#FTSE #Nasdaq #Forex Timeframes are not our thing but still, our software is used to map important dates in the future. Thus, we know it’s 67 days ’till the next GP, the dogs are 5.9 & 12.2 years old, wifes birthday is in 152 days, that sort of thing. But knowing when #GBPUSD would precisely hit the 1.35 target given in our last report (link) is curiously absent in the status bar of our program.

This was an ambitious feature created, back in the days when it was naively thought we could get a handle on time. Alas, similar to the current Dr Who, we’re unable to do this. And why does a female Doctor need a posse of assistants spanning social demographics, when a male Doctor only ever needed a single assistant? Is the implication, a female Doctor cannot handle the same workload as her male counterpoint?

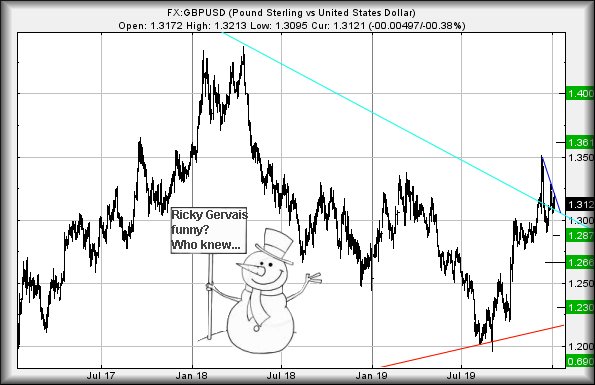

Our last diatribe relating to the Pound / Dollar pairing was given with the relationship at 1.292. If was to take just three weeks for the price achieve our 1.35 target, only to fall back to its usual holding pattern within the next few weeks. With 20:20 hindsight, the impetus for the share price jump was the Coronation of Boris but we’re increasingly concerned as to movements in the period since. Essentially, what had felt like strength is now doing a fair impersonation of a Flash in a Pan.

The relationship has certainly flopped around since the UK election, currently residing in a zone where weakness below 1.304 calculates with the potential of reversal to an initial 1.287. While visually, there’s a strong argument for a bounce at such a level, we’d warn if 1.287 breaks, our secondary calculation is at 1.266. Unfortunately, this shall take the pairing firmly into the grasp of a longer term “bottom” at 1.230.

However, one aspect of this period of flailing around is the potential, should the pairing firm up above 1.33 as this should trigger strength to an initial 1.361. And if exceeded, our secondary of 1.40 looks pretty logical.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:24:17PM |

BRENT |

68.07 |

‘cess | ||||||||

|

10:26:07PM |

GOLD |

1575.08 |

‘cess | ||||||||

|

10:28:19PM |

FTSE |

7563.84 |

7542 |

7490.5 |

7428 |

7596 |

7606 |

7621.5 |

7648 |

7560 |

‘cess |

|

10:30:16PM |

FRANCE |

6005 |

‘cess | ||||||||

|

10:44:31PM |

GERMANY |

13180.73 |

‘cess | ||||||||

|

10:46:37PM |

US500 |

3232.67 |

Shambles | ||||||||

|

10:50:03PM |

DOW |

28539 |

Shambles | ||||||||

|

10:53:44PM |

NASDAQ |

8830 |

8809 |

8788.5 |

8759 |

8865 |

8877 |

8912.5 |

8981 |

8834 | |

|

10:56:26PM |

JAPAN |

23339 |

‘cess |