#FTSE #DAX By any standards, this has been a terrible week. Both dogs AND both cats decided to celebrate this final last week of European unity by throwing up, the dogs at least alerting us, the cats choosing the Forex Model and doing it without any warning.

Who knew both types of animal could suffer their own version of ‘Winter Vomiting Bug’?

But once we’d opted to make a group booking at the Vets, the diagnosis was straightforward, if somewhat expensive. Apparently there was something doing the rounds locally, the Vets Practice gifted unusually high levels of January income as domestic pets enacted their own post-Xmas weight loss regime.

One amusing result following ‘Vet day’ has been angry cat & cat-hating dog deciding to bury their differences, an event which has taken nearly two years.

Similarly, this week the FTSE felt like it’s had a similar complaint to the animals, one day feeling okay, the next utterly foul. We’ve a vague hope, similar to our household pets, it shall make recovery with a ‘so what was bothering you’ action.

Anytime now would be good!

The market closed Thursday in a position where it becomes relatively easy to extrapolate a reversal cycle to 6,700 points. If broken, secondary calculates at a “must bounce” bottom of 6,400 points. If we opt draw lines on charts, the current scenario allows this, the market needing above 7,460 to cancel the concept. Of course, as usual, we’ve got a ‘However’.

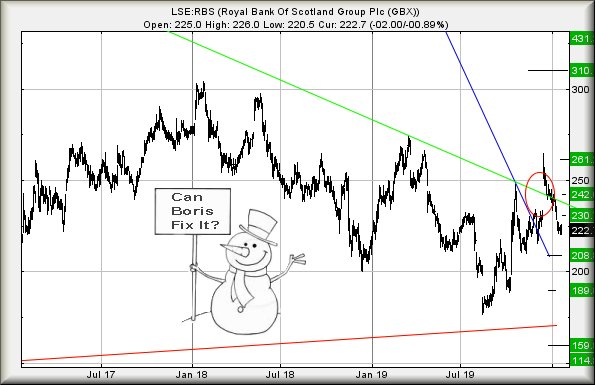

Brexit has never happened before, so there’s no playbook telling us what to expect. In fact, the reality of an 11 month exit period is liable to make 2020 interesting, as rumour vs reality should constantly happen while negotiations progress.

In addition, the low experienced on Thursday was a point at which we’d ordinarily hope for a rebound, so we’re going to look for miracle recovery signs for the FTSE near term. The UK Market, unlike one of the Golden Retrievers, is unlikely to try climb inside the dishwasher, a game she plays when her appetite is normal. But should the FTSE manage above a near term 7,402 points, it calculates with an initial ambition at 7,438 points.

If above this level, further computations return 7,490 as a target level. We’re not confident about such a number, due to the immediate downtrend being at 7,460 and almost certainly capable of provoking hesitation in movement.

Now we’ve spent time pretending optimism, what happens if the FTSE makes its way below 7,357 points? Initially we are looking at reversal to 7,309 points with secondary, if broken, down at 7,280 points. As always, beware a Spike Down at the market open on Friday morning as such will doubtless be an indication of a recovery day ahead!

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:24:37PM |

BRENT |

58.12 |

57.8 |

57.285 |

58.4 |

58.37 |

58.615 |

57.34 |

Success | ||

|

10:26:49PM |

GOLD |

1575.16 |

1572 |

1567.5 |

1578 |

1584 |

1585.5 |

1576 |

‘cess | ||

|

10:29:33PM |

FTSE |

7425 |

7378 |

7353 |

7457 |

7456 |

7483.5 |

7400 |

Success | ||

|

10:31:24PM |

FRANCE |

5911.2 |

5857 |

5841.5 |

5912 |

5912 |

5932.5 |

5860 |

Success | ||

|

10:33:39PM |

GERMANY |

13274 |

13116 |

13073 |

13176 |

13282 |

13339.5 |

13183 |

Success | ||

|

10:37:13PM |

US500 |

3290.92 |

3269 |

3257 |

3278 |

3298 |

3316 |

3269 |

Success | ||

|

10:42:53PM |

DOW |

28835.4 |

28555 |

28435.5 |

28714 |

28876 |

28919.25 |

28780 |

Success | ||

|

10:46:27PM |

NASDAQ |

9220.04 |

9100 |

9071.5 |

9133 |

9234 |

9263 |

9144 |

Success | ||

|

10:49:08PM |

JAPAN |

23209 |

22911 |

22816.5 |

23015 |

23241 |

23300 |

23090 |

Success |

30/01/2020 FTSE Closed at 7381 points. Change of -1.36%. Total value traded through LSE was: £ 5,559,853,454 a change of 15.61%

29/01/2020 FTSE Closed at 7483 points. Change of 0.04%. Total value traded through LSE was: £ 4,809,159,339 a change of -5.83%

28/01/2020 FTSE Closed at 7480 points. Change of 0.92%. Total value traded through LSE was: £ 5,106,872,635 a change of -10.29%

27/01/2020 FTSE Closed at 7412 points. Change of -2.28%. Total value traded through LSE was: £ 5,692,912,952 a change of 6.13%

24/01/2020 FTSE Closed at 7585 points. Change of 1.04%. Total value traded through LSE was: £ 5,364,214,029 a change of -0.13%

23/01/2020 FTSE Closed at 7507 points. Change of -0.85%. Total value traded through LSE was: £ 5,371,375,210 a change of -4.17%

22/01/2020 FTSE Closed at 7571 points. Change of -0.51%. Total value traded through LSE was: £ 5,604,978,241 a change of 11.63%

28/01/2020 FTSE Closed at 7480 points. Change of 0.92%. Total value traded through LSE was: £ 5,106,872,635 a change of -10.29%

27/01/2020 FTSE Closed at 7412 points. Change of -2.28%. Total value traded through LSE was: £ 5,692,912,952 a change of 6.13%

24/01/2020 FTSE Closed at 7585 points. Change of 1.04%. Total value traded through LSE was: £ 5,364,214,029 a change of -0.13%

23/01/2020 FTSE Closed at 7507 points. Change of -0.85%. Total value traded through LSE was: £ 5,371,375,210 a change of -4.17%

22/01/2020 FTSE Closed at 7571 points. Change of -0.51%. Total value traded through LSE was: £ 5,604,978,241 a change of 11.63%

24/01/2020 FTSE Closed at 7585 points. Change of 1.04%. Total value traded through LSE was: £ 5,364,214,029 a change of -0.13%

23/01/2020 FTSE Closed at 7507 points. Change of -0.85%. Total value traded through LSE was: £ 5,371,375,210 a change of -4.17%

22/01/2020 FTSE Closed at 7571 points. Change of -0.51%. Total value traded through LSE was: £ 5,604,978,241 a change of 11.63%

22/01/2020 FTSE Closed at 7571 points. Change of -0.51%. Total value traded through LSE was: £ 5,604,978,241 a change of 11.63%