With all the controversy about vaccines & masks, a decision to wear a different type of mask to a hospital appointment provoked some interesting results. Immediately recognised as, unlike in movies, they don’t hide your identity. More importantly, the nurses were in hysterics, the ward sister gleefully ‘borrowing’ it for a staff meeting. It appears the FTSE is also clearly wearing its own version of a superhero mask.

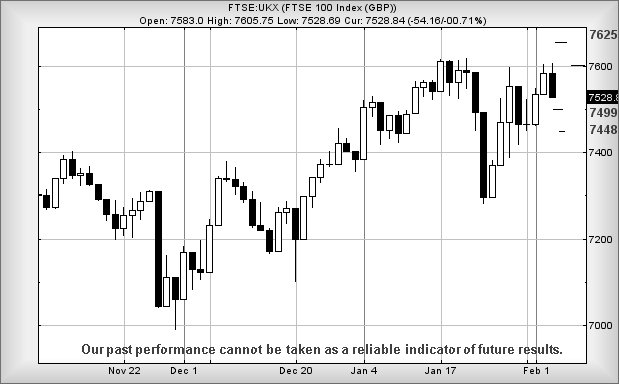

Witnessing a day, where the FTSE yet again did well despite a backdrop of the Nasdaq down 2.3%, Wall St down by 1.5%, France down and Germany flat, the UK market has continued to excel in the initial optimism which followed the pre-pandemic high being exceeded. Unfortunately, the market is now facing the next major hurdle. It closed Thursday at 7672 points, marginally below the previous high in January 2020 of 7674 points. We’d be comfortable Friday would again experience gains, if the UK index had just managed a few points higher. However, the visual implication given by this behaviour may be of slight nerves in the market place. Even the day high, at 7687 points, proved slightly below the previous high on the Blue trend at 7689 points. Perhaps we’re being a little pedantic but we’re more than a little curious as to what level the FTSE shall run out of steam, while it catches up with the previously flamboyant nature of other markets in the world.

The immediate situation for the FTSE 100 is pretty straightforward as movement above 7688 points should next target recovery to an initial 7714 with secondary, if bettered, at 7770 points. If triggered, the tightest stop looks like 7622 points.

Our alternate scenario allows weakness below 7622 to provoke reversals to an initial 7579 with secondary, if broken, a bottom of 7513 points and hopefully a proper bounce. The index now needs below 7380 to justify real panic.

As for the Nasdaq, it feels difficult letting a 2.3% reversal pass without comment. Presently trading at 14,705 points, the market requires below 14,450 to justify ongoing concern as this calculates with the potential of reversal to 13,755 next. If broken, our secondary works out at 12,941 points and visually, we’d hope for a rebound. Given price movements on the Nasdaq this week, we’re already resigned to 13,755 making an appearance.

Many thanks, again from the coffee fund, to those who discover an advert on this page worth visiting.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:45:19PM | BRENT | 90.81 | 90.38 | 89.7 | 91.1 | 91.93 | 92.71 | 90.96 | ‘cess | ||

| 9:47:15PM | GOLD | 1827.2 | 1821 | 1816 | 1836 | 1843 | 1852 | 1825 | Shambles | ||

| 9:48:52PM | FTSE | 7616.73 | 7606 | 7591 | 7647 | 7690 | 7724 | 7627 | ‘cess | ||

| 9:51:43PM | FRANCE | 7043 | 7037 | 6988 | 7079 | 7142 | 7160 | 7077 | Success | ||

| 9:54:00PM | GERMANY | 15385 | 15354 | 15309 | 15471 | 15582 | 15621 | 15480 | ‘cess | ||

| 9:56:13PM | US500 | 4498.62 | 4482 | 4446 | 4532 | 4554 | 4566 | 4519 | Success | ||

| 9:58:13PM | DOW | 35239 | 35105 | 34991 | 35355 | 35570 | 35636 | 35407 | Success | ||

| 10:00:55PM | NASDAQ | 14705.27 | 14632 | 14591 | 14782 | 14836 | 14862 | 14728 | |||

| 10:03:38PM | JAPAN | 27375 | 27333 | 27206 | 27614 | 27525 | 27574 | 27421 | ‘cess |

10/02/2022 FTSE Closed at 7672 points. Change of 0.38%. Total value traded through LSE was: £ 6,626,677,333 a change of -0.02%

9/02/2022 FTSE Closed at 7643 points. Change of 1%. Total value traded through LSE was: £ 6,627,688,349 a change of 1.84%

8/02/2022 FTSE Closed at 7567 points. Change of -0.08%. Total value traded through LSE was: £ 6,508,230,293 a change of 10.94%

7/02/2022 FTSE Closed at 7573 points. Change of 0.76%. Total value traded through LSE was: £ 5,866,179,162 a change of 4.27%

4/02/2022 FTSE Closed at 7516 points. Change of 3.55%. Total value traded through LSE was: £ 5,625,836,746 a change of -14.55%

3/02/2022 FTSE Closed at 7258 points. Change of -4.29%. Total value traded through LSE was: £ 6,584,025,295 a change of 21.45%

2/02/2022 FTSE Closed at 7583 points. Change of 0.64%. Total value traded through LSE was: £ 5,421,060,269 a change of -9.84%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:AVCT Avacta** **LSE:CCL Carnival** **LSE:EZJ EasyJet** **LSE:FRES Fresnillo** **LSE:GLEN Glencore Xstra** **LSE:IAG British Airways** **LSE:SCLP Scancell** **LSE:VOD Vodafone** **

********

Updated charts published on : Aviva, Avacta, Carnival, EasyJet, Fresnillo, Glencore Xstra, British Airways, Scancell, Vodafone,

LSE:AV. Aviva. Close Mid-Price: 445.5 Percentage Change: + 0.00% Day High: 448.8 Day Low: 443.6

Target met. All Aviva needs are mid-price trades ABOVE 448.8 to improve a ……..

</p

View Previous Aviva & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 64 Percentage Change: -6.57% Day High: 68 Day Low: 61.5

Weakness on Avacta below 61.5 will invariably lead to 55 with secondary, ……..

</p

View Previous Avacta & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1585.2 Percentage Change: + 2.22% Day High: 1604 Day Low: 1535.6

Target met. Further movement against Carnival ABOVE 1604 should improve a ……..

</p

View Previous Carnival & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 727.4 Percentage Change: + 3.94% Day High: 727.6 Day Low: 702

Further movement against EasyJet ABOVE 727.6 should improve acceleration ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 631.6 Percentage Change: -0.69% Day High: 640.4 Day Low: 621.8

If Fresnillo experiences continued weakness below 612, it will invariably ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 421.05 Percentage Change: + 0.25% Day High: 428.4 Day Low: 417.5

In the event of Glencore Xstra enjoying further trades beyond 428.4, the ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 178.3 Percentage Change: + 1.91% Day High: 180.04 Day Low: 173.72

All British Airways needs are mid-price trades ABOVE 180.04 to improve a ……..

</p

View Previous British Airways & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 15.5 Percentage Change: -7.46% Day High: 16.75 Day Low: 15.62

Continued weakness against SCLP taking the price below 15.62 calculates a ……..

</p

View Previous Scancell & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 138.44 Percentage Change: -0.79% Day High: 141.6 Day Low: 136.98

Target met. All Vodafone needs are mid-price trades ABOVE 141.6 to improv ……..

</p

View Previous Vodafone & Big Picture ***

*** End of “Updated Today” comments on shares.

<m> John Strang