#Gold_Futures #SP500 My wife likes to “joke”; placing me in a room with a washing machine is similar to giving a politician a book on Ethics, each unable to comprehend exactly what they are looking at. For many people, glancing a charts can provoke a similar response, yet there can be some simple pointers to future behaviour. LGEN are currently on the cusp of doing something interesting, needing only a little common sense to analyse a line on a chart.

The line in question is shown, in Blue, on the chart below.

Every now and then, we’re asked about the correct protocol for drawing trend lines. Should a downtrend always be Blue, should an uptrend always be Red? Frankly, it doesn’t matter. Many years ago, we decided on this convention simply to make charts look more colourful yet simple, especially as we assiduously avoid polluting our reports with a plethora of confusing Moving Average curves. We really like a straightforward chart, presented without random “tech indicator” interruptions which the vast majority of folk don’t understand. In real life, the only two tech indicators worthy of consideration are trend lines and candles.

At present, Legal & General Group Plc, a leading UK headquartered financial services provider, offering life insurance, pensions, retirement and investment services, exhibit something fairly interesting. It’s circled in Red on the chart above, shown in greater detail below.

The share price has broken through the pandemic downtrend, still not bothering to trouble its pre-Covid-19 high but certainly coming close. Around the world, other markets exhibit useful acceleration once share prices start exceed the level before everything hit the fan in early 2020. In the case of Legal & General, closure above 315p should prove critical in triggering some breakout behaviour.

The immediate situation implies, rather firmly, the market is perfectly aware of the Blue downtrend. LGEN has been permitted to exceed the trend, yet the share price hasn’t made any solid movements. Instead, the price is fluttering nervously in place, on the edge of moving but so far, unable to make a triggering motion. The key question, of course, is what can be regarded as a trigger?

For Legal & General, our inclination is to watch for movement exceeding the share price High since it broke Blue. If we accept this suggestion, above just 295p should prove important, allowing price recovery to an initial 301p and yet another post-pandemic high. Our longer term secondary (or the next day, timeframes must be vague) if this modest initial target is exceeded, calculates at 318p. From a Big Picture perspective, this secondary is critical, giving the share price the opportunity to close a session above its 315p level in early 2020. The implication of this scenario will prove important, taking the price into a zone where a distant 374p shall be viewed as the long term influence.

Plainly put, the share price is presently trading in a region where snapping up a quick profit for a small move to 318p may neatly avoid the potential gain to 374p. The chart suggests the price wants to go up, ‘simply’ needing the correct set of circumstances in the UK to kick things off.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:44:23PM | BRENT | 83.28 | |||||||||

| 9:46:07PM | GOLD | 1824.13 | 1812 | 1809 | 1803 | 1822 | 1827 | 1832 | 1842 | 1817 | ‘cess |

| 9:48:52PM | FTSE | 7298.65 | |||||||||

| 9:50:58PM | FRANCE | 7048 | ‘cess | ||||||||

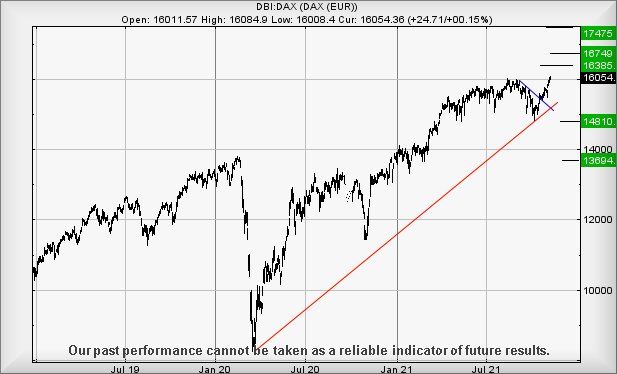

| 9:54:11PM | GERMANY | 16030 | |||||||||

| 9:56:11PM | US500 | 4700 | 4680 | 4667 | 4649 | 4707 | 4709 | 4718 | 4724 | 4694 | |

| 10:04:15PM | DOW | 36414.7 | ‘cess | ||||||||

| 10:06:03PM | NASDAQ | 16333 | Shambles | ||||||||

| 10:08:29PM | JAPAN | 29667 |

Once again, many thanks to the nice folk who discover adverts on this page worthy of visiting. We like someone else buying us a coffee!

