#Gold The #FTSE remains a marketplace giving the rest of the world a masterclass in how to actually do nothing while pretending to work. We’ve all had work colleagues like this, folk capable of pretending to read a screen all day, only to burst into panicked action around 4pm then failing at their main task of the day which may have been to place an order or get a quote. If questioned the next day, the excuse is always the same, waiting for someone to call them back.

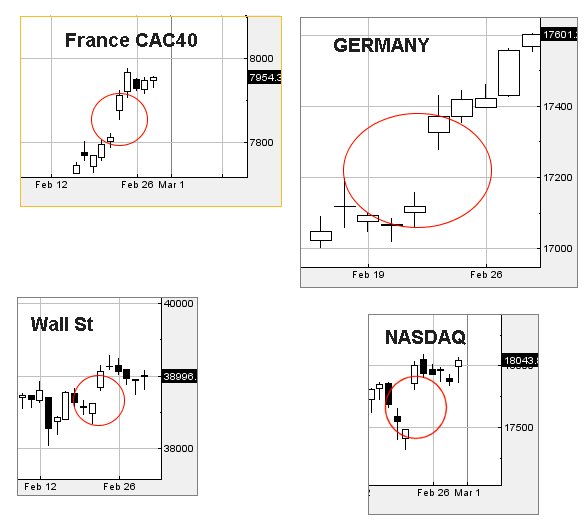

What’s worrying us about the FTSE is we “know” it must be approaching the panic action phase of performance as it’s effectively been treading water for a couple of years. Our suspicion is the market shall head upward and, as previously mentioned, a hope tempered by the salient detail many other world markets are at logical highs and facing potential reversals unless the index’s start being “gapped up”. As if by magic, these surprise gaps are appearing on many major markets, leading us to conclude the intention is to keep the rises coming. For example, if we take the Nasdaq which closed Thursday at a new all time high, the party could very well continue until just over 18,600 points, a level at which it again should experience hesitation UNLESS the market once again gaps it up.

Of course, the FTSE has missed out on this manipulation, remaining following its own confident but unfathomable path.

Near term, FTSE movement below just 7620 looks capable of promoting reversal to an initial 7576 points and a very possible bounce. Our secondary, should such a level break, calculates down at a less likely 7539 points, one of these numbers which is arithmetically possible but visually failing to make much sense. If triggered, our tightest stop loss in this scenario works out at 7678 points.

Alternately, if the FTSE does the unthinkable and opts to follow other markets, above 7651 should trigger near term recovery to an initial 7678 with our secondary, if bettered, at 7716 points, a level at which some hesitation makes visual sense. On a brighter note, the Grand Prix is actually this weekend and hopefully it provides some entertainment. Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:47:24PM | BRENT | 8185.6 | 8019 | 7893 | 8113 | 8272 | 8339 | 8139 | |||

| 9:50:44PM | GOLD | 2043.21 | 2028 | 2022 | 2012 | 2039 | 2052 | 2062 | 2073 | 2042 | Success |

| 9:59:20PM | FTSE | 7661.1 | 7618 | 7605 | 7580 | 7645 | 7681 | 7696 | 7722 | 7652 | Success |

| 10:01:54PM | STOX50 | 4891.2 | 4864 | 4853 | 4892 | 4905 | 4909 | 4885 | ‘cess | ||

| 10:08:10PM | GERMANY | 17732.9 | 17600 | 17534 | 17654 | 17761 | 17810 | 17701 | |||

| 10:11:22PM | US500 | 5091.4 | 5050 | 5029 | 5076 | 5101 | 5114 | 5073 | Success | ||

| 10:34:46PM | DOW | 38967 | 38790 | 38686 | 38922 | 39072 | 39099 | 38905 | ‘cess | ||

| 10:37:20PM | NASDAQ | 18032 | 17928 | 17863 | 18010 | 18044 | 18082 | 17967 | ‘cess | ||

| 10:40:11PM | JAPAN | 39311 | 38999 | 38918 | 39183 | 39346 | 39449 | 39104 | Shambles |

29/02/2024 FTSE Closed at 7630 points. Change of 0.08%. Total value traded through LSE was: £ 10,436,888,007 a change of 63.71%

28/02/2024 FTSE Closed at 7624 points. Change of -0.77%. Total value traded through LSE was: £ 6,375,065,167 a change of 28.06%

27/02/2024 FTSE Closed at 7683 points. Change of -0.01%. Total value traded through LSE was: £ 4,978,135,688 a change of -13%

26/02/2024 FTSE Closed at 7684 points. Change of -0.29%. Total value traded through LSE was: £ 5,722,289,036 a change of 8.14%

23/02/2024 FTSE Closed at 7706 points. Change of 0.29%. Total value traded through LSE was: £ 5,291,710,334 a change of -10.94%

22/02/2024 FTSE Closed at 7684 points. Change of 0.29%. Total value traded through LSE was: £ 5,941,569,029 a change of 3.14%

21/02/2024 FTSE Closed at 7662 points. Change of -0.74%. Total value traded through LSE was: £ 5,760,836,180 a change of 16.25%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:EMG MAN** **LSE:FRES Fresnillo** **LSE:HL. Hargreaves Lansdown** **LSE:QED Quadrise** **LSE:RBD Reabold Resources PLC** **LSE:SRP Serco** **LSE:STAN Standard Chartered** **LSE:STAR Star Energy** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Avacta, MAN, Fresnillo, Hargreaves Lansdown, Quadrise, Serco, Standard Chartered, Star Energy, Zoo Digital,

LSE:AVCT Avacta Close Mid-Price: 54.5 Percentage Change: -27.04% Day High: 61.5 Day Low: 51.5

Target met. Continued weakness against AVCT taking the price below 51.5 c ……..

