#FTSE #WallSt

The UK market is poised for some pretty impressive movement. There’s only one little problem, that of direction. Essentially, it’s looking about as confident and precise as the UK Prime Minister giving an answer in parliament. In the absence of a good April Fools joke, we’re essentially suggesting the market is poised to move quite strongly, making us search for probable trigger levels which should prove viable in indicating direction.

Firstly though, in an attempt to be topical, we followed the herd and sent our energy company our electricity reading. The company had two caveats on their webpage, pleading we refrain from calling them due to high numbers of folk presenting meter readings. Preferring not to speak to a human being, it was a matter of seconds to enter the actual meter reading against our account. Immediately suspecting their server was overwhelmed, the system refused to acknowledge our number, repeating the mantra of us being wrong with a helpful “Ooops, Incorrect Reading Entered”. By taking a photo of the meter reading, there was no doubt the number was correct, so we checked the last bill. It contained an estimated reading, approximately double the current figure. We then checked previous bills (along with our photo’s of the reading) and discovered their system has been cheerfully rejecting our physical readings for over a year, instead substituting “estimated” numbers. Our home, heated by a wood-burner and sometimes oil fired heating, has just three major devices which consume energy. My espresso coffee machine, a tumble drier (used infrequently), and a dishwasher which has survived a whole year. Lights are all energy saving, exterior floodlights are now all LED units. Even the oven is never used, my wife preferring her big ugly Ninja multi function thing which squats incomprehensively on a worktop.

Some simple calculations followed and it transpires their ‘estimates’ were costing £133 per month as opposed to a more reasonable £30 per month. We’d allowed ourselves to be stitched up royally by ignoring these estimates, thinking the bills couldn’t be very far away from reality. Of course, this tale has nothing to do with the stock market, nor April Fools day, other than to illustrate things can become clearer by taking a hard look at them.

Alas, for the UK stock market, this is not proving to be the case!

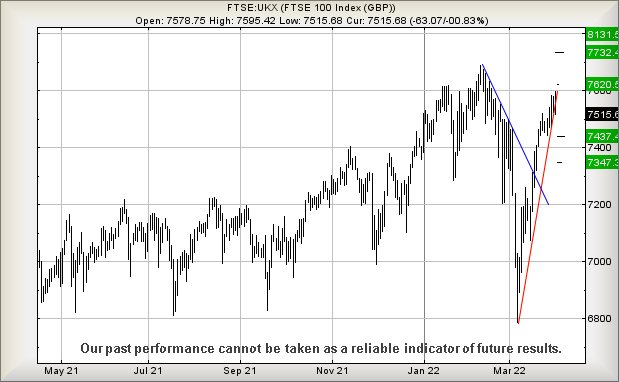

The FTSE closed Thursday at 7533 points. We suspect the market requires above 7575 to escape the prospect of some near term