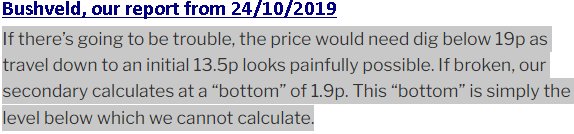

#Gold #SP500 This week, we’re doing a few “Readers Requests”, if only due to the number we’re dodging in our email. August being August, we dodged the issue as the number of folk reading our daily blurb drops dramatically. But it’s now September and the stock market shall doubtless resume its usual misbehaviour. There’s a funny thing about Bushveld, one which ties rather neatly with our recent comment of timeframes being an issue.

Nearly five years ago, we’d pointed out the potential of Bushveld Minerals reaching down to 1.9p but really didn’t think the arithmetic set of circumstances would arise. Of course, that all changed when Covid-19 kicked off in 2020 and the rest, as they say, is history. It was to take until a week ago but finally, Bushveld completed its long trek downhill and reached our target level of 1.9p. Another side to this tale was equally silly. In the same report, we’d created a set of parameters with a target level at 39p. The market opted to exhibit its sense of humour, reaching this target within just a week of the analysis. If only shares would come with something like a microwave timer!

For Bushveld, the situation with this battery material major remains the same, we still cannot calculate below 1.9p, so perhaps there’s a reasonable argument which shall reveal upward triggers for the share price which shall signify proper share price recovery. We cannot help but smile at the “vanadium” market, a resource obviously absent from Scotland but this little country has its own designs for effective power storage. A major project has kicked off, pumping water uphill to be stored inside a mountain, only released when generators need turned. This is presumably a hedge against the phenomena of cold winter months, when the wind sometimes doesn’t blow for weeks on end and windfarms remain static. At least, this did happen in 2010 and again for a few days last winter.

The immediate situation for BMN suggests paying some attention, if the share price stumbles above 2.65p as this should ideally trigger near term price recovery to an initial 3.7p. If exceeded, our secondary ambition works out at 4.5p and a share price level where our software demands the price actually close a session before becoming too excited for the longer term.

Perhaps this shall be a share, where “the only way is up” could become a justified theme tune.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:20:48PM | BRENT | 9030.7 | ‘cess | ||||||||

| 9:25:06PM | GOLD | 1922.15 | 1921 | 1918 | 1914 | 1925 | 1931 | 1934 | 1940 | 1923 | |

| 9:27:13PM | FTSE | 7507.4 | ‘cess | ||||||||

| 9:29:18PM | STOX50 | 4262.5 | ‘cess | ||||||||

| 9:31:59PM | GERMANY | 15825.7 | ‘cess | ||||||||

| 9:34:31PM | US500 | 4486 | Success | ||||||||

| 9:54:07PM | DOW | 34661.5 | 34566 | 34497 | 34401 | 34674 | 34730 | 34823 | 35002 | 34630 | Success |

| 9:56:13PM | NASDAQ | 15459.6 | ‘cess | ||||||||

| 9:58:25PM | JAPAN | 32661 | ‘cess |

11/09/2023 FTSE Closed at 7496 points. Change of 0.24%. Total value traded through LSE was: £ 4,619,826,018 a change of -15.09%

8/09/2023 FTSE Closed at 7478 points. Change of 0.5%. Total value traded through LSE was: £ 5,440,944,541 a change of 24.28%

7/09/2023 FTSE Closed at 7441 points. Change of 0.2%. Total value traded through LSE was: £ 4,377,889,513 a change of 26.38%

6/09/2023 FTSE Closed at 7426 points. Change of -0.15%. Total value traded through LSE was: £ 3,464,082,337 a change of -12.27%

5/09/2023 FTSE Closed at 7437 points. Change of -0.2%. Total value traded through LSE was: £ 3,948,449,247 a change of 27.07%

4/09/2023 FTSE Closed at 7452 points. Change of -0.16%. Total value traded through LSE was: £ 3,107,267,145 a change of -28.59%

1/09/2023 FTSE Closed at 7464 points. Change of 0.34%. Total value traded through LSE was: £ 4,351,126,417 a change of -43.85%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BP. BP PLC** **LSE:CNA Centrica** **LSE:DARK Darktrace Plc** **LSE:DGE Diageo** **LSE:FOXT Foxtons** **LSE:IHG Intercontinental Hotels Group** **LSE:IQE IQE** **LSE:SPT Spirent Comms** **

********

Updated charts published on : BP PLC, Centrica, Darktrace Plc, Diageo, Foxtons, Intercontinental Hotels Group, IQE, Spirent Comms,

LSE:BP. BP PLC. Close Mid-Price: 517.3 Percentage Change: + 0.00% Day High: 521.7 Day Low: 515.3

Target met. In the event of BP PLC enjoying further trades beyond 521.7, ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 162.45 Percentage Change: + 0.34% Day High: 164 Day Low: 161.9

In the event of Centrica enjoying further trades beyond 164, the share sh ……..

</p

View Previous Centrica & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 410 Percentage Change: + 1.61% Day High: 418.4 Day Low: 406.4

Continued trades against DARK with a mid-price ABOVE 418.4 should improve ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:DGE Diageo Close Mid-Price: 3175.5 Percentage Change: -0.77% Day High: 3216 Day Low: 3162

Weakness on Diageo below 3162 will invariably lead to 3121p with secondar ……..

</p

View Previous Diageo & Big Picture ***

LSE:FOXT Foxtons. Close Mid-Price: 36.2 Percentage Change: + 3.43% Day High: 36.2 Day Low: 36.2

All Foxtons needs are mid-price trades ABOVE 40 to improve acceleration t ……..

</p

View Previous Foxtons & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 6122 Percentage Change: -0.20% Day High: 6156 Day Low: 6016

All Intercontinental Hotels Group needs are mid-price trades ABOVE 6156 t ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:IQE IQE Close Mid-Price: 16.46 Percentage Change: -2.60% Day High: 16.96 Day Low: 16.26

If IQE experiences continued weakness below 16.26, it will invariably lea ……..

</p

View Previous IQE & Big Picture ***

LSE:SPT Spirent Comms Close Mid-Price: 145.8 Percentage Change: -0.75% Day High: 147.1 Day Low: 141.7

If Spirent Comms experiences continued weakness below 141.7, it will inva ……..

</p

View Previous Spirent Comms & Big Picture ***