#Gold #WallSt With the worst time of the year getting underway here in Argyll, the start of March is deemed as the time to start servicing garden machinery. Our chainsaws, strimmer, motor mower, and the little tractor will all have developed mystery faults, due to inactivity for 4 months. But a new tool revolutionised the start of the week, something everyone else knows about but I’ve never used.

This secret weapon is called “Braces”, a device known for holding trousers up!

The issue with servicing machinery comes from wearing a style of trousers known as “Cargo” pants. Spoiling the wearer with a plentiful supply of pockets, they’ve always been an issue with a proclivity to fall down due to the weight of things being carted around. Obviously, a mobile phone and cordless headset, a Gerber multitool, Mole grips, and a few long screwdrivers which double as emergency levers. And a multi-meter along with a bunch of copper wire. This is all because I’m lazy and detest taking multiple tool boxes from shed to shed, especially as if it rains, one inevitably is left outside. After a day tinkering around, not a single engine has been started yet, but oils and filters have all been changed where required.

What has this to do with Plus500?

They appear to be the “Cargo pants” of trading, offering something for everyone from everywhere. Their share is listed on the main London Stock Exchange, their Head Office is listed as being in Haifa, and their office address is given as being in the Seychelles. Obviously a company who prefer the sunny side of life but, all joking aside, their website proved quite refreshing with a glance at their Demo Account facility offering decent charts along with what will be a bewildering range of trading options for those new to the game.

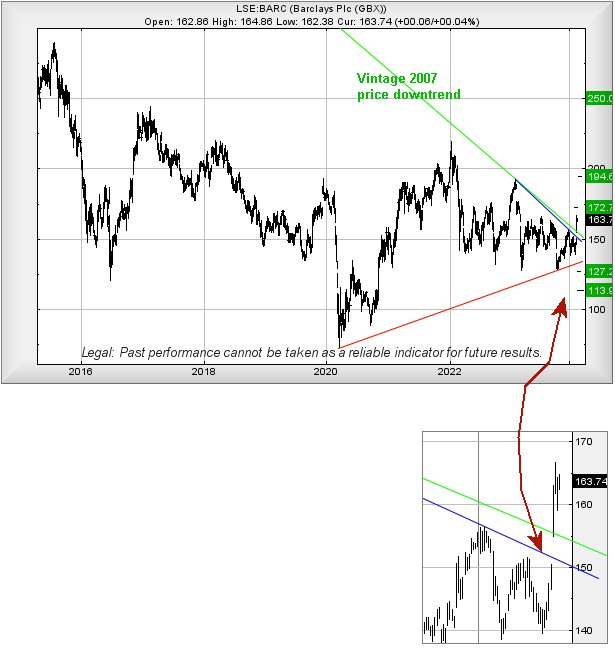

We’re reviewing their share price due to a couple of folk dropping us emails recently, asking our thoughts for the future as they’re being recommended by some folk as a Strong Buy allegedly.

Some doubts exist about such a sentiment. Obviously the share price could go up but from behaviour this year, we’re a bit cautious, suspecting the price intends some fairly slight reversals. Trading around 1726p at time of writing, it need only slip below 1690p to probably trigger some reversal down to an initial 1573p with secondary, if broken, an eventual bottom hopefully above 1350p as this would tend protect the honour of the Red line on the chart.

If things intend turn positive, above 1865p looks capable of a lift to an initial 1952p and a break above the Blue downtrend since 2018. This potentially shall open the door for our secondary, especially if the share price closes a session above the Blue trend. As a result, it opens the doors for a visit to 2182p and perhaps beyond.