8/11/2021 FTSE Closed at 7300 points. Change of -0.04%. Total value traded through LSE was: £ 5,475,805,501 a change of 1.81%

5/11/2021 FTSE Closed at 7303 points. Change of 0.33%. Total value traded through LSE was: £ 5,378,363,881 a change of -21.99%

4/11/2021 FTSE Closed at 7279 points. Change of 0.43%. Total value traded through LSE was: £ 6,894,189,975 a change of 28.51%

3/11/2021 FTSE Closed at 7248 points. Change of -0.36%. Total value traded through LSE was: £ 5,364,561,051 a change of -4.12%

2/11/2021 FTSE Closed at 7274 points. Change of -0.19%. Total value traded through LSE was: £ 5,594,886,752 a change of 24.19%

1/11/2021 FTSE Closed at 7288 points. Change of 0.7%. Total value traded through LSE was: £ 4,505,252,834 a change of -24.3%

29/10/2021 FTSE Closed at 7237 points. Change of -0.17%. Total value traded through LSE was: £ 5,951,106,978 a change of 27.04%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:CASP Caspian** **LSE:CBX Cellular Goods** **LSE:DDDD 4D Pharma** **LSE:EZJ EasyJet** **LSE:FRES Fresnillo** **LSE:ITRK Intertek** **LSE:PMG Parkmead** **LSE:VOG VICTORIA** **LSE:ZOL Zoldav** **

********

Updated charts published on : Aviva, Caspian, Cellular Goods, 4D Pharma, EasyJet, Fresnillo, Intertek, Parkmead, VICTORIA, Zoldav,

LSE:AV. Aviva Close Mid-Price: 403.3 Percentage Change: -0.17% Day High: 404.9 Day Low: 401.6

Now above 412p should give hope for genuine movement, allowing an initial ……..

</p

View Previous Aviva & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 4 Percentage Change: + 0.00% Day High: 4 Day Low: 4

Weakness now below 4 suggests the possibility of reversal to an initial 3. ……..

</p

View Previous Caspian & Big Picture ***

LSE:CBX Cellular Goods. Close Mid-Price: 8.25 Percentage Change: + 17.86% Day High: 8.25 Day Low: 7.1

Further movement against Cellular Goods ABOVE 8.25 should improve acceler ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 77.4 Percentage Change: -3.49% Day High: 93 Day Low: 76

All 4D Pharma needs are mid-price trades ABOVE 93 to improve acceleration ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 650.4 Percentage Change: -1.03% Day High: 663.2 Day Low: 640.2

Continued trades against EZJ with a mid-price ABOVE 663.2 should improve ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 925.8 Percentage Change: + 2.75% Day High: 932 Day Low: 905

Further movement against Fresnillo ABOVE 932 should improve acceleration ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5160 Percentage Change: + 1.53% Day High: 5174 Day Low: 5072

This is showing an interesting potential as movement above 5175 now threat ……..

</p

View Previous Intertek & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 47.6 Percentage Change: -2.46% Day High: 48 Day Low: 47.2

There’s something about the motor trade which simply feels dangerous at pr ……..

</p

View Previous Parkmead & Big Picture ***

LSE:VOG VICTORIA Close Mid-Price: 3 Percentage Change: -6.25% Day High: 3.12 Day Low: 3

In the event VICTORIA experiences weakness below 3 it calculates with a d ……..

</p

View Previous VICTORIA & Big Picture ***

LSE:ZOL Zoldav Close Mid-Price: 25 Percentage Change: -9.09% Day High: 25 Day Low: 20

If Zoldav experiences continued weakness below 20, it will invariably lea ……..

</p

View Previous Zoldav & Big Picture ***