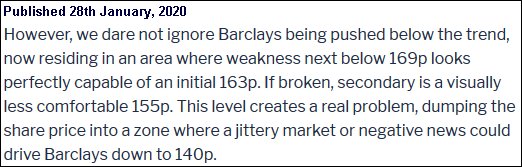

#Gold #SP500 Completing our monthly wade into the sewer which is the retail banks, Barclays managed flush itself quite thoroughly down the plughole. At the end of January, (link here) we gave a fairly unambiguous outlook as shown in the image below.

Visually, there’s some hope for a rebound anytime soon as the price challenges the Red uptrend since 2009. At present, any rebound needs exceed 158p to give some slight hope as this calculates with the potential of recovery to 166p. If beaten, our secondary works out at 185p, visually pretty impressive but failing (currently) to exceed Blue and scurry into safety for the longer term.

What happens if the share price now withers below 139p?

Initially we’re looking at weakness to 135p but should such a point break, life becomes pretty dangerous for Barclays with the potential of 90p making itself known as secondary.

Thankfully we’re keeping things brief tonight (Monday) as we’ve been mesmerised by the US markets during their final 90 minutes of trade. Witnessing the DOW achieve a 5.1% rise was truly unusual, suggesting recent panic drops have been exaggerated, resulting in a situation where some strong recovery across the markets can be hoped for. In the case of the DOW, allegedly moves now above 26,750 should prove capable of an 1,100 point rise!

Unless, of course, someone sneezes.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:27:14PM |

BRENT |

52.8 |

Success | ||||||||

|

10:28:41PM |

GOLD |

1589.96 |

1583 |

1578 |

1567 |

1597 |

1611 |

1619 |

1627 |

1595 |

‘cess |

|

10:32:32PM |

FTSE |

6717.91 | |||||||||

|

10:34:41PM |

FRANCE |

5407.2 |

Shambles | ||||||||

|

10:38:25PM |

GERMANY |

11999.04 |

Shambles | ||||||||

|

10:47:42PM |

US500 |

3078.27 |

2989 |

2954 |

2910 |

3040 |

3086 |

3103.25 |

3139 |

3031 |

Success |

|

10:52:47PM |

DOW |

26607.7 |

Success | ||||||||

|

10:54:56PM |

NASDAQ |

8833 |

Success | ||||||||

|

10:56:50PM |

JAPAN |

21484 |

‘cess |

2/03/2020 FTSE Closed at 6654 points. Change of 1.12%. Total value traded through LSE was: £ 11,007,742,370 a change of -20.6%

28/02/2020 FTSE Closed at 6580 points. Change of -3.18%. Total value traded through LSE was: £ 13,863,850,185 a change of 59.9%

27/02/2020 FTSE Closed at 6796 points. Change of -3.49%. Total value traded through LSE was: £ 8,670,151,517 a change of 31.45%

26/02/2020 FTSE Closed at 7042 points. Change of 0.36%. Total value traded through LSE was: £ 6,595,554,712 a change of -16.85%

25/02/2020 FTSE Closed at 7017 points. Change of -1.94%. Total value traded through LSE was: £ 7,932,387,742 a change of 6.36%

24/02/2020 FTSE Closed at 7156 points. Change of -3.34%. Total value traded through LSE was: £ 7,457,826,437 a change of 17.05%

21/02/2020 FTSE Closed at 7403 points. Change of -0.44%. Total value traded through LSE was: £ 6,371,450,688 a change of 1.87%

27/02/2020 FTSE Closed at 6796 points. Change of -3.49%. Total value traded through LSE was: £ 8,670,151,517 a change of 31.45%

26/02/2020 FTSE Closed at 7042 points. Change of 0.36%. Total value traded through LSE was: £ 6,595,554,712 a change of -16.85%

25/02/2020 FTSE Closed at 7017 points. Change of -1.94%. Total value traded through LSE was: £ 7,932,387,742 a change of 6.36%

24/02/2020 FTSE Closed at 7156 points. Change of -3.34%. Total value traded through LSE was: £ 7,457,826,437 a change of 17.05%

21/02/2020 FTSE Closed at 7403 points. Change of -0.44%. Total value traded through LSE was: £ 6,371,450,688 a change of 1.87%

25/02/2020 FTSE Closed at 7017 points. Change of -1.94%. Total value traded through LSE was: £ 7,932,387,742 a change of 6.36%

24/02/2020 FTSE Closed at 7156 points. Change of -3.34%. Total value traded through LSE was: £ 7,457,826,437 a change of 17.05%

21/02/2020 FTSE Closed at 7403 points. Change of -0.44%. Total value traded through LSE was: £ 6,371,450,688 a change of 1.87%

21/02/2020 FTSE Closed at 7403 points. Change of -0.44%. Total value traded through LSE was: £ 6,371,450,688 a change of 1.87%