</p

View Previous Avacta & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 243.5 Percentage Change: + 0.95% Day High: 262.3 Day Low: 242

Continued trades against EMG with a mid-price ABOVE 262.3 should improve ……..

</p

View Previous MAN & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 455.4 Percentage Change: + 0.84% Day High: 464.9 Day Low: 449.2

If Fresnillo experiences continued weakness below 449.2, it will invariab ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 728.4 Percentage Change: -3.63% Day High: 747 Day Low: 724.8

Continued weakness against HL. taking the price below 724.8 calculates as ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:QED Quadrise Close Mid-Price: 1.98 Percentage Change: -3.54% Day High: 2 Day Low: 1.8

If Quadrise experiences continued weakness below 1.8, it will invariably ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RBD Reabold Resources PLC Close Mid-Price: 0.08 Percentage Change: -6.25% Day High: 0.08 Day Low: 0.08

??????? ……..

</p

View Previous Reabold Resources PLC & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 187.3 Percentage Change: + 4.52% Day High: 192.7 Day Low: 183.8

Target met. In the event of Serco enjoying further trades beyond 192.7, t ……..

</p

View Previous Serco & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 667.6 Percentage Change: + 2.83% Day High: 669.8 Day Low: 644.8

All Standard Chartered needs are mid-price trades ABOVE 669.8 to improve ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:STAR Star Energy. Close Mid-Price: 7.96 Percentage Change: + 3.18% Day High: 7.75 Day Low: 7.12

If Star Energy experiences continued weakness below 7.12, it will invaria ……..

</p

View Previous Star Energy & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 23.5 Percentage Change: -8.74% Day High: 25.5 Day Low: 22.25

Target met. Continued weakness against ZOO taking the price below 22.25 c ……..

</p

View Previous Zoo Digital & Big Picture ***

*** End of “Updated Today” comments on shares. Listed below are those where commentary remains valid.

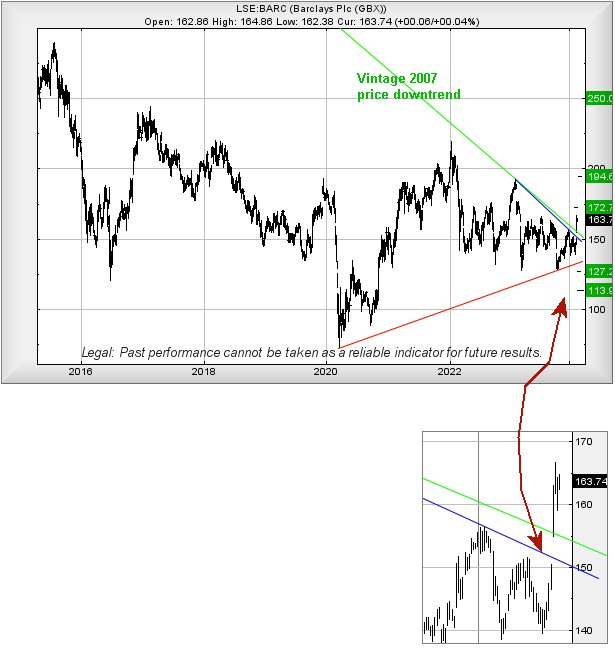

Click Epic to jump to share:LSE:AAL Anglo American** **LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:AV. Aviva** **LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:BDEV Barrett Devs** **LSE:BLOE Block Energy PLC** **LSE:BLVN Bowleven** **LSE:BME B & M** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:CAR Carclo** **LSE:CASP Caspian** **LSE:CCL Carnival** **LSE:CEY Centamin** **LSE:CLAI Cellular Goods** **LSE:CNA Centrica** **LSE:CPI Capita** **LSE:DARK Darktrace Plc** **LSE:DGE Diageo** **LSE:ECO ECO (Atlantic) O & G** **LSE:EME Empyrean** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:FGP Firstgroup** **LSE:FOXT Foxtons** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:GLEN Glencore Xstra** **LSE:GRG Greggs** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:IDS International Distribution** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:IPF International Personal Finance** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:MMAG Music Magpie** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:ODX Omega Diags** **LSE:OPG OPG Power Ventures** **LSE:OXIG Oxford Instruments** **LSE:PHP Primary Health** **LSE:PMG Parkmead** **LSE:RKH Rockhopper** **LSE:RR. Rolls Royce** **LSE:SBRY Sainsbury** **LSE:SCLP Scancell** **LSE:SDY Speedyhire** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:SPT Spirent Comms** **LSE:SPX Spirax** **LSE:TERN Tern Plc** **LSE:TLW Tullow** **LSE:TRN The Trainline** **LSE:TSCO Tesco** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **

********

Many thanks for taking the time to read this and good luck for today. Please feel free to mention us after something goes right!

Risk Warning & Notice to Investors

Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Trends and Targets Ltd, Shareprice, or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.