#Gold #Japan When we last reviewed HSBC back in January, we made the point the share price needed to close a session below 533p to utterly scupper our optimism for the future. The market opted to force incredulity to the limits, their share price closing at 534p toward the end of March. At least it indicated we’d been watching the correct trend, always something of a relief!

At present, HSBC are wandering in circles, essentially trapped at price levels seen before the pandemic and in common with many other UK based stocks, refusing to break free. Perhaps it is indeed the case, the UK needs act less in thrall to the USA and instead, work in its own best interests instead. This was an accusation recently made (privately) by a senior executive of HSBC in a personal capacity, after the UK banned Chinese telecoms company Huawei from taking part in the 5G mobile phone network build. Of course, with 40% of HSBC profits generated from Hong Kong and China, there is some justification in thinking “well, he would say that…”

Currently, we’re not very impressed with share price movements while the share slowly meanders toward the Blue downtrend on the chart, a line exerting a force since 2006. At time of writing, the implication is the share needs close a session above 694p to confirm the world has changed and some solid improvement should be anticipated. Such movement suggests triggering growth to an initial 759p with our secondary, if beaten, at a future 910p, along with almost certain hesitation.

Presently trading around 636p, HSBC needs below 619p to justify raised eyebrows as this risks triggering near term reversal to an initial 599p and probable bounce. However, in the event 599p breaks, any bounce is liable to prove short lived as a visit to our secondary at 562p looks perfectly viable. The 562p level is a real nuisance. Should it break, the share price can easily argue in favour of discovering 441p as a future bottom. However, for now, nothing is pointing at a reversal cycle. Instead, the pedantic behaviour of August markets is failing to provide any real guidance for the future.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:46:31PM | BRENT | 8720.3 | ‘cess | ||||||||

| 9:51:19PM | GOLD | 1914.11 | 1914 | 1901 | 1872 | 1932 | 1932 | 1935 | 1942 | 1922 | ‘cess |

| 9:53:33PM | FTSE | 7595.1 | ‘cess | ||||||||

| 9:56:09PM | STOX50 | 4328.1 | |||||||||

| 9:58:18PM | GERMANY | 15898.2 | ‘cess | ||||||||

| 10:00:03PM | US500 | 4474 | |||||||||

| 10:02:56PM | DOW | 35191.5 | |||||||||

| 10:12:08PM | NASDAQ | 15121.9 | ‘cess | ||||||||

| 10:16:24PM | JAPAN | 32186 | 32060 | 31936 | 31736 | 32207 | 32408 | 32497 | 32643 | 32237 |

\

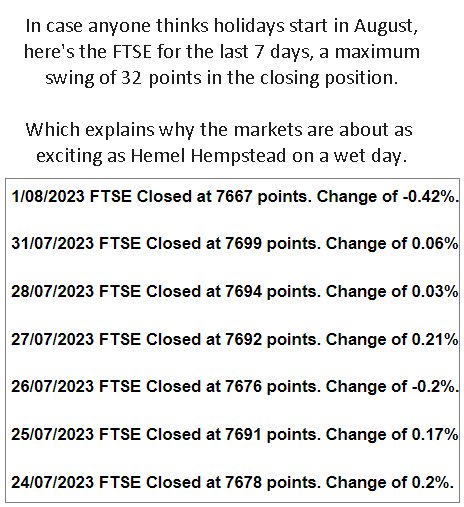

9/08/2023 FTSE Closed at 7587 points. Change of 0.8%. Total value traded through LSE was: £ 4,744,774,883 a change of 3.35%

8/08/2023 FTSE Closed at 7527 points. Change of -0.36%. Total value traded through LSE was: £ 4,591,181,240 a change of 31.12%

7/08/2023 FTSE Closed at 7554 points. Change of -0.13%. Total value traded through LSE was: £ 3,501,608,401 a change of -4.09%

4/08/2023 FTSE Closed at 7564 points. Change of 0.46%. Total value traded through LSE was: £ 3,650,960,164 a change of -42.72%

3/08/2023 FTSE Closed at 7529 points. Change of -0.42%. Total value traded through LSE was: £ 6,373,701,191 a change of 36.1%

2/08/2023 FTSE Closed at 7561 points. Change of -1.38%. Total value traded through LSE was: £ 4,683,211,781 a change of 12.76%

1/08/2023 FTSE Closed at 7667 points. Change of -0.42%. Total value traded through LSE was: £ 4,153,367,086 a change of -3.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:FGP Firstgroup** **LSE:GENL Genel** **LSE:HIK Hikma** **LSE:IPF International Personal Finance** **LSE:TERN Tern Plc** **LSE:TLW Tullow** **

********

Updated charts published on : Firstgroup, Genel, Hikma, International Personal Finance, Tern Plc, Tullow,

LSE:FGP Firstgroup. Close Mid-Price: 153.8 Percentage Change: + 2.12% Day High: 154.9 Day Low: 147.4

Further movement against Firstgroup ABOVE 154.9 should improve accelerati ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 88.7 Percentage Change: + 1.95% Day High: 91 Day Low: 85

In the event Genel experiences weakness below 85 it calculates with a dro ……..

</p

View Previous Genel & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 2205 Percentage Change: + 0.50% Day High: 2212 Day Low: 2173

Further movement against Hikma ABOVE 2212 should improve acceleration tow ……..

</p

View Previous Hikma & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 127.5 Percentage Change: + 2.00% Day High: 129.5 Day Low: 124

Target met. Further movement against International Personal Finance ABOVE ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 5.25 Percentage Change: -8.70% Day High: 6.1 Day Low: 5.25

Continued weakness against TERN taking the price below 5.25 calculates as ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TLW Tullow. Close Mid-Price: 36.4 Percentage Change: + 4.00% Day High: 36.5 Day Low: 34.86

Continued trades against TLW with a mid-price ABOVE 36.5 should improve t ……..

</p

View Previous Tullow & Big Picture ***