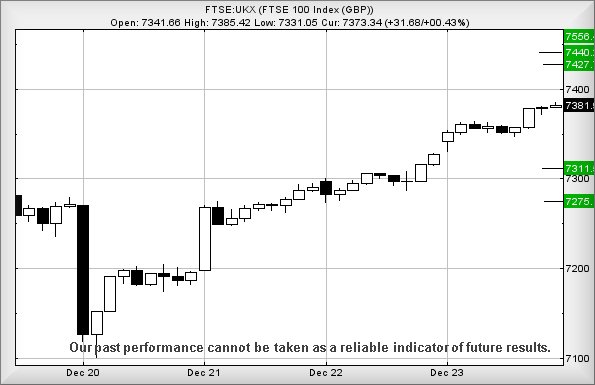

Despite few people taking the time out to read this (something to do with Xmas holidays), our whimsical report for Thursday proved rather concise. Our initial target of 7378 points was successfully achieved, bettered by 7 points, and giving a nice little useful 36 point trade. Of course, the big question relates to Friday mornings potentials.

A painful memory of many years ago brings a reminder of opening a Long position on Xmas eve morning, sometime around 10am. Of course, nothing actually happened for an age and eventually, at 12.15pm with the market due to close at 12.30pm, the decision was made to close the position and go do Xmas shopping. Quite literally, within minutes of the position being closed, the FTSE started to make solid movements and reached the target level, the final thing on screen as the the system shut down for the holiday break. Despite not trading anymore, this spiteful reminder of why the morning session on Xmas Eve remains, also providing the reason we don’t trade.

When involved in a trade, emotion enters the frame. Anxiety, fear, greed, impatience, or whatever excuse the human brain can discover to foul logical thinking. Successful traders are the folk who can lock emotion away in a drawer, calmly dealing with the scenario they chose. Idiotic traders, like we were, experienced panic, in this instance a fear of discovering the shops were closed but more commonly, panic due to a worry about profit vanishing, often taking minimal profits rather than “risk” a trade running to its logical target. They say you can’t go ‘burst’ making profits but you can completely burn yourself out and lose all perspective. There was a famous day, when 27 days were completed, averaging £1 profit per trade. This was pretty close to the end of our personal efforts to trade!

The funny thing, a couple of friends asked earlier this year about some long term investments. We’d suggested Rolls Royce at 107p, experiencing a complete roller coaster of emotions in the months since, only to be utterly horrified when the chum emailed to ask how Rolls Royce were doing. As per our initial scenario, she’d bailed at 139p and banked profits, opting to leave the value of her initial investment running for the longer term. While on a daily basis, we’ve been worriedly monitoring the share price, she hadn’t even bothered looking at it. She was blissfully unaware of the fairly wild ride the share price has been taking.

This again encapsulates the reason we don’t/can’t trade. We take the transactions far too personally.

As for the FTSE for Friday, the index remains looking positive. Despite FTSE Futures currently being marginally down from Thursdays close, things risk becoming quite enticing should the FTSE manage above 7388 points. Such a Xmas miracle comes with the potential of movement to 7427 points next. If bettered, our secondary calculates at 7440 points. Alas, this is Xmas Eve and as mentioned earlier, a session we distrust.

If triggered, the index needs fall below 7324 points to spoil the party, threatening reversal to 7311 points with secondary, if broken, down at 7275 points.

Finally, have a good Xmas break. We’ll be back on Wednesday 29th next week, hopefully sober, well fed, and calm.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:59:43PM | BRENT | 76.58 | 74.74 | 74.47 | 73.68 | 75.67 | 76.84 | 77.185 | 79.82 | 75.23 | ‘cess |

| 11:01:16PM | GOLD | 1809.1 | 1796 | 1791.5 | 1785 | 1808 | 1811 | 1814 | 1820 | 1803 | ‘cess |

| 11:04:58PM | FTSE | 7373 | 7331 | 7321 | 7299 | 7363 | 7385 | 7394 | 7436 | 7343 | ‘cess |

| 11:08:37PM | FRANCE | 7107.3 | 7048 | 7031 | 7001 | 7088 | 7121 | 7139 | 7151 | 7062 | ‘cess |

| 11:10:44PM | GERMANY | 15753 | 15601 | 15540 | 15461 | 15681 | 15777 | 15791.5 | 15896 | 15693 | Success |

| 11:13:20PM | NASDAQ | 16307 | 16146 | 16079 | 15986 | 16230 | 16360 | 16391 | 16487 | 16290 | ‘cess |

| 11:15:12PM | US500 | 4725 | 4721 | 4716 | 4708 | 4732 | 4740 | 4745 | 4776 | 4703 | ‘cess |

| 11:17:24PM | DOW | 3591 | 35745 | 35677 | 35546 | 35888 | 36070 | 36131 | 36342 | 35809 | Success |

| 11:20:13PM | JAPAN | 28847 | 28787 | 28764 | 28714 | 28847 | 28916 | 29011 | 29268 | 28702 | ‘cess |

23/12/2021 FTSE Closed at 7373 points. Change of 0.44%. Total value traded through LSE was: £ 3,429,761,214 a change of -22.36%

22/12/2021 FTSE Closed at 7341 points. Change of 0.6%. Total value traded through LSE was: £ 4,417,772,606 a change of -20.48%

21/12/2021 FTSE Closed at 7297 points. Change of 1.38%. Total value traded through LSE was: £ 5,555,401,277 a change of -2.97%

20/12/2021 FTSE Closed at 7198 points. Change of -0.98%. Total value traded through LSE was: £ 5,725,360,926 a change of 374.84%

17/12/2021 FTSE Closed at 7269 points. Change of 0.12%. Total value traded through LSE was: £ 1,205,733,107 a change of 0%

16/12/2021 FTSE Closed at 7260 points. Change of 1.26%. Total value traded through LSE was: £ 1,205,733,107 a change of -77.58%

15/12/2021 FTSE Closed at 7170 points. Change of -0.67%. Total value traded through LSE was: £ 5,378,114,182 a change of 0.31%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:BDEV Barrett Devs** **LSE:BP. BP PLC** **LSE:CASP Caspian** **LSE:CCL Carnival** **LSE:DGE Diageo** **LSE:HIK Hikma** **LSE:IGG IG Group** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:OXIG Oxford Instruments** **LSE:RKH Rockhopper** **LSE:RR. Rolls Royce** **LSE:STAN Standard Chartered** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Aviva, Barclays, BALFOUR BEATTY, Barrett Devs, BP PLC, Caspian, Carnival, Diageo, Hikma, IG Group, National Glib, Natwest, Oxford Instruments, Rockhopper, Rolls Royce, Standard Chartered, Taylor Wimpey,

LSE:AV. Aviva. Close Mid-Price: 409.4 Percentage Change: + 0.74% Day High: 410.4 Day Low: 405

Above 411 still looks useful, allowing movement to an initial 421 with sec ……..

</p

View Previous Aviva & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 187.4 Percentage Change: + 0.84% Day High: 188.28 Day Low: 187

Continuing above 189 now looks hopeful, allowing for an initial 196 with s ……..

</p

View Previous Barclays & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 263 Percentage Change: + 2.90% Day High: 266.2 Day Low: 256.8

Above just 266.2 should now make movement to 270 difficult to avoid. If be ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BDEV Barrett Devs Close Mid-Price: 738.6 Percentage Change: -0.19% Day High: 745.2 Day Low: 738

Now above 746 looks capable of 760 next. If exceeded, our secondary calcul ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 337.95 Percentage Change: + 0.97% Day High: 341.85 Day Low: 336.4

Movements continuing above 342 remain pointing at 353 next, along with a s ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 5.05 Percentage Change: + 14.77% Day High: 5.8 Day Low: 4.4

Target Met. Now above 5.8 calculates with the surprise potential of an ini ……..

</p

View Previous Caspian & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1428.8 Percentage Change: + 0.51% Day High: 1469.8 Day Low: 1412.4

Above 1470 should bring the price to an initial 1544p. If bettered, our se ……..

</p

View Previous Carnival & Big Picture ***

LSE:DGE Diageo Close Mid-Price: 4037 Percentage Change: -0.12% Day High: 4056.5 Day Low: 4014

In the event of Diageo enjoying further trades beyond 4057, the share shou ……..

</p

View Previous Diageo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 2186 Percentage Change: -1.18% Day High: 2225 Day Low: 2175

This suddenly is looking a bit risky as weakness below 2175 suggests comin ……..

</p

View Previous Hikma & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 804 Percentage Change: + 0.50% Day High: 807 Day Low: 798.5

Still surprisingly useful, above 807 now suggests the potential of recover ……..

</p

View Previous IG Group & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1084.4 Percentage Change: -0.11% Day High: 1088 Day Low: 1073.6

Continued trades against NG. with a mid-price ABOVE 1088 should improve th ……..

</p

View Previous National Glib & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 226.5 Percentage Change: + 0.80% Day High: 227.7 Day Low: 224.3

This is truly absurd as the outlook is effectively unchanged. The share re ……..

</p

View Previous Natwest & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2655 Percentage Change: + 1.14% Day High: 2755 Day Low: 2605

Target Met. Further movement against Oxford Instruments ABOVE 2757 should ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 8.24 Percentage Change: + 0.49% Day High: 8.2 Day Low: 7.27

Above 8.25p still suggests an initial 9.35p with our longer term secondary ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 120.84 Percentage Change: + 2.11% Day High: 123.68 Day Low: 118.48

Target Met. Near term, above 124 is expected to bring an initial 128 with ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 440.5 Percentage Change: + 1.66% Day High: 442 Day Low: 434.2

Something has changed slightly as above 442 now anticipates an initial 455 ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 175.25 Percentage Change: + 0.66% Day High: 175.5 Day Low: 173.65

Movement now above 176 indicates the potential of recovery to an initial 1 ……..

</p

View Previous Taylor Wimpey & Big Picture ***