#Gold #DOW

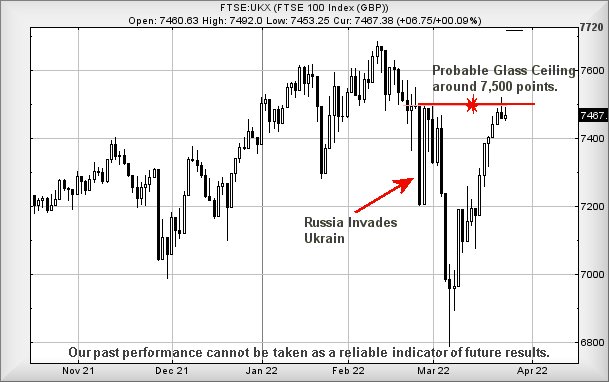

The market is now in a very strange situation, one where a long position may prove fascinating. Or extremely painful! It has now been a month since the Ukraine thing kicked off and were we completely gullible, we’d now be proposing the FTSE intends recovery toward 7,720 next. After all, as the chart highlights, the index has recovered to the pre-Russia level.

This, we suspect, is where a glass ceiling shall come into play, if only due to realisation the issue has not gone away.

The day before Russia invaded, the FTSE had a high of 7,550 points. To be stubborn, only market closure above this level will convince us a return to normality can be scheduled, perhaps because everyone has made friends again. Instead, we suspect we’re looking at a phoney recovery, possibly fuelled by a complete lack of knowledge as to what is actually going on. Painfully obvious propaganda from both sides is tending to cloud any attempt to discover reality and while this should be expected in any conflict, market movements, certainly from a day to day perspective, feel the opposite of trustworthy. It’s possible the stunning recovery from the 6,800 point level on March 7th shall prove completely erroneous, an amazing 700 point rise in just 14 sessions risking becoming a fond memory very quickly, if anything goes seriously wrong in Europe.

With the market flirting coquettishly at the level before everything hit the fan, we’d be reticent in advocating any sort of long position at present. Clearly, the market has recovered but so far, has failed to exceed the high achieved prior to this mess.

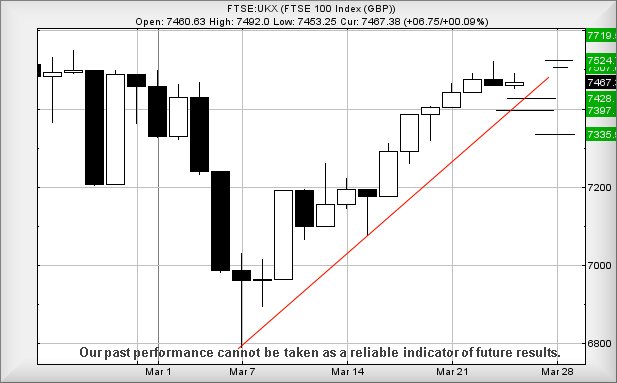

As for our popular FTSE for Friday, we’re going to start with a potential short scenario. However, it must be remembered the market is currently hovering at a hesitation level, a point in time where both Long and Short positions are liable to fizzle out around our initial target levels.

Near term, below 7453 should apparently promote reversal to a rather tame 7428 points. If broken, our secondary calculates at 7397 points. Visually, our initial target does make some sense, running into an imaginary Red uptrend since the low earlier this month. We’re not convinced about our secondary, if only due to it taking the index into a zone with a longer term attraction down at 7335 points.

Our Long position scenario is slightly less vague, suggesting movements next above 7492 should make an attempt at an initial 7507 points. If exceeded, our secondary calculates at 7524 points. Both ambitions keep the index toddling around the glass ceiling level, something we shall not concede is broken until such time the FTSE closes above the high, the day before Russia did its thing.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:20:34PM | BRENT | 115.25 | 114.22 | 112.98 | 117.64 | 120.51 | 122.695 | 125.52 | ‘cess | ||