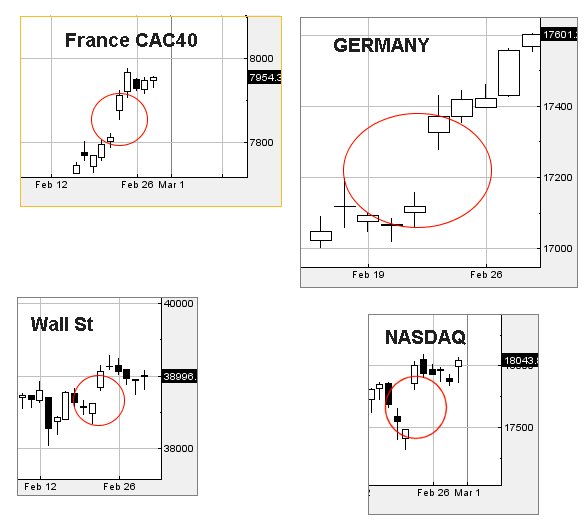

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:55:37PM | BRENT | 8264.9 | |||||||||

| 9:59:10PM | GOLD | 2114.55 | 2079 | 2064 | 2045 | 2093 | 2121 | 2127 | 2148 | 2108 | ‘cess |

| 10:01:49PM | FTSE | 7638.3 | |||||||||

| 10:09:38PM | STOX50 | 4907.6 | |||||||||

| 10:12:48PM | GERMANY | 17687.3 | |||||||||

| 10:14:46PM | US500 | 5126.1 | ‘cess | ||||||||

| 10:22:10PM | DOW | 38949 | 38865 | 38774 | 38657 | 39029 | 39061 | 39152 | 39248 | 39011 | |

| 10:25:07PM | NASDAQ | 18205 | |||||||||

| 10:27:37PM | JAPAN | 40054 |

4/03/2024 FTSE Closed at 7640 points. Change of -0.55%. Total value traded through LSE was: £ 5,830,824,809 a change of -4.21%

1/03/2024 FTSE Closed at 7682 points. Change of 0.68%. Total value traded through LSE was: £ 6,087,264,861 a change of -41.68%

29/02/2024 FTSE Closed at 7630 points. Change of 0.08%. Total value traded through LSE was: £ 10,436,888,007 a change of 63.71%

28/02/2024 FTSE Closed at 7624 points. Change of -0.77%. Total value traded through LSE was: £ 6,375,065,167 a change of 28.06%

27/02/2024 FTSE Closed at 7683 points. Change of -0.01%. Total value traded through LSE was: £ 4,978,135,688 a change of -13%

26/02/2024 FTSE Closed at 7684 points. Change of -0.29%. Total value traded through LSE was: £ 5,722,289,036 a change of 8.14%

23/02/2024 FTSE Closed at 7706 points. Change of 0.29%. Total value traded through LSE was: £ 5,291,710,334 a change of -10.94%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:CNA Centrica** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:RR. Rolls Royce** **LSE:TSCO Tesco** **

********

Updated charts published on : Aston Martin, Centrica, Natwest, Ocado Plc, Rolls Royce, Tesco,

LSE:AML Aston Martin Close Mid-Price: 165 Percentage Change: -6.62% Day High: 174.9 Day Low: 158.5

Target met. If Aston Martin experiences continued weakness below 158.5, i ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 125.35 Percentage Change: -0.87% Day High: 127.65 Day Low: 123.9

Continued weakness against CNA taking the price below 123.9 calculates as ……..

</p

View Previous Centrica & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 248.3 Percentage Change: + 0.61% Day High: 248.8 Day Low: 245.7

Continued trades against NWG with a mid-price ABOVE 248.8 should improve ……..

</p

View Previous Natwest & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 445 Percentage Change: -6.51% Day High: 471.1 Day Low: 433.6

In the event Ocado Plc experiences weakness below 433.6 it calculates wit ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 376.4 Percentage Change: + 0.43% Day High: 380.3 Day Low: 372.7

Continued trades against RR. with a mid-price ABOVE 380.3 should improve ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 275.9 Percentage Change: -0.61% Day High: 277.1 Day Low: 273.6

If Tesco experiences continued weakness below 273.6, it will invariably l ……..

</p

View Previous Tesco & Big Picture ***