It’s quite curious how both the FTSE, along with Wall St, each managed to attain pretty important target levels at the start of 2022. These levels had been calculated as viable since the lows of March 2020 and we were inclined to anticipate some hesitation across the markets, if they made an appearance.

What really surprises us is the coincidence of each market reaching similar milestones at the same time, despite the trading patterns on the FTSE and Wall St being utterly different. If there were any true similarity between the two index’, the FTSE would currently be trading around 9,600 points, rather than the 7450 level. Alternately, if Wall St were exhibiting similar lack of strength to the FTSE, that particular index would presently be trading around 28,000 points rather than 36,000. Yet, for some mysterious reason, both markets reached a level we regard (from a Big Picture perspective) as pretty important, perhaps explaining the currently case of volatility.

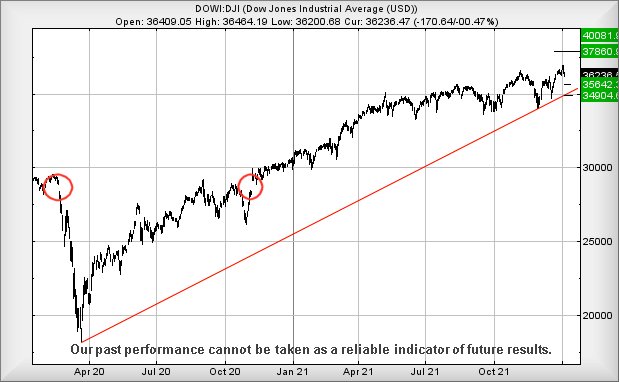

For Wall St, the immediate situation sounds serious as weakness next below 36,200 calculates with a reversal potential toward 36,542 points. We’ve a pretty strong argument hoping for a bounce at such a level, ideally just above this target. But if 36,542 breaks, we can work out a “bottom” potential down at 34,900 points or so. It’s amazing to note such a “bottom” also virtually coincides with the Red uptrend since March 2020, again providing an argument for some sort of bounce.

However, despite these slightly gloomy potentials, it’s worth remembering until such time Red breaks on the Wall St chart, the market has marginally exceeded our Big Picture target level and this tends imply the index is in an uptrend. If this is indeed the case, anything next above 36,955 shall be regarded with impressive potentials, allowing growth to an initial 37,880 with secondary, if bettered, now at 40,080 points sometime in the future. We do expect a degree of hysterics and volatility, if the 40,000 level makes an appearance.

As for the FTSE, the recent visit to 7,530 was fascinating, taking the index into an important region where the Big Picture demanded the index close a session above 7,518 points to promise a future of wine and roses. Alas, on the day, the best the FTSE could offer was closing at 7,516 points on Wednesday with Thursday providing a logical slight reversal. We take considerable hope from Wednesdays high of 7,530. Movement now above such a level (or closure above 7,518 points) now confirms a Big Picture potential of future movement to 7,696 points. If exceeded, our longer term secondary comes in at 8,080 points.

Even from an immediate stance, above just 7,496 points apparently should attempt near term growth to 7,536 points. Obviously, such a target again exceeds Wednesdays high, also giving London a fair chance to close a session above 7,518 and triggering the foregoing Big Picture expectations.

It’s almost difficult to pour misery on the FTSE’s future chances but, of course, we’ll take a stab at it. Currently, below 7,395 looks like it shall prove capable of triggering some reversals down to 7,314 points. Should the market opt to break such a level, our secondary works out at 7,240 points and a hopeful bounce.

Finally, we didn’t anticipate starting the year with such a statement but we suspect this particular analysis shall prove worth printing out and sticking on the wall. From our perspective, quite a few of the foregoing numbers look pretty important for 2022.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:28:24PM | BRENT | 81.76 | 81.33 | 80.915 | 82.1 | 82.58 | 82.8 | 81.4 | ‘cess | ||

| 9:31:05PM | GOLD | 1788.14 | 1786 | 1782 | 1801 | 1808 | 1811 | 1793 | Success | ||

| 9:33:20PM | FTSE | 7451.46 | 7425 | 7395 | 7480 | 7497 | 7509 | 7444 | ‘cess | ||

| 9:36:13PM | FRANCE | 7250 | 7235 | 7205 | 7271 | 7302 | 7317 | 7267 | Success | ||

| 9:39:58PM | GERMANY | 16037.99 | 15982 | 15930 | 16058 | 16152 | 16208 | 16050 | |||

| 9:42:22PM | US500 | 4699 | 4670 | 4652 | 4718 | 4724 | 4733 | 4693 | ‘cess | ||

| 9:45:08PM | DOW | 36271.7 | 36198 | 36113 | 36376 | 36538 | 36585 | 36335 | ‘cess | ||

| 9:47:47PM | NASDAQ | 15798 | 15607 | 15502.5 | 15808 | 15899 | 15923 | 15723 | ‘cess | ||

| 9:55:57PM | JAPAN | 28712 | 28473 | 28432 | 28723 | 28929 | 29025 | 28678 | Success |

6/01/2022 FTSE Closed at 7450 points. Change of -0.88%. Total value traded through LSE was: £ 6,138,809,460 a change of 26.57%

5/01/2022 FTSE Closed at 7516 points. Change of 0.15%. Total value traded through LSE was: £ 4,850,064,854 a change of -31.07%

4/01/2022 FTSE Closed at 7505 points. Change of 1.64%. Total value traded through LSE was: £ 7,036,052,579 a change of 378.45%

31/12/2021 FTSE Closed at 7384 points. Change of -0.26%. Total value traded through LSE was: £ 1,470,600,972 a change of -36.25%

30/12/2021 FTSE Closed at 7403 points. Change of -100%. Total value traded through LSE was: £ 2,306,886,388 a change of 0%

29/12/2021 FTSE Closed at 7420 points. Change of 0%. Total value traded through LSE was: £ 3,844,071,499 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AVCT Avacta** **LSE:BARC Barclays** **LSE:CASP Caspian** **LSE:DDDD 4D Pharma** **LSE:EZJ EasyJet** **LSE:FGP Firstgroup** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:NWG Natwest** **LSE:POLY Polymetal** **LSE:PPC President Energy** **LSE:STAN Standard Chartered** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : AFC Energy, Avacta, Barclays, Caspian, 4D Pharma, EasyJet, Firstgroup, Fresnillo, Hikma, HSBC, British Airways, Lloyds Grp., Marks and Spencer, Natwest, Polymetal, President Energy, Standard Chartered, Zoo Digital,

LSE:AFC AFC Energy Close Mid-Price: 45.3 Percentage Change: -6.11% Day High: 48.1 Day Low: 43.4

Continued weakness against AFC taking the price below 43.4 calculates as ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 115.6 Percentage Change: + 0.00% Day High: 115 Day Low: 111.5

In the event Avacta experiences weakness below 111.5 it calculates with a ……..

</p

View Previous Avacta & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 200.45 Percentage Change: + 1.28% Day High: 201.05 Day Low: 195.8

Movement continuing above 201.5 still suggests an initial 205. Crucially, ……..

</p

View Previous Barclays & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 3.5 Percentage Change: -15.66% Day High: 4.15 Day Low: 3.45

Continued weakness against CASP taking the price below 3.45 calculates as ……..

</p

View Previous Caspian & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 50.2 Percentage Change: -3.09% Day High: 52.6 Day Low: 49

In the event 4D Pharma experiences weakness below 49 it calculates with a ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 624.2 Percentage Change: + 1.23% Day High: 635 Day Low: 599.6

Target met. Further movement against EasyJet ABOVE 635 should improve acc ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 100.6 Percentage Change: -1.85% Day High: 102.7 Day Low: 97

Weakness on Firstgroup below 97 will invariably lead to 90 as an initial ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 820.6 Percentage Change: -4.09% Day High: 845.4 Day Low: 820.6

Continued weakness against FRES taking the price below 820.6 calculates a ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 2125 Percentage Change: -3.01% Day High: 2191 Day Low: 2129

Target met. In the event Hikma experiences weakness below 2129 it calcula ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 478.25 Percentage Change: + 2.12% Day High: 479.45 Day Low: 463.95

Further movement against HSBC ABOVE 479.45 should improve acceleration to ……..

</p

View Previous HSBC & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 161.58 Percentage Change: + 0.47% Day High: 167.2 Day Low: 155.54

IAG have produced this first GaGa movement of 2022, suggesting quite firml ……..

</p

View Previous British Airways & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 52 Percentage Change: + 2.60% Day High: 51.95 Day Low: 49.82

Target Met. Further movement against Lloyds Grp. ABOVE 52 should now provo ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 250.9 Percentage Change: + 0.48% Day High: 256.7 Day Low: 245.9

Target met. All Marks and Spencer needs are mid-price trades ABOVE 256.7 ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 243.6 Percentage Change: + 2.61% Day High: 243.3 Day Low: 234.2

Continued trades against NWG with a mid-price ABOVE 243.3 should improve ……..

</p

View Previous Natwest & Big Picture ***

LSE:POLY Polymetal Close Mid-Price: 1200.5 Percentage Change: -3.88% Day High: 1237.5 Day Low: 1198.5

Target met. Weakness on Polymetal below 1198.5 will invariably lead to 11 ……..

</p

View Previous Polymetal & Big Picture ***

LSE:PPC President Energy Close Mid-Price: 1.92 Percentage Change: -0.77% Day High: 1.94 Day Low: 1.85

In the event President Energy experiences weakness below 1.85 it calculat ……..

</p

View Previous President Energy & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 477.3 Percentage Change: + 3.72% Day High: 479.1 Day Low: 455.4

Target met. In the event of Standard Chartered enjoying further trades be ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 136 Percentage Change: + 2.64% Day High: 133.5 Day Low: 129

All Zoo Digital needs are mid-price trades ABOVE 133.5 to improve acceler ……..

</p

View Previous Zoo Digital & Big Picture ***