#FreeFutures This year, Formula 1 has proven quite vibrant, less processional than recent years, and even Ferrari are looking more interesting. Obviously, the marque doesn’t have a chance of winning any titles but it’s nice to see the red cars ‘up there’. Despite a suspicion the current leader for the drivers title, Red Bull, shall be discovered to be secretly interpreting rules to suit themselves, Ferrari remain trailing at just 4th place in the constructors standings.

However, the car manufacturer appear to be suffering a share price which is doing very nicely! Perhaps this confirms the theory of Ferrari making their best road cars, when their racing team is doing poorly. The company last won a world championship in 2007 but their shares, traded in New York, continue to go from strength to strength.

The immediate situation is quite positive, suggesting movement next above $238 should make an attempt at an initial confident $245. If exceeded, we can calculate the potential of a longer term visit to $257. For everything to go into reverse, the share price needs slip below $204 as this permits reversal an initial $191 with secondary, if broken, at $175 and an almost certain bounce.

FTSE for FRIDAY It has been a pretty painful week, the UK market enjoying a range of just 60 ish points over 4 days. As we enter the Halloween weekend, should we suspect a major fright is awaiting to panic traders? There is a detail worthy of consideration. Our report last Friday provided a target of 7275 points. On both Tuesday and Wednesday of this week, the index achieved 7280 points, marginally above our target level and giving a reasonable reserve of hope for what’s coming next.

Above 7281 points now suggests coming strength to an initial 7354 points. If bettered, our secondary calculates at 7425 points. An interesting (from our perspective) detail relates to the recent period of relative hiatus, while on an upward cycle. Quite often, things change pretty fast with sharp upward movements over a period of days. While it’s the case the FTSE needs trouble the 7500 point, just to challenge the market level, pre-pandemic, arguments are accumulating supporting such a potential.

If everything intends go a little bit wrong, the FTSE needs below 7210 points to risk triggering reversal to an initial 7156 points. If broken, we can work out the risk of a secondary at 7082 points, hopefully with a solid bounce.

As always, many thanks to those who find worthwhile adverts to visit on this page.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

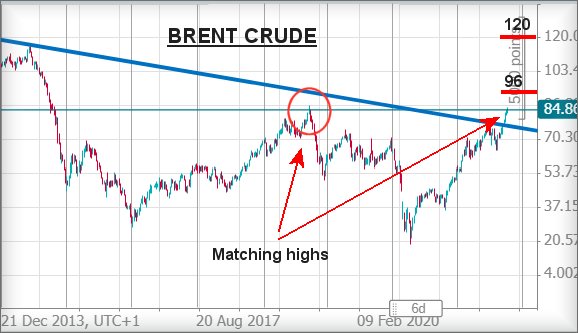

| 9:46:54PM | BRENT | 83.98 | 81.6 | 81.045 | 82.72 | 84 | 84.585 | 83.24 | ‘cess | ||

| 9:48:28PM | GOLD | 1799.39 | 1792 | 1787 | 1804 | 1811 | 1816.5 | 1792 | Success | ||

| 9:50:26PM | FTSE | 7246 | 7217 | 7200 | 7256 | 7261 | 7274 | 7229 | ‘cess | ||

| 9:53:00PM | FRANCE | 6801.5 | 6764 | 6752.5 | 6804 | 6805 | 6829 | 6764 | Success | ||

| 9:54:45PM | GERMANY | 15664.46 | 15626 | 15614 | 15696 | 15715 | 15745 | 15644 | ‘cess | ||

| 9:56:45PM | US500 | 4587.42 | 4569 | 4561 | 4591 | 4593 | 4600 | 4577 | Success | ||

| 9:58:17PM | DOW | 35776.7 | 35502 | 35418 | 35607 | 35796 | 35833.5 | 35597 | ‘cess | ||

| 10:00:34PM | NASDAQ | 15680 | 15636 | 15576.5 | 15722 | 15738 | 15765.5 | 15698 | ‘cess | ||

| 10:02:44PM | JAPAN | 28871 | 28672 | 28624 | 28862 | 28915 | 28998 | 28790 |

28/10/2021 FTSE Closed at 7249 points. Change of -0.06%. Total value traded through LSE was: £ 4,684,429,352 a change of -6.92%

27/10/2021 FTSE Closed at 7253 points. Change of -0.33%. Total value traded through LSE was: £ 5,032,708,114 a change of -16.48%

26/10/2021 FTSE Closed at 7277 points. Change of 0.76%. Total value traded through LSE was: £ 6,025,954,185 a change of 32.49%

25/10/2021 FTSE Closed at 7222 points. Change of 0.25%. Total value traded through LSE was: £ 4,548,373,792 a change of -2.6%

22/10/2021 FTSE Closed at 7204 points. Change of 0.19%. Total value traded through LSE was: £ 4,669,794,204 a change of -12.27%

21/10/2021 FTSE Closed at 7190 points. Change of -0.46%. Total value traded through LSE was: £ 5,323,076,986 a change of 2.72%

20/10/2021 FTSE Closed at 7223 points. Change of 0.08%. Total value traded through LSE was: £ 5,182,365,180 a change of -1.88%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CAR Carclo** **LSE:EXPN Experian** **LSE:IHG Intercontinental Hotels Group** **LSE:LLOY Lloyds Grp.** **LSE:QFI Quadrise** **LSE:RKH Rockhopper** **LSE:RR. Rolls Royce** **LSE:SBRY Sainsbury** **LSE:TLW Tullow** **LSE:VOD Vodafone** **

********

Updated charts published on : Carclo, Experian, Intercontinental Hotels Group, Lloyds Grp., Quadrise, Rockhopper, Rolls Royce, Sainsbury, Tullow, Vodafone,

LSE:CAR Carclo. Close Mid-Price: 43.7 Percentage Change: + 3.55% Day High: 45.1 Day Low: 43.1

Target met. Further movement against Carclo ABOVE 45.1 should improve acc ……..

</p

View Previous Carclo & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3320 Percentage Change: + 0.12% Day High: 3319 Day Low: 3289

Above 3337 should enter a cycle to an initial 3420 with secondary, if bett ……..

</p

View Previous Experian & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 5088 Percentage Change: + 1.23% Day High: 5100 Day Low: 4990

This is poised on the edge of some action. Above just 5115 now calculates ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 49.58 Percentage Change: + 1.27% Day High: 50.33 Day Low: 49.15

All Lloyds Grp. needs are mid-price trades ABOVE 50.33 to improve acceler ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 3.55 Percentage Change: -2.34% Day High: 3.4 Day Low: 3.29

Weakness on Quadrise below 3.29 will invariably lead to 2.8 and hopefully ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RKH Rockhopper Close Mid-Price: 5.7 Percentage Change: -6.56% Day High: 6.08 Day Low: 5.99

Continued weakness against RKH taking the price below 4.5 now allows for ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 132.02 Percentage Change: -1.42% Day High: 136.26 Day Low: 131.16

In the event Rolls Royce experiences weakness below 131.16 it calculates ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 299.6 Percentage Change: -2.25% Day High: 307.8 Day Low: 297.3

Further movement against Sainsbury ABOVE 307.8 should improve acceleratio ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 45.77 Percentage Change: -4.67% Day High: 47.8 Day Low: 45.46

Target met. Continued weakness against TLW taking the price below 45.46 c ……..

</p

View Previous Tullow & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 108.98 Percentage Change: -2.71% Day High: 111.78 Day Low: 109.1

Continued weakness against VOD taking the price below 109.1 calculates as ……..

</p

View Previous Vodafone & Big Picture ***