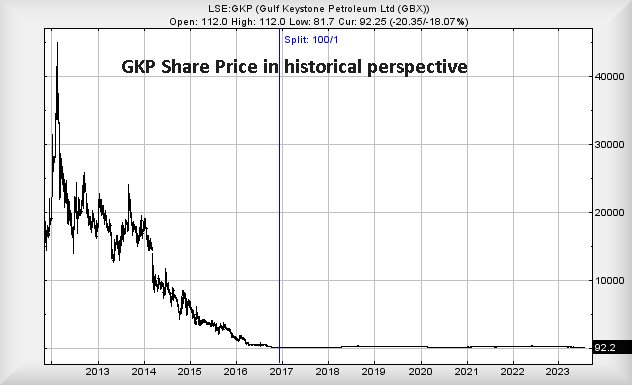

#FTSE #WallSt The term “getting cancelled” is thought to be very recent but, we suspect the methodology was first embraced by a small group of internet people, collectively known as the ‘GKP Gestapo’. They had a problem with anyone daring to write logically about the share, using their ‘offended gang’ to create an email/social media campaign against both the unfortunate journalist and also, the publication editor. This woefully stupid stance had a consequence; for quite a while no-one wrote about Gulf Keystone as the hassle wasn’t worth it. Yet their share price continued to fall. There are currently investors who need GKP above 45,000p to break even, thanks to these pound shop “promoters” actively silencing common sense. Currently, it’s trading around 92p!

Obviously, we’ve a personal axe to grind, often due to spending hours running analysis and producing 500+ words on potential GKP future prices, only to find hesitation against publication for fear of rocking the boat. Amusingly, the method used by the self appointed defenders of ‘Gulfy’ remains in use today by those groups anxious to find offence. Whether the subject is Climate Change, Gender, Cryptocurrency, Trump, or pineapple on pizza, the moment personal attacks are employed, it has become easier to believe the other side.

Rather than provide rebuttal against any facts, instead they attack a writer on a personal basis and hope the mud sticks. Currently, there’s an American guy called “Jim Cramer” on CNBC who constantly appears to be the subject of ridicule via Reddit and Twitter. While we’ve scant knowledge of his broadcasts, the attacks against him appear based entirely on his personality, rather than anything of substance. We can only assume at some stage he ran afoul of the agenda from a group of chatroom experts, folk now determined to “cancel” him.

As for Gulf Keystone currently, things don’t look very useful.

The immediate situation suggests below 81p risks triggering reversal to an initial 63p, a price level which hopefully shall prove capable of a bounce, if only due to historical price movements. Below 63p risks being ridiculous, calculating with the threat of an ultimate bottom down at 20p, this being a level below which we cannot calculate.

There is a slight hope for a panic bounce anytime soon, if only due to the truly awful drop potentials. Currently, their share price needs exceed Blue (141p) and hopefully do something convincing. This works out as capable of triggering price recovery to 190p eventually. Our long term secondary, should this target level be exceeded, calculates at a future 270p

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:20:56PM | BRENT | 8594.4 | Success | ||||||||

| 11:24:11PM | GOLD | 1924.65 | ‘cess | ||||||||

| 11:26:57PM | FTSE | 7542.1 | 7486 | 7453 | 7414 | 7522 | 7570 | 7585 | 7618 | 7532 | ‘cess |

| 11:29:25PM | STOX50 | 4310.8 | Success | ||||||||

| 11:32:13PM | GERMANY | 15828.5 | ‘cess | ||||||||

| 11:34:10PM | US500 | 4497.9 | ‘cess | ||||||||

| 11:36:12PM | DOW | 35291.2 | 35002 | 34909 | 34712 | 35170 | 35438 | 35467 | 35622 | 35348 | |

| 11:42:23PM | NASDAQ | 15268 | Success | ||||||||

| 11:45:18PM | JAPAN | 32269 |

8/08/2023 FTSE Closed at 7527 points. Change of -0.36%. Total value traded through LSE was: £ 4,591,181,240 a change of 31.12%

7/08/2023 FTSE Closed at 7554 points. Change of -0.13%. Total value traded through LSE was: £ 3,501,608,401 a change of -4.09%

4/08/2023 FTSE Closed at 7564 points. Change of 0.46%. Total value traded through LSE was: £ 3,650,960,164 a change of -42.72%

3/08/2023 FTSE Closed at 7529 points. Change of -0.42%. Total value traded through LSE was: £ 6,373,701,191 a change of 36.1%

2/08/2023 FTSE Closed at 7561 points. Change of -1.38%. Total value traded through LSE was: £ 4,683,211,781 a change of 12.76%

1/08/2023 FTSE Closed at 7667 points. Change of -0.42%. Total value traded through LSE was: £ 4,153,367,086 a change of -3.72%

31/07/2023 FTSE Closed at 7699 points. Change of 0.06%. Total value traded through LSE was: £ 4,313,676,670 a change of -54.58%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CPI Capita** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:HIK Hikma** **LSE:IHG Intercontinental Hotels Group** **LSE:NG. National Glib** **LSE:TERN Tern Plc** **

********

Updated charts published on : Capita, Fresnillo, Genel, Gulf Keystone, Hikma, Intercontinental Hotels Group, National Glib, Tern Plc,

LSE:CPI Capita Close Mid-Price: 19.94 Percentage Change: -1.97% Day High: 20.54 Day Low: 19.56

Target met. If Capita experiences continued weakness below 19.56, it will ……..

</p

View Previous Capita & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 544.2 Percentage Change: -3.37% Day High: 564.2 Day Low: 545

Weakness on Fresnillo below 545 will invariably lead to 518p with seconda ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel Close Mid-Price: 87 Percentage Change: -5.43% Day High: 92 Day Low: 86

Target met. Weakness on Genel below 86 will invariably lead to 89 with se ……..

</p

View Previous Genel & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 92.25 Percentage Change: -18.07% Day High: 112 Day Low: 81.7

Target met. Continued weakness against GKP taking the price below 81.7 ca ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 2194 Percentage Change: + 2.09% Day High: 2191 Day Low: 2152

Continued trades against HIK with a mid-price ABOVE 2191 should improve t ……..

</p

View Previous Hikma & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 5790 Percentage Change: + 2.33% Day High: 5800 Day Low: 5664

In the event of Intercontinental Hotels Group enjoying further trades bey ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 975.8 Percentage Change: + 1.08% Day High: 980.4 Day Low: 961.6

In the event National Glib experiences weakness below 961.6 it calculates ……..

</p

View Previous National Glib & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 5.75 Percentage Change: -12.08% Day High: 6.75 Day Low: 5.35

Weakness on Tern Plc below 5.35 will invariably lead to 3p with secondary ……..

</p

View Previous Tern Plc & Big Picture ***