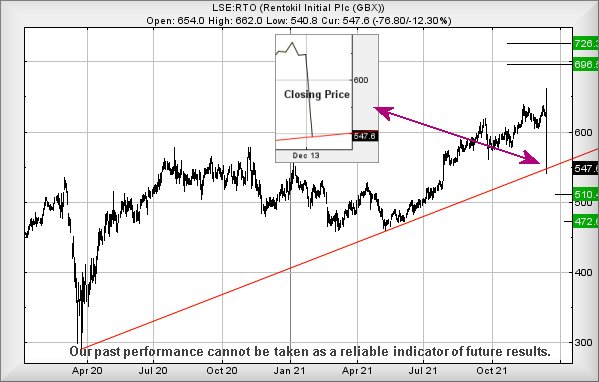

#FTSE #WallSt Rentokil share price movements on 14th December starkly illustrate the ‘market truism’, “Buy on the rumour, Sell on the news!”. Ending the day down 12%, the company announced they had become the largest Pest Control company in the world, taking over US company Terminex. With depressing inevitability, the eventual reversal to end the day down was attributed to the terms of the deal but we’re not sold on this concept.

We can be cynical, due to the price level the share closed the day at (547.6p), along with a simple calculation to discover the exact, immediate, level of the Red line. It works out the share price was required to close the day below 547.485p to successfully break Red. By an amazing stroke of luck (?), the share price ended the session 12/100th of a penny above the trend, presumably in safety and a point at which we may hope for a bounce.

From a near term perspective, the share price needs exceed 582p to trigger a prospective early warning signal. Recovery such as this allows for an initial 612p but should a reason be discovered to trade above 612p, things are liable to become interesting for the longer term, calculating with the suggestion of ongoing growth to 696p with secondary, if bettered, at 726p and a very probable point of hesitation.

When we examine the potentials, should a reversal scenario occur, the price looks like it actually needs below 533p to provoke a serious trigger, one which calculates as capable of bringing further slumps to 510p initially. Should such a level break, we can work out a secondary at 472p, a share price level which suggests a bounce can be hoped.

In conclusion, the chart overall looks pretty positive and while we’re perhaps grasping at straws with our observations on the company closing price for the 14th, there was clearly some sort of justification for the market ensuring the closing price didn’t break trend. Multiple experiences in the past tend suggest this is something worth paying attention to.

Once again, our thanks to the folk who discover adverts on this page worthy of visiting.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:22:42PM | BRENT | 73.26 | ‘cess | ||||||||

| 9:24:38PM | GOLD | 1771.29 | Success | ||||||||

| 9:26:54PM | FTSE | 7226.42 | 7206 | 7178 | 7148 | 7266 | 7287 | 7305 | 7338 | 7223 | ‘cess |

| 9:29:09PM | FRANCE | 6915.8 | ‘cess | ||||||||

| 9:48:52PM | GERMANY | 15524 | Success | ||||||||

| 9:51:18PM | US500 | 4637.72 | Success | ||||||||

| 9:53:49PM | DOW | 35569 | 35438 | 35340 | 35074 | 35595 | 35780 | 35866 | 36010 | 35598 | ‘cess |

| 9:56:30PM | NASDAQ | 15934 | Success | ||||||||

| 9:58:47PM | JAPAN | 28322 | ‘cess |

14/12/2021 FTSE Closed at 7218 points. Change of -0.18%. Total value traded through LSE was: £ 5,361,283,608 a change of -6.74%

13/12/2021 FTSE Closed at 7231 points. Change of -0.82%. Total value traded through LSE was: £ 5,748,563,220 a change of 23.93%

10/12/2021 FTSE Closed at 7291 points. Change of -0.41%. Total value traded through LSE was: £ 4,638,576,552 a change of -14.79%

9/12/2021 FTSE Closed at 7321 points. Change of -0.22%. Total value traded through LSE was: £ 5,443,441,871 a change of -11.44%

8/12/2021 FTSE Closed at 7337 points. Change of -0.04%. Total value traded through LSE was: £ 6,146,296,986 a change of 1.35%

7/12/2021 FTSE Closed at 7340 points. Change of 1.49%. Total value traded through LSE was: £ 6,064,412,188 a change of 23.32%

6/12/2021 FTSE Closed at 7232 points. Change of 1.54%. Total value traded through LSE was: £ 4,917,455,192 a change of -4.51%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:CASP Caspian** **LSE:CEY Centamin** **LSE:DARK Darktrace Plc** **LSE:DDDD 4D Pharma** **LSE:EXPN Experian** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:NG. National Glib** **LSE:OPG OPG Power Ventures** **LSE:POLY Polymetal** **LSE:TSCO Tesco** **

********

Updated charts published on : Aston Martin, Caspian, Centamin, Darktrace Plc, 4D Pharma, Experian, IQE, ITM Power, National Glib, OPG Power Ventures, Polymetal, Tesco,

LSE:AML Aston Martin Close Mid-Price: 1190.5 Percentage Change: -3.25% Day High: 1240.5 Day Low: 1188.5

Weakness on Aston Martin below 1188.5 will invariably lead to 1084 with s ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 3.75 Percentage Change: -3.85% Day High: 3.9 Day Low: 3.75

Continued weakness against CASP taking the price below 3.75 calculates as ……..

</p

View Previous Caspian & Big Picture ***

LSE:CEY Centamin Close Mid-Price: 82.14 Percentage Change: -1.46% Day High: 84.24 Day Low: 81.88

Continued weakness against CEY taking the price below 81.88 calculates as ……..

</p

View Previous Centamin & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 376 Percentage Change: -4.03% Day High: 403.2 Day Low: 375

Weakness on Darktrace Plc below 375 will invariably lead to 322 with seco ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 52.7 Percentage Change: -7.87% Day High: 58.3 Day Low: 52

Target met. Continued weakness against DDDD taking the price below 52 cal ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 3507 Percentage Change: -3.12% Day High: 3674 Day Low: 3509

All Experian needs are mid-price trades ABOVE 3674 to improve acceleratio ……..

</p

View Previous Experian & Big Picture ***

LSE:IQE IQE Close Mid-Price: 32 Percentage Change: -1.54% Day High: 33.1 Day Low: 31.8

Weakness on IQE below 31.8 will invariably lead to 31 with secondary (if ……..

</p

View Previous IQE & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 382.2 Percentage Change: -0.16% Day High: 412.2 Day Low: 375.4

This is starting to look a little ropey as weakness below 375 now calculat ……..

</p

View Previous ITM Power & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1055.4 Percentage Change: + 0.42% Day High: 1060.2 Day Low: 1049

Target met. Continued trades against NG. with a mid-price ABOVE 1060.2 sh ……..

</p

View Previous National Glib & Big Picture ***

LSE:OPG OPG Power Ventures Close Mid-Price: 11.12 Percentage Change: -2.20% Day High: 11.62 Day Low: 11.12

If OPG Power Ventures experiences continued weakness below 11.12, it will ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:POLY Polymetal Close Mid-Price: 1265 Percentage Change: -1.98% Day High: 1282 Day Low: 1260

Continued weakness against POLY taking the price below 1260 calculates as ……..

</p

View Previous Polymetal & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 284.75 Percentage Change: -0.21% Day High: 287.3 Day Low: 284

Continued trades against TSCO with a mid-price ABOVE 287.3 should improve ……..

</p

View Previous Tesco & Big Picture ***