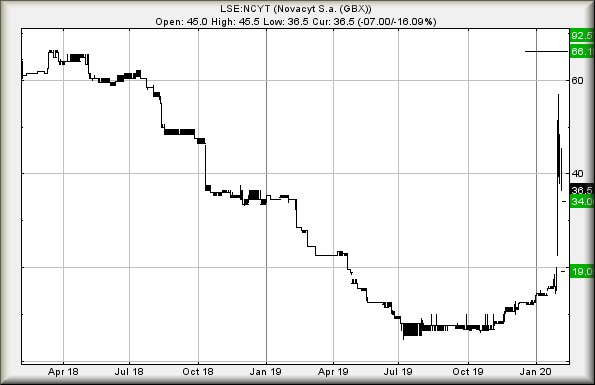

#Brent #CAC40 Judging by some emails, internet chatroom gossips are suggesting an expectation of “something” happening here. We need to stress, we’ve only been asked to review the numbers against this, not to check any fundamentals or whatever. Fridays drop was certainly scary, giving considerable food for thought.

Firstly, we calculated a logical bottom against this at 696p. It closed Friday at 700p, so no immediate reason for panic, aside from the important detail the share price actually moved below 696p during the session. It did so with a spike downward at 4pm, almost like the market was snatching a “sell order” prior to movement in the other direction! There is now some fairly serious danger, should the share now trade below 678p as it enters a zone where the Big Picture calculates with an initial target of 522, followed by a logical bottom of 6.5p. Visually, this is quite absurd, made possible by the massive drop last December.

However, the share DID NOT close below 696p, so we’re hopeful some sort of bounce is coming.

Near term, any excuse to better 806p calculates with an initial ambition of 871p, a fairly sedate ambition but worthy of attention is the price manages above such a level. Our secondary calculates at 1162p but realistically, if positive news is involved, it could accelerate pretty swiftly to 1527p. This is a heck of a jump, made possible by the severity of the shares reversals.

Our suspicion is some sort of rebound is expected anytime now. Here’s hoping!

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

3:28:22PM |

BRENT |

54.52 |

54.46 |

54.215 |

53.42 |

55.25 |

55.48 |

55.74 |

56.23 |

54.6 | |

|

3:31:18PM |

GOLD |

1570.8 |

‘cess | ||||||||

|

4:09:22PM |

FTSE |

7446.24 |

‘cess | ||||||||

|

4:11:04PM |

FRANCE |

6008.5 |

5997 |

5984.5 |

5963 |

6031 |

6044 |

6049 |

6067 |

6011 | |

|

4:13:53PM |

GERMANY |

13466.55 |

Success | ||||||||

|

4:15:54PM |

US500 |

3324.67 |

‘cess | ||||||||

|

4:19:44PM |

DOW |

29083.2 |

Success | ||||||||

|

4:21:40PM |

NASDAQ |

9392 | |||||||||

|

4:23:59PM |

JAPAN |

23674 |