| 9:23:27PM | GOLD | 1958 | 1936 | 1928 | 1950 | 1968 | 1975 | 1986 | ‘cess | ||

| 9:25:13PM | FTSE | 7479.1 | 7448 | 7433 | 7475 | 7494 | 7516 | 7547 | |||

| 9:27:20PM | FRANCE | 6585 | 6537 | 6495 | 6587 | 6601 | 6616 | 6642 | ‘cess | ||

| 9:28:59PM | GERMANY | 14341 | 14183 | 14122 | 14290 | 14385 | 14451 | 14541 | Shambles | ||

| 9:35:11PM | US500 | 4525 | 4462 | 4442 | 4502 | 4526 | 4529 | 4551 | ‘cess | ||

| 9:37:31PM | DOW | 34741 | 34325 | 34196 | 34478 | 34768 | 34784 | 34911 | ‘cess | ||

| 9:40:34PM | NASDAQ | 14768 | 14440 | 14299 | 14560 | 14769 | 14810 | 14936 | ‘cess | ||

| 9:43:40PM | JAPAN | 28332 | 27930 | 27826 | 28043 | 28360 | 28444 | 28561 | Success |

24/03/2022 FTSE Closed at 7467 points. Change of 0.09%. Total value traded through LSE was: £ 6,886,600,225 a change of 4.56%

23/03/2022 FTSE Closed at 7460 points. Change of -0.21%. Total value traded through LSE was: £ 6,586,106,936 a change of -2.72%

22/03/2022 FTSE Closed at 7476 points. Change of 0.46%. Total value traded through LSE was: £ 6,769,927,193 a change of 15.91%

21/03/2022 FTSE Closed at 7442 points. Change of 0.51%. Total value traded through LSE was: £ 5,840,589,175 a change of -56.99%

18/03/2022 FTSE Closed at 7404 points. Change of 0.26%. Total value traded through LSE was: £ 13,580,954,595 a change of 97.5%

17/03/2022 FTSE Closed at 7385 points. Change of 1.29%. Total value traded through LSE was: £ 6,876,379,438 a change of -21.82%

16/03/2022 FTSE Closed at 7291 points. Change of 1.69%. Total value traded through LSE was: £ 8,795,974,053 a change of 28.56%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:ECO ECO (Atlantic) O & G** **LSE:EME Empyrean** **LSE:GENL Genel** **LSE:POLY Polymetal** **LSE:SRP Serco** **

********

Updated charts published on : Astrazeneca, BP PLC, British Telecom, ECO (Atlantic) O & G, Empyrean, Genel, Polymetal, Serco,

LSE:AZN Astrazeneca. Close Mid-Price: 9836 Percentage Change: + 1.09% Day High: 9859 Day Low: 9692

In the event of Astrazeneca enjoying further trades beyond 9859, the shar ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 389.2 Percentage Change: + 0.34% Day High: 394 Day Low: 386.3

All BP PLC needs are mid-price trades ABOVE 394 to improve acceleration t ……..

</p

View Previous BP PLC & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 184.75 Percentage Change: + 1.54% Day High: 186.45 Day Low: 181.55

Further movement against British Telecom ABOVE 186.45 should improve acce ……..

</p

View Previous British Telecom & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 39.5 Percentage Change: + 6.76% Day High: 39.5 Day Low: 36.75

In the event of ECO (Atlantic) O & G enjoying further trades beyond 39.5, ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EME Empyrean. Close Mid-Price: 10.57 Percentage Change: + 1.68% Day High: 11.3 Day Low: 10.45

Continued trades against EME with a mid-price ABOVE 11.3 should improve t ……..

</p

View Previous Empyrean & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 179 Percentage Change: + 4.07% Day High: 179.4 Day Low: 170.8

All Genel needs are mid-price trades ABOVE 179.4 to improve acceleration ……..

</p

View Previous Genel & Big Picture ***

LSE:POLY Polymetal. Close Mid-Price: 166 Percentage Change: + 20.73% Day High: 184.05 Day Low: 140

There is a slight chance this may be about to do something interesting. Ab ……..

</p

View Previous Polymetal & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 139.8 Percentage Change: + 0.36% Day High: 140.8 Day Low: 137.4

Continued trades against SRP with a mid-price ABOVE 140.8 should improve ……..

</p

View Previous Serco & Big Picture ***