#Gold #SP500 It took a Hawaiian shirt to reveal just how miserable the UK has become! Attending a late lunch on Sunday, the weather was pretty good and a particularly loud shirt presented itself in my wardrobe, an ideal garment for an sunny outdoors event. From the eyes upon me, it felt like I was wearing Chippendales garb to a vicars tea party. The uniform du jour amongst the blokes was either a white shirt, a white t-shirt, or if daring, a grey t-shirt with a daring grey outline of something. Amongst woman, the dress code was similar with only blue striped t-shirts offering the chance for individuality, this proving to be the style of choice for roughly half the attendees.

While I shall admit I wore the thing “for a laugh”, the real surprise was appreciating how drab our standard dress code has become, few folk willing to simply have fun by being a bit different. Over the years, I’ve become used to being ‘looked at’ when across on the mainland and choosing to wear a wide brimmed hat in the rain. These devices are truly clever, capable of keeping the wearer dry, yet folk in the city display some difficulty in handling such a radical concept, doubtless preferring their choice of getting wet. One standout event from the lunch came, when a couple of blokes asked where I’d got the shirt. Neither was overwhelmed at my answer, doubtless expecting a tale of shopping in Honolulu, rather than the true answer; “ten quid on eBay!”.

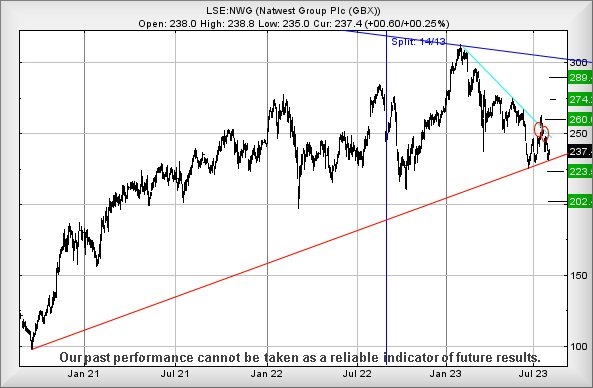

If only Natwest would make an effort to cheer people up…

The bank share price continues to underwhelm the market, making a brief attempt to escape the immediate downtrend, one which was quashed after just three sessions. Worse, as circled on the chart, the share price executed a GapUp/GapDown manoeuvre, one which looks perfectly capable of promoting reversals down to 202p eventually. Thus far, the uptrend since 2020 appears to be respected but, if this share follows our usual rules, no-one should be surprised if 202p makes itself known as a price level, a point from which we’d hope for a solid bounce. There’s a slight chance for a recoil at an initial 223 but realistically, once below 230p we suspect a visit to 202p shall become almost preordained.

At present, the price requires exceed 249 to hopefully trigger share price recovery to an initial 260 with secondary, if bettered, at a potential 274p and some hesitation. Unfortunately, for now we fear the worst.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 4:29:04PM | BRENT | 8588.6 | ||||||||

| 4:31:09PM | GOLD | 1942.41 | 1925 | 1894 | 1832 | 1955 | 1947 | 1949 | 1953 | 1939 |

| 4:34:00PM | FTSE | 7510.8 | 7615 | |||||||

| 4:36:24PM | STOX50 | 4303.33 | 4306 | |||||||

| 8:44:30PM | GERMANY | 15833.9 | 15878 | |||||||

| 8:46:59PM | US500 | 4477.4 | 4473 | 4462 | 4436 | 4497 | 4543 | 4581 | 4641 | 4504 |

| 8:50:00PM | DOW | 35054 | 35278 | |||||||

| 8:52:55PM | NASDAQ | 15280.1 | 15333 | |||||||

| 9:01:08PM | JAPAN | 31949 | 31996 |

4/08/2023 FTSE Closed at 7564 points. Change of 0.46%. Total value traded through LSE was: £ 3,650,960,164 a change of -42.72%

3/08/2023 FTSE Closed at 7529 points. Change of -0.42%. Total value traded through LSE was: £ 6,373,701,191 a change of 36.1%

2/08/2023 FTSE Closed at 7561 points. Change of -1.38%. Total value traded through LSE was: £ 4,683,211,781 a change of 12.76%

1/08/2023 FTSE Closed at 7667 points. Change of -0.42%. Total value traded through LSE was: £ 4,153,367,086 a change of -3.72%

31/07/2023 FTSE Closed at 7699 points. Change of 0.06%. Total value traded through LSE was: £ 4,313,676,670 a change of -54.58%

28/07/2023 FTSE Closed at 7694 points. Change of 0.03%. Total value traded through LSE was: £ 9,496,592,538 a change of 26.18%

27/07/2023 FTSE Closed at 7692 points. Change of 0.21%. Total value traded through LSE was: £ 7,526,466,026 a change of 81.26%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:CPI Capita** **LSE:EXPN Experian** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:NG. National Glib** **LSE:ODX Omega Diags** **LSE:RR. Rolls Royce** **LSE:SRP Serco** **LSE:TERN Tern Plc** **

********

Updated charts published on : Asos, Capita, Experian, Fresnillo, Genel, National Glib, Omega Diags, Rolls Royce, Serco, Tern Plc,

LSE:ASC Asos. Close Mid-Price: 439 Percentage Change: + 3.61% Day High: 444 Day Low: 418.3

Target met. Further movement against Asos ABOVE 444 should improve accele ……..

</p

View Previous Asos & Big Picture ***

LSE:CPI Capita Close Mid-Price: 21.94 Percentage Change: -18.26% Day High: 26.98 Day Low: 21.98

Weakness on Capita below 21.98 will invariably lead to 19p with secondary ……..

</p

View Previous Capita & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2848 Percentage Change: -0.97% Day High: 2870 Day Low: 2820

Below 2816 looks troublesome, capable of triggering reversal down to an in ……..

</p

View Previous Experian & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 558.4 Percentage Change: + 0.04% Day High: 560.6 Day Low: 546

Target met. Continued weakness against FRES taking the price below 546 ca ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel Close Mid-Price: 93.7 Percentage Change: -4.19% Day High: 97.9 Day Low: 93

If Genel experiences continued weakness below 93, it will invariably lead ……..

</p

View Previous Genel & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 979.6 Percentage Change: + 0.72% Day High: 978.4 Day Low: 964.4

Weakness on National Glib below 964.4 will invariably lead to 945 with se ……..

</p

View Previous National Glib & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 2.35 Percentage Change: -4.08% Day High: 2.45 Day Low: 2.3

Continued weakness against ODX taking the price below 2.3p calculates as ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 206.5 Percentage Change: + 7.44% Day High: 205.9 Day Low: 192.95

Target met. In the event of Rolls Royce enjoying further trades beyond 20 ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SRP Serco Close Mid-Price: 157.7 Percentage Change: -2.35% Day High: 162.3 Day Low: 156.3

Further movement against Serco ABOVE 162.3 should improve acceleration to ……..

</p

View Previous Serco & Big Picture ***

LSE:TERN Tern Plc. Close Mid-Price: 8.5 Percentage Change: + ##.##% Day High: 10.5 Day Low: 3.75

Above 9p calculates with the potential of another lift to 10.4 with second ……..

</p

View Previous Tern Plc & Big Picture ***