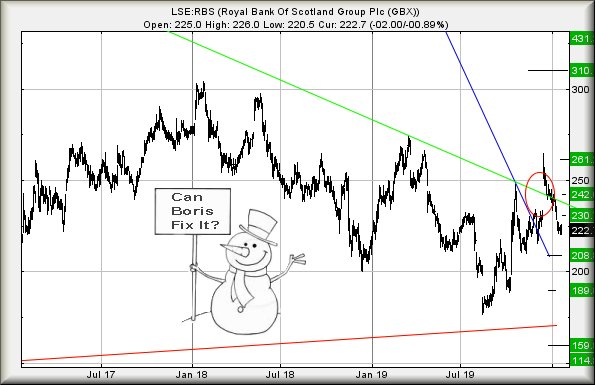

#France #DOWJONES It’s time for our monthly dip into the rancid waters of the UK’s Retail Banking Sector. So far this year, #RBS hasn’t need seek trouble as the price revels in a period of decline. We’re not even confident a downtrend exists to map movements against, the price tending move with the directional ability of a house fly!

At time of writing, it’s trading around 222p and we’ve a ‘concern’ level flagged at 211.25p. Essentially, if the price next manages trade below such a level, an initial (useless) drop target of 208p is expected. In fairness, we’d expect some sort of bounce at the 208p level, despite any initial break. Our secondary target, and hopefully a sensible bottom, calculates down at 189p. (or 18.9p in old money, prior to their 10:1 reconfiguration in an attempt to hide quite how dire price movements have been)

There’s a pretty major problem, should 189p break.

As the chart shows, 159 lurks below this level but as the price moves into the land of Lower Lows, bottom works out at 114p eventually.

There is (thankfully) a fairly major ‘however’. Circled on the chart was a forced movement to propel RBS above a trend line. At the time, we feared the share could suffer being gapped back below the trend, a market ploy which traditionally leaves investors walking funny. Thankfully, this has not happened (so far) either with RBS, Barclays or Lloyds. This gives us vague hope the market isn’t intending to utterly throttle Retail Bank share prices.

If this is to prove the case, we’d hope for a bounce anytime now. In theory, anything above 226p calculates with an initial potential of 230p, utterly useless in the great scheme of things. But if 230p is exceeded, we’re looking for secondary at 242p along with recovery above the trend. This should be significant, moving the share to relative safety with at least an attempt at the level of the most recent high, our target calculating at 261p.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:33:47PM |

BRENT |

62.43 |

Success | ||||||||

|

9:35:30PM |

GOLD |

1558.91 | |||||||||

|

9:41:41PM |

FTSE |

7567.33 |

Shambles | ||||||||

|

10:04:13PM |

FRANCE |

5999.2 |

5997 |

5978 |

5947 |

6034 |

6068 |

6081 |

6109 |

6025 |

Success |

|

10:17:55PM |

GERMANY |

13465 |

Success | ||||||||

|

10:19:28PM |

US500 |

3318.37 |

‘cess | ||||||||

|

10:21:59PM |

DOW |

29158 |

29132 |

29110.5 |

29033 |

29224 |

29323 |

29403.5 |

29494 |

29214 |

Success |

|

10:24:50PM |

NASDAQ |

9176.87 |

Success | ||||||||

|

10:26:49PM |

JAPAN |

23817 |

Success |