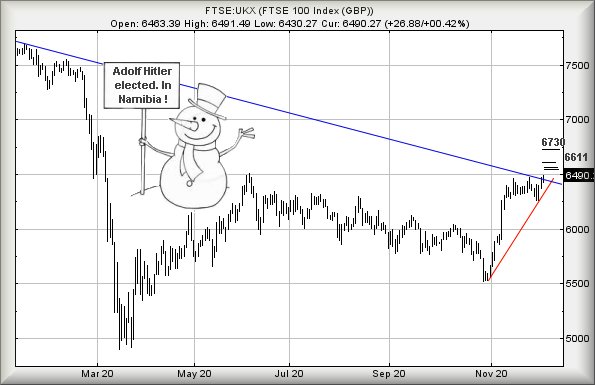

FTSE for FRIDAY (FTSE:UKX) Last Friday again provided a clue why our glance at the UK100 market is so popular, literally worldwide. We’d given criteria for a modest 55 point rise on the FTSE, calculating a secondary target at 6,560 points (link). On Friday, the FTSE topped out at 6,559.18 points, almost exactly our ambition and once again proving there’s a little bit more than guesswork going on!

Unusually, we also mentioned a 3rd target for the FTSE at 6,611 points, this being successfully achieved on Wednesday when the index achieved a day high of 6,623. It certainly feels, at least until such time our Govt foul up Brexit negotiations or Covid-19 immunisations, a Santa Rally is taking place. This being the case, some considerable hope is available for further market movements upward, though we’ve understandable hesitation with Big Picture ambitions. Surely UK politicians shall discover some method of derailing the potential of a 600 point rise cycle?

Near term, we calculate movement above 6,641 points as being capable of an initial 6,697 points. This target level is quite interesting as we’ve currently 3 distinctly different scenario establishing this as a viable target level. Usually we’re more than happy when 2 scenario agree, thus confidence appears possible. If exceeded, our secondary works out at 6,747 points.

From a bigger picture viewpoint, the FTSE has finally above the 6,500 level, a painfully obvious glass ceiling. Longer term, we can now mention 7,081 with secondary 7,310 as quite strong recovery prospects. It’s definitely “fingers crossed time” as London would need reverse below 6,074 to justify hysterics. In the absence of strong political will attempting to damage the markets, confidence appears possible.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:24:06PM | BRENT | 50.36 | 48.81 | 48.41 | 49.7 | 50.99 | 51.13 | 49.5 | ‘cess | ||

| 10:26:24PM | GOLD | 1837 | 1828 | 1817.5 | 1850 | 1853 | 1863.5 | 1833 | |||

| 10:45:32PM | FTSE | 6602 | 6557 | 6549.5 | 6602 | 6617 | 6641.5 | 6583 | ‘cess | ||

| 10:48:13PM | FRANCE | 5540 | 5507 | 5491.5 | 5550 | 5571 | 5588 | 5531 | |||

| 10:51:35PM | GERMANY | 13299 | 13259 | 13194 | 13325 | 13370 | 13394 | 13280 | ‘cess | ||

| 10:53:53PM | US500 | 3669 | 3655 | 3638.5 | 3678 | 3684 | 3699.5 | 3657 | ‘cess | ||

| 10:56:42PM | DOW | 30040 | 29936 | 29868 | 30066 | 30130 | 30162 | 30019 | ‘cess | ||

| 10:59:00PM | NASDAQ | 12402 | 12220 | 12147 | 12380 | 12448 | 12460.5 | 12348 | ‘cess | ||

| 11:01:14PM | JAPAN | 26688 | 26606 | 26537 | 26753 | 26831 | 26893.5 | 26670 | ‘cess |