#Gold #WallSt As we approach Halloween, it obviously makes sense to review a scary share with the moniker BOO. Personally, a very Halloween event occurred during the last 24 hours, thanks to either Covid-19 vaccine or the Flu vaccine. From chatting to others, I’m inclined to suspect what was experienced was a Flu vaccine thing and the Covid jag did nothing harmful. After being stabbed twice by a nurse at noon, she warned any side effects shouldn’t last more than 24 hours and to get in touch if they did. But more assuringly, she added most folk don’t experience ANY side effects.

For this individual, this proved incorrect as virtually all flu symptoms kicked into play by around midnight, one after the other. The first one, bouts of uncontrolled shivering, lasted until around 2am and the point where my wife was ready to call an ambulance. I told her not to worry as I was starting to feel hot and sticky, just like a fever. By 4am, the fever symptoms left the building but a vile headache appeared and by 6am, the headache mercifully gone, the only problem was I could now hardly walk, due to severe muscle pains. And by 8am, the fever symptoms returned for a while, lasting just long enough to remind that the bedding now needed changed, along with the pillows. And by 12 noon, precisely 24 hours after the injections, we drove along to a local cafe for lunch as there was absolutely nothing wrong with me. There’s a ridiculous urban legend of the Flu Vaccine giving people Flu. I’d suggest this isn’t the case but the side effects did feel like two weeks of influenza on fast forward!

All things considered, it was one of these; “If Halloween did Vaccinations…” moments.

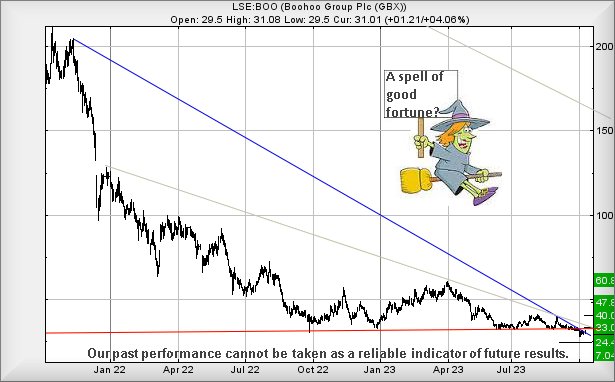

Boohoo share price has been experiencing a rather frightening time since the end of 2021 and finally is starting to show early symptoms of exiting the misery. We’re hopefully not reaching too hard but from our perspective, the price currently need only exceed 32.3p to give the first signal some recovery may be upon it.

We are hinging this on what happens, should just 31.08p be exceeded, only 0.07 above the current price so there’s not a lot of work required.

Above 31.08 calculates with the potential of a lift to 33p, once again returning above an uptrend which dates back to 2015. Normally, this would be quite a big deal, taking the share out of its immediate Blue downtrend. Should 33p be exceeded, things get interesting as a future 40p works out as a sane ambition. Visually this could signify the start of a proper share price recovery cycle but, to be safe, we shall prefer review the numbers if the 40p ambition makes itself known.

Our converse scenario remains scary as below 28p threatens a visit to 24p. If broken, our eventual ultimate bottom works out at just 7p.

For the present, we suspect Boohoo are about to experience some positive movement. Hopefully they don’t have any scary news to release, in keeping with the season.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:04:17PM | FTSE | 7617 | Success | ||||||||

| 10:12:22PM | BRENT | 8699.8 | |||||||||

| 10:15:52PM | GOLD | 1859.94 | 1853 | 1850 | 1845 | 1860 | 1865 | 1874 | 1895 | 1853 | |

| 10:18:17PM | STOX50 | 4179.5 | Success | ||||||||

| 10:20:32PM | GERMANY | 15395.7 | Success | ||||||||

| 10:23:04PM | US500 | 4357.4 | Success | ||||||||

| 10:26:29PM | DOW | 33735 | 33591 | 33480 | 33337 | 33675 | 33911 | 34068 | 34246 | 33712 | ‘cess |

| 10:29:47PM | NASDAQ | 15140.9 | ‘cess | ||||||||

| 10:39:50PM | JAPAN | 31785 | Success |

10/10/2023 FTSE Closed at 7628 points. Change of 1.82%. Total value traded through LSE was: £ 5,388,462,932 a change of 18%

9/10/2023 FTSE Closed at 7492 points. Change of -0.03%. Total value traded through LSE was: £ 4,566,678,677 a change of -5.8%

6/10/2023 FTSE Closed at 7494 points. Change of 0.58%. Total value traded through LSE was: £ 4,848,110,994 a change of 10.75%

5/10/2023 FTSE Closed at 7451 points. Change of 0.53%. Total value traded through LSE was: £ 4,377,671,479 a change of -22.43%

4/10/2023 FTSE Closed at 7412 points. Change of -0.78%. Total value traded through LSE was: £ 5,643,867,508 a change of 31.79%

3/10/2023 FTSE Closed at 7470 points. Change of -0.53%. Total value traded through LSE was: £ 4,282,549,883 a change of -23.79%

2/10/2023 FTSE Closed at 7510 points. Change of -1.29%. Total value traded through LSE was: £ 5,619,099,797 a change of 6.15%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:CCL Carnival** **LSE:JET Just Eat** **LSE:SPT Spirent Comms** **LSE:SPX Spirax** **

********

Updated charts published on : Avacta, Carnival, Just Eat, Spirent Comms, Spirax,

LSE:AVCT Avacta. Close Mid-Price: 151 Percentage Change: + 10.62% Day High: 151 Day Low: 136.5

Target met. Further movement against Avacta ABOVE 151 should improve acce ……..

</p

View Previous Avacta & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 957.2 Percentage Change: + 5.79% Day High: 958.4 Day Low: 909.2

This is surprisingly insipid as below 892 now looks capable of reversal to ……..

</p

View Previous Carnival & Big Picture ***

LSE:JET Just Eat. Close Mid-Price: 1044 Percentage Change: + 7.24% Day High: 1052 Day Low: 1014

Now above 1052 indicates the potential of a lift to an initial 1147p. If e ……..

</p

View Previous Just Eat & Big Picture ***

LSE:SPT Spirent Comms. Close Mid-Price: 98.5 Percentage Change: + 5.63% Day High: 98.7 Day Low: 95.55

In the event of Spirent Comms enjoying further trades beyond 98.7, the sh ……..

</p

View Previous Spirent Comms & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 8888 Percentage Change: -2.01% Day High: 9146 Day Low: 8832

Target met. In the event Spirax experiences weakness below 8832 it calcul ……..

</p

View Previous Spirax & Big Picture ***