#FTSE #Nasdaq A few emails arrived, asking our “take” on Harland & Wolff, a shipbuilder best known for one of their products which sank on its maiden voyage, The Titanic. Their share price, quite often, hasn’t fared much better than the ship but now, something unusual appears to be happening. Thankfully, this is a tale which doesn’t involve an iceberg or a film I haven’t watched.

If only the drone of the theme song had been as easy to filter out from day to day life!

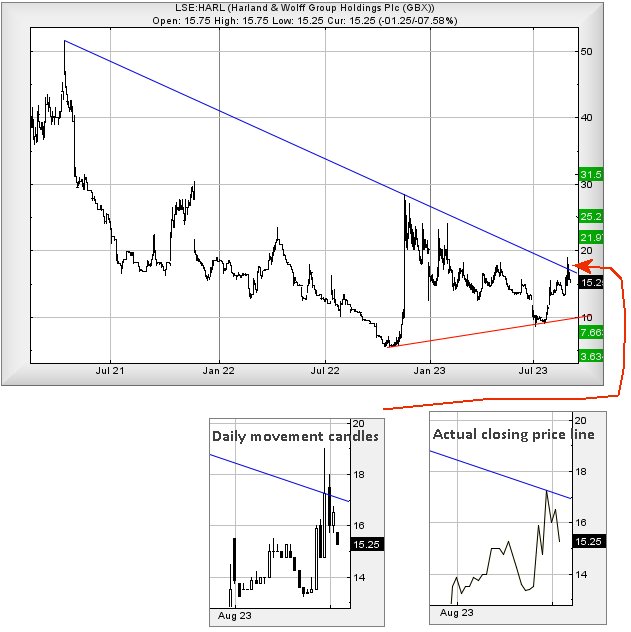

First though, something quite unusual has been happening with their share price in the last few sessions and it illustrates quite clearly why we prefer witnessing a share close beyond a trend line, rather than trust any intraday values. At the end of August, Harland & Wolff celebrated with a share price which soared to 19p, maybe not that big a deal as it’s currently at 15.25p. But on the day itself, the movement proved less modest with the market closing the session just above the 17p level. In the normal turn of events, this sort of thing isn’t a big deal but for Harland & Wolff, it perhaps signifies something quite important. The share has a very obvious downtrend since 2021 and on August 31st, the market took precise care to ensure the share price closed hard against the Blue trend line, ensuring it was only the kiss of an iceberg rather than a full blown puncture!

On the rare occasions when this sort of thing happens, we always question why the price wasn’t allowed to break free, instead kept imprisoned below the Blue line. Was the market simply not ready to let it run free or does the market know something? A cliché saying; ‘the market always knows best’ certainly springs to mind but our inclination is to take the visit to 19p as an early warning shot.

It’s now the case where above 19p calculates with the potential of a visit to an initial 21.9 with secondary, if exceeded, working out at a long term 31p and a price level where the visuals demand some hesitation and the need for us to revisit the numbers.

Our usual alternate scenario requires the share sink below 10p to cause a rush to the lifeboats, allowing for reversal to an initial 7p with secondary, if broken, down in the 3p zone and perhaps a bounce. But visually, we’re inclined toward some hope for the future, doubtless fuelled by good news from the company.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:39:03PM | BRENT | 8985 | Success | ||||||||

| 9:42:43PM | GOLD | 1926 | |||||||||

| 9:45:06PM | FTSE | 7419.3 | 7387 | 7355 | 7313 | 7430 | 7458 | 7486 | 7519 | 7423 | Success |

| 9:47:13PM | STOX50 | 4260.6 | Success | ||||||||

| 9:49:51PM | GERMANY | 15750.5 | Success | ||||||||

| 10:02:20PM | US500 | 4494 | Success | ||||||||

| 10:04:59PM | DOW | 34652 | ‘cess | ||||||||

| 10:08:08PM | NASDAQ | 15486 | 15394 | 15310 | 15204 | 15483 | 15558 | 15627 | 15705 | 15475 | Success |

| 10:12:02PM | JAPAN | 33056 |

\

5/09/2023 FTSE Closed at 7437 points. Change of -0.2%. Total value traded through LSE was: £ 3,948,449,247 a change of 27.07%

4/09/2023 FTSE Closed at 7452 points. Change of -0.16%. Total value traded through LSE was: £ 3,107,267,145 a change of -28.59%

1/09/2023 FTSE Closed at 7464 points. Change of 0.34%. Total value traded through LSE was: £ 4,351,126,417 a change of -43.85%

31/08/2023 FTSE Closed at 7439 points. Change of -0.45%. Total value traded through LSE was: £ 7,748,715,745 a change of 104.69%

30/08/2023 FTSE Closed at 7473 points. Change of 0.11%. Total value traded through LSE was: £ 3,785,593,396 a change of -59.43%

29/08/2023 FTSE Closed at 7465 points. Change of 1.73%. Total value traded through LSE was: £ 9,331,622,622 a change of 194.32%

25/08/2023 FTSE Closed at 7338 points. Change of -100%. Total value traded through LSE was: £ 3,170,549,348 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AV. Aviva** **LSE:BP. BP PLC** **LSE:CNA Centrica** **LSE:CPI Capita** **LSE:SCLP Scancell** **LSE:STAN Standard Chartered** **LSE:TLW Tullow** **

********

Updated charts published on : AFC Energy, Aviva, BP PLC, Centrica, Capita, Scancell, Standard Chartered, Tullow,

LSE:AFC AFC Energy. Close Mid-Price: 18.9 Percentage Change: + 13.31% Day High: 19.6 Day Low: 16.5

Further movement against AFC Energy ABOVE 19.6 should improve acceleratio ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AV. Aviva Close Mid-Price: 371.5 Percentage Change: -0.35% Day High: 374.5 Day Low: 368.9

In the event Aviva experiences weakness below 368.9 it calculates with a ……..

</p

View Previous Aviva & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 511.5 Percentage Change: + 1.95% Day High: 514.3 Day Low: 497.2

Target met. All BP PLC needs are mid-price trades ABOVE 514.3 to improve ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 156 Percentage Change: + 1.96% Day High: 156.45 Day Low: 152.4

All Centrica needs are mid-price trades ABOVE 156.45 to improve accelerat ……..

</p

View Previous Centrica & Big Picture ***

LSE:CPI Capita Close Mid-Price: 17.12 Percentage Change: -2.51% Day High: 17.61 Day Low: 17

Weakness on Capita below 17 will invariably lead to 16p with secondary (i ……..

</p

View Previous Capita & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 9.25 Percentage Change: + 13.50% Day High: 9.25 Day Low: 7.65

Weakness on Scancell below 7.65 will invariably lead to 6.1 with secondar ……..

</p

View Previous Scancell & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 703.6 Percentage Change: -0.82% Day High: 711.6 Day Low: 695.6

Continued weakness against STAN taking the price below 695.6 calculates a ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TLW Tullow. Close Mid-Price: 39 Percentage Change: + 2.36% Day High: 39.84 Day Low: 37.46

Target met. Continued trades against TLW with a mid-price ABOVE 40p shoul ……..

</p

View Previous Tullow & Big Picture ***