:ITV ITV Close Mid-Price: 55.78 Percentage Change: -1.76% Day High: 56.98 Day Low: 55.5

Target met. In the event ITV experiences weakness below 55.5 it calculate ……..

</p

View Previous ITV & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 490.7 Percentage Change: -0.63% Day High: 496.4 Day Low: 470.5

Continued weakness against OCDO taking the price below 470.5 calculates a ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 370.5 Percentage Change: + 3.32% Day High: 372.4 Day Low: 360.1

In the event of Rolls Royce enjoying further trades beyond 372.4, the sha ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 25.75 Percentage Change: -2.83% Day High: 25.75 Day Low: 25.75

Weakness on Zoo Digital below 25.75 will invariably lead to 24.5p with se ……..

</p

View Previous Zoo Digital & Big Picture ***