#Brent #Dax With the retail banks, there’s a race to avoid the start! With Grand Prix, there’s a race to the end and in recent years, nothing has come close to the excitement of Singapore at the weekend. With four cars almost nose to tail, the final laps proved amazing, the stress getting to one of the Mercedes drivers who decided to test how effective the front crumple zone of his car was, literally on the final lap.

The poor bloke did a perfect “From Hero to Zero” crash, missing 3rd place in the race and gifting that honour to his team-mate, Louis Hamilton.

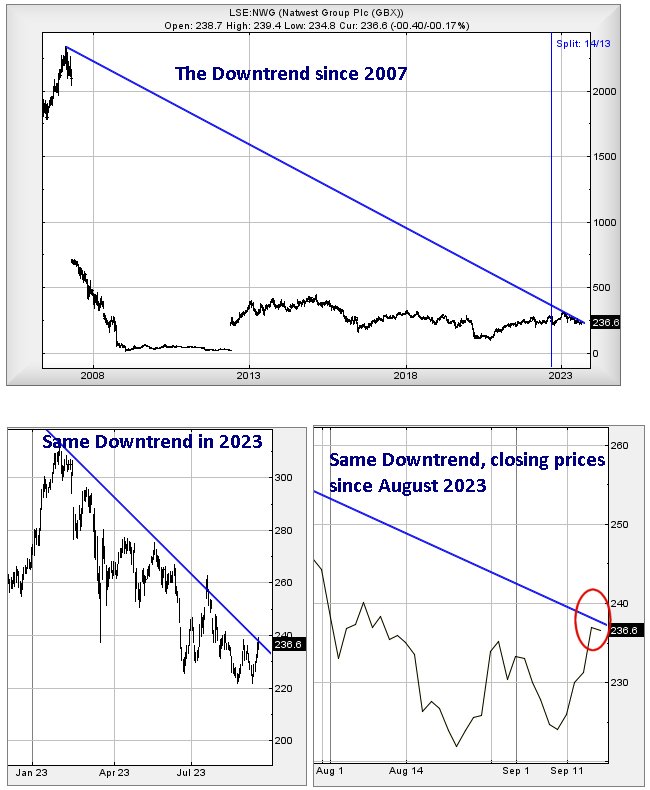

Similarly, Natwest appears to be shuffling into position where it might actually start to do something useful. Amazingly, this particular scenario dates back to 2007 and the Blue downtrend on the chart.

As shown above, this Blue line, dating back to a time when politicians lost their integrity with the Financial Crash, could easily be thought of as a crayon mark on a chart, were it not for Natwest share price behaviour in the last week. When an extensive effort is made to ensure a share fails to close above a downtrend (circled in Red above), it tends make our attention zoom in, just in case we’re seeing a signal for something important. In this particular instance, we suspect this shall prove to be the case. We’d urge no-one to get too excited as we’re not about to propose anything as interesting as the Singapore GP but it certainly feels like something solid could happen fairly quickly.

Trading around 236p at time of writing, the share price need only exceed 240p to hopefully trigger movement to an initial 249p with our secondary, if bettered, working out at an irritating 258p. Despite a potential 18p rise not deserving sneezed at, visually such an ambition matches the highs from July and a price level where we suspect the share price shall develop a bit of a stutter. Our usual rules demand the share close above these prior highs of 261p before we dare regard Natwest as entering any sort of serious race. Until then, rather aptly, it remains trapped in the retail bank equivalent of a clown car.

Should Natwest indulge in its favoured hobby of throwing custard pies at traders, below 231p becomes problematic, allowing for reversal to 217 with secondary, if broken, calculating down at 204p and hopefully a proper bounce.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 6:49:50PM | BRENT | 9378.8 | 9222 | 9178 | 9099 | 9322 | 9425 | 9500.5 | 10295 | 8950 |

| 6:55:15PM | GOLD | 1923.37 | 1916 | |||||||

| 6:58:10PM | FTSE | 7695 | 7696 | |||||||

| 7:00:10PM | STOX50 | 4284.3 | 4288 | |||||||

| 7:03:21PM | GERMANY | 15870.9 | 15893 | |||||||

| 7:05:15PM | US500 | 4451 | 4464 | 4438 | 4412 | 4484 | 4516 | 4524 | 4555 | 4477 |

| 9:53:33PM | DOW | 34593.5 | 34882 | |||||||

| 9:55:49PM | NASDAQ | 15197.68 | 15246 | |||||||

| 9:57:43PM | JAPAN | 33282 | 33320 |

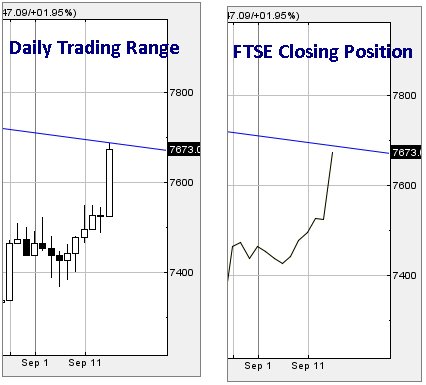

15/09/2023 FTSE Closed at 7711 points. Change of 0.5%. Total value traded through LSE was: £ 13,856,220,608 a change of 129.91%

14/09/2023 FTSE Closed at 7673 points. Change of 1.97%. Total value traded through LSE was: £ 6,026,828,350 a change of 14.3%

13/09/2023 FTSE Closed at 7525 points. Change of -0.03%. Total value traded through LSE was: £ 5,272,761,043 a change of 13.44%

12/09/2023 FTSE Closed at 7527 points. Change of 0.41%. Total value traded through LSE was: £ 4,648,224,872 a change of 0.61%

11/09/2023 FTSE Closed at 7496 points. Change of 0.24%. Total value traded through LSE was: £ 4,619,826,018 a change of -15.09%

8/09/2023 FTSE Closed at 7478 points. Change of 0.5%. Total value traded through LSE was: £ 5,440,944,541 a change of 24.28%

7/09/2023 FTSE Closed at 7441 points. Change of 0.2%. Total value traded through LSE was: £ 4,377,889,513 a change of 26.38%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:BME B & M** **LSE:BP. BP PLC** **LSE:CNA Centrica** **LSE:FGP Firstgroup** **LSE:GRG Greggs** **LSE:IHG Intercontinental Hotels Group** **LSE:NG. National Glib** **LSE:OXIG Oxford Instruments** **LSE:PHP Primary Health** **LSE:RR. Rolls Royce** **LSE:TSCO Tesco** **

********

Updated charts published on : Anglo American, B & M, BP PLC, Centrica, Firstgroup, Greggs, Intercontinental Hotels Group, National Glib, Oxford Instruments, Primary Health, Rolls Royce, Tesco,

LSE:AAL Anglo American. Close Mid-Price: 2302.5 Percentage Change: + 1.77% Day High: 2321.5 Day Low: 2255.5

Target met. In the event of Anglo American enjoying further trades beyond ……..

</p

View Previous Anglo American & Big Picture ***

LSE:BME B & M. Close Mid-Price: 577 Percentage Change: + 1.37% Day High: 585.6 Day Low: 573.6

All B & M needs are mid-price trades ABOVE 585.6 to improve acceleration ……..

</p

View Previous B & M & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 523.2 Percentage Change: -0.17% Day High: 528.9 Day Low: 520.7

Target met. In the event of BP PLC enjoying further trades beyond 528.9, ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 169.7 Percentage Change: + 0.59% Day High: 170.05 Day Low: 167.2

Further movement against Centrica ABOVE 170.05 should improve acceleratio ……..

</p

View Previous Centrica & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 156.2 Percentage Change: -1.08% Day High: 159.9 Day Low: 155

Continued trades against FGP with a mid-price ABOVE 159.9 should improve ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GRG Greggs. Close Mid-Price: 2540 Percentage Change: + 1.93% Day High: 2554 Day Low: 2500

Further movement against Greggs ABOVE 2554 should improve acceleration to ……..

</p

View Previous Greggs & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 6296 Percentage Change: + 0.87% Day High: 6344 Day Low: 6296

Target met. All Intercontinental Hotels Group needs are mid-price trades ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1022.5 Percentage Change: -0.39% Day High: 1037.5 Day Low: 1021.5

Further movement against National Glib ABOVE 1037.5 should improve accele ……..

</p

View Previous National Glib & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2295 Percentage Change: -1.08% Day High: 2380 Day Low: 2295

In the event of Oxford Instruments enjoying further trades beyond 2380, th ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:PHP Primary Health Close Mid-Price: 97.4 Percentage Change: -1.62% Day High: 99.9 Day Low: 96.6

Continued trades against PHP with a mid-price ABOVE 99.9 should improve t ……..

</p

View Previous Primary Health & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 227.4 Percentage Change: + 0.71% Day High: 231.4 Day Low: 227

Target met. All Rolls Royce needs are mid-price trades ABOVE 232 to impro ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 270.7 Percentage Change: + 1.42% Day High: 271.7 Day Low: 268.8

Target met. All Tesco needs are mid-price trades ABOVE 271.7 to improve a ……..

</p

View Previous Tesco & Big Picture ***