#Brent #Dax The weekends Formula 1 race proved more boring than usual, principally because there wasn’t one. The F1 media had made a really big deal of the Bahrain track being open for “testing” on 22nd February and the logical assumption the race would follow the testing period proved utterly wrong. There is a one week gap between the two events but, to be honest, “testing” proved quite boring anyway with no surprises in car performance. So we’re not anxiously awaiting the weekends actual race and, who knows, Barclays may prove more interesting.

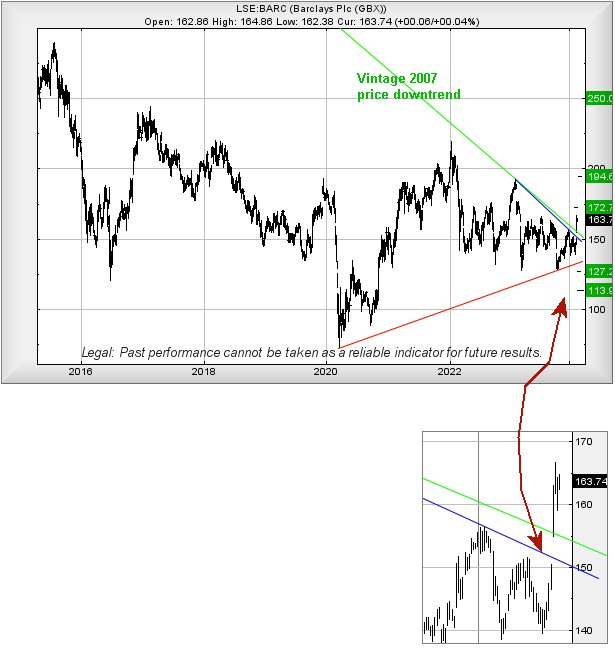

As the chart below shows, Barclays share price was gapped up above the downtrend since January 2023, creating the situation where movement next above 167p should prove capable of provoking ongoing recovery to an initial 172.7p with secondary, if beaten, now at an interesting looking 194p. This secondary is of special interest, perhaps even giving the share price an opportunity to close a session above the prior closing high of 189.5p and suggest happy days may be ahead for the share price.

In addition, there is something just a bit questionable about the decision to “gap” Barclays up, when the organisation released positive financial results. Not only was the share price gapped up above the downtrend since January 2023, it was also gapped above the downtrend which dates back to February 2007, a time when the share price almost reached 800p. We’ve shown this as a Green trend line on the chart and from our perspective, there’s a heck of a big question now making itself known. Essentially, should we view the influences on the price as coming from a period where 189p was the ruling high or, if 800p shall bear any influence against future movements. Hopefully share price movements in the coming weeks contribute toward an answer as it will make a change to our calculation potentials.

Of course, this could prove an enormous practical joke by a market, constantly keeping everyone “amused” by the way UK retail banks are treated. The share price needs below 139 to ring alarm bells, giving the option of reversal to 127 initially with secondary, if broken, a probable bottom at 112p.

We suspect, this time, some hope should be possible for Barclays. Hopefully within investors lifetimes…

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 9:27:50PM | BRENT | 8083.8 | 8103 | 7991 | 7879 | 8175 | 8288 | 8320 | 8404 | 8152 |

| 9:30:20PM | GOLD | 2035.22 | ||||||||

| 9:33:09PM | FTSE | 7712 | ||||||||

| 9:36:50PM | STOX50 | 4869.8 | ||||||||

| 9:39:17PM | GERMANY | 17411 | 17282 | 17225 | 17150 | 17393 | 17440 | 17899 | 18370 | 17285 |

| 9:41:21PM | US500 | 5082.8 | ||||||||

| 9:53:20PM | DOW | 39091 | ||||||||

| 9:55:55PM | NASDAQ | 17909.9 | ||||||||

| 9:58:14PM | JAPAN | 39417 |

23/02/2024 FTSE Closed at 7706 points. Change of 0.29%. Total value traded through LSE was: £ 5,291,710,334 a change of -10.94%

22/02/2024 FTSE Closed at 7684 points. Change of 0.29%. Total value traded through LSE was: £ 5,941,569,029 a change of 3.14%

21/02/2024 FTSE Closed at 7662 points. Change of -0.74%. Total value traded through LSE was: £ 5,760,836,180 a change of 16.25%

20/02/2024 FTSE Closed at 7719 points. Change of -0.12%. Total value traded through LSE was: £ 4,955,387,121 a change of 38.92%

19/02/2024 FTSE Closed at 7728 points. Change of 0.22%. Total value traded through LSE was: £ 3,567,027,566 a change of -46.92%

16/02/2024 FTSE Closed at 7711 points. Change of 1.5%. Total value traded through LSE was: £ 6,719,822,861 a change of 59.53%

15/02/2024 FTSE Closed at 7597 points. Change of 0.38%. Total value traded through LSE was: £ 4,212,176,049 a change of -10.97%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

********

Updated charts published on :