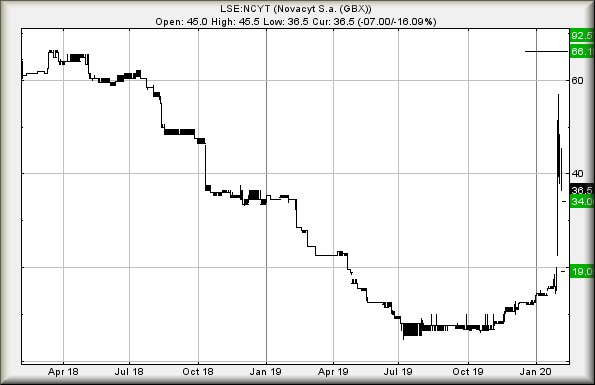

#FTSE #NASDAQ Our 31st October review of Eurasia (link) proved accurate. It also confirmed our grasp of time is tenuous at best, the share taking until the start of February to trigger a rise. And now, having achieved our 7.25p target, the share has been suspended from trading, leaving us wondering about our level of prescience.

It truly is a puzzle, the market only choosing to display the share price as CLOSING above 7.25p on the very day it was suspended, for some reason choosing 7.3p as the “closing price” on a day when the ordinary mortal couldn’t actually trade. Needless to say, a bunch of orders were shown as executed, the final “trade” of the day showing as 7.25p anyway! Quite why these trades took place is a bit of a raised eyebrow, 1/2 million at 8:05am through to one million showing at 4:07pm. According to our reports, all trades show a “buy” indicator.

We’re a little confused at this.

We find ourselves in a strange situation, releasing commentary against a share which isn’t trading. It’s a share which successfully hit and exceeded our secondary target during the last four sessions and now, it’s a share showing as closing at 7.3p, above our secondary.

Therefore it must be regarded as primed for future rises? (by just 0.05p, not particularly convincing)

Presumably it’s hoped the suspension shall be short lived, creating a situation where movement now above 7.9p (the prior highest intraday trading price) looks perfectly capable of a lift to 9p next. If exceeded, we can now calculate secondary at a more encouraging 11.75p eventually. In line with our grasp of timeframes, the secondary target could be longer term or perhaps the day after suspension is lifted. The Big Picture gives 19.75p as a major target for the future, one which requires the price to shrink below 4p to utterly cancel.

This brings us to the glaringly obvious. The stock market, always a kind and generous place, will doubtless be perfectly capable of throwing some reversals at the price following trade recommencing. So long as any market games do not drag the price below Blue (the long term downtrend), we shall be fairly relaxed but obviously, should it be taken below the critical line, we’ll need revisit the numbers in a panic.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:43:57PM |

BRENT |

54.34 | |||||||||

|

10:45:35PM |

GOLD |

1568.68 |

‘cess | ||||||||

|

10:54:20PM |

FTSE |

7505.53 |

7484 |

7468 |

7448 |

7522 |

7528 |

7543 |

7592 |

7480 |

Success |

|

10:55:42PM |

FRANCE |

6051.5 |

‘cess | ||||||||

|

10:57:33PM |

GERMANY |

13636 |

Success | ||||||||

|

10:58:59PM |

US500 |

3360.62 |

‘cess | ||||||||

|

11:00:58PM |

DOW |

29309 |

Success | ||||||||

|

11:02:22PM |

NASDAQ |

9529.49 |

9490 |

9457 |

9409 |

9550 |

9601 |

9627 |

9672 |

9531 |

‘cess |

|

11:05:17PM |

JAPAN |

23913 |

Success |