#FTSE #SP500 When we previously reviewed Asos a year ago, we’d given quite a dire prediction with movement below 775 looking capable of a visit to 592p with secondary, if broken, an eventual bottom of a silly looking 90p. Now, from reading the gossip columns in the financial press, it appears others may be raising an eyebrow at the share price of this fallen star of the fashion world.

Mr Ashley and his Frasers Group have now apparently increased their share holding to just under 10% of the equity, challenging another couple of guys who believe they are capable of turning the company around from within.

No matter what, Asos appears to be living in interesting times and while we’re no longer pointing to 90p as a potential bottom, it currently appears weakness below just 322p threatens ongoing reversal to 277p, a price level not witnessed since 2009. If broken, our secondary and ultimate bottom now calculates down at an eventual 139p, hopefully with a bounce. Our suspicion is fairly basic, should Mr Ashley opt to try for a takeover, anytime between current and 277p shall make a lot of sense.

Of course, there is always the question, will people continue purchasing online, if they can once again make terrible fashion decisions in stores?

If any bounce is to prove valid, it currently calculates above 412p should tick the first box for viable recovery, pointing at the potential of recovery to an initial 443p with secondary, if exceeded, working out a 589p. This secondary should prove important, allowing the share price the opportunity to eventually close above Red on the chart (presently 498p) and offer great things for the future.

Unfortunately, as mentioned early, it’s easy to believe a “bottom” shall occur anywhere between current and 277p, if a battle between giants kicks off for the perceived value of this fashion retailer.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:22:54PM | BRENT | 74.15 | ‘cess | ||||||||

| 11:06:57PM | GOLD | 1944.18 | |||||||||

| 11:09:02PM | FTSE | 7591.87 | 7581 | 7570 | 7557 | 7601 | 7601 | 7616 | 7637 | 7583 | Shambles |

| 11:11:41PM | STOX50 | 4351.9 | Success | ||||||||

| 11:13:50PM | GERMANY | 16230.28 | |||||||||

| 11:16:20PM | US500 | 4367.57 | 4334 | 4323 | 4306 | 4355 | 4375 | 4386 | 4399 | 4353 | ‘cess |

| 11:19:31PM | DOW | 34127 | Success | ||||||||

| 11:21:37PM | NASDAQ | 14916.59 | ‘cess | ||||||||

| 11:25:18PM | JAPAN | 33456 | Success |

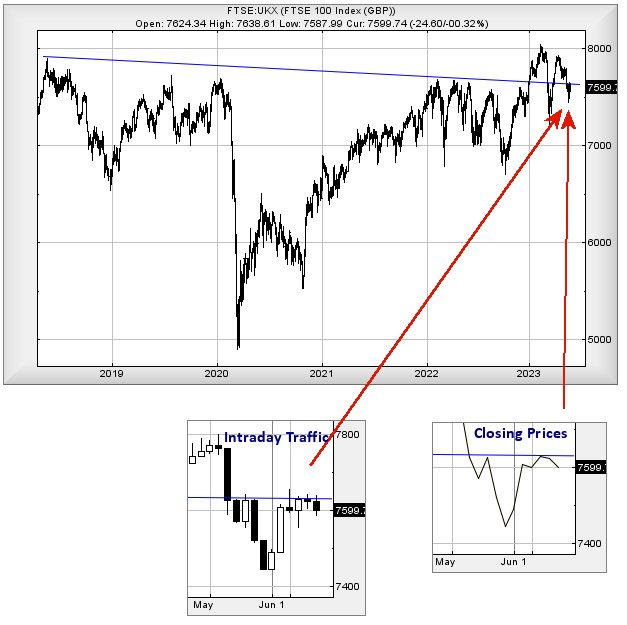

13/06/2023 FTSE Closed at 7594 points. Change of 1.66%. Total value traded through LSE was: £ 5,610,301,636 a change of 24.77%

12/06/2023 FTSE Closed at 7470 points. Change of -1.22%. Total value traded through LSE was: £ 4,496,360,714 a change of 0.19%

9/06/2023 FTSE Closed at 7562 points. Change of -0.49%. Total value traded through LSE was: £ 4,487,952,425 a change of -12.07%

8/06/2023 FTSE Closed at 7599 points. Change of -0.33%. Total value traded through LSE was: £ 5,104,102,479 a change of 3.08%

7/06/2023 FTSE Closed at 7624 points. Change of -0.05%. Total value traded through LSE was: £ 4,951,636,659 a change of 0.85%

6/06/2023 FTSE Closed at 7628 points. Change of 0.38%. Total value traded through LSE was: £ 4,909,723,355 a change of 21.93%

5/06/2023 FTSE Closed at 7599 points. Change of -0.11%. Total value traded through LSE was: £ 4,026,661,677 a change of -31.04%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CASP Caspian** **LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:HL. Hargreaves Lansdown** **LSE:IAG British Airways** **LSE:NG. National Glib** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Caspian, Cellular Goods, Carnival, Hargreaves Lansdown, British Airways, National Glib, Taylor Wimpey, Vodafone, Zoo Digital,

LSE:CASP Caspian Close Mid-Price: 4.85 Percentage Change: -3.96% Day High: 5.05 Day Low: 4.85

If Caspian experiences continued weakness below 4.85, it will invariably ……..

</p

View Previous Caspian & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 0.82 Percentage Change: -2.94% Day High: 0.85 Day Low: 0.82

Weakness on Cellular Goods below 0.82 will invariably lead to 0.58 and ho ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1064.5 Percentage Change: + 3.90% Day High: 1069 Day Low: 1028

Target met. All Carnival needs are mid-price trades ABOVE 1069 to improve ……..

</p

View Previous Carnival & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 863.4 Percentage Change: + 0.49% Day High: 874 Day Low: 861

All Hargreaves Lansdown needs are mid-price trades ABOVE 874 to improve a ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 165.75 Percentage Change: + 1.66% Day High: 165.75 Day Low: 163.05

Target met. All British Airways needs are mid-price trades ABOVE 165.75 ……..

</p

View Previous British Airways & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1036 Percentage Change: -1.10% Day High: 1047.5 Day Low: 1034.5

Target met. Continued weakness against NG. taking the price below 1034.5 ……..

</p

View Previous National Glib & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 110.9 Percentage Change: -3.23% Day High: 115.15 Day Low: 109.7

In the event Taylor Wimpey experiences weakness below 109.7 it calculates ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 72.43 Percentage Change: -0.58% Day High: 73.67 Day Low: 71.71

Target met. If Vodafone experiences continued weakness below 71.71, it wi ……..

</p

View Previous Vodafone & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 116 Percentage Change: + 0.43% Day High: 117 Day Low: 111.5

Continued weakness against ZOO taking the price below 111.5 calculates as ……..

</p

View Previous Zoo Digital & Big Picture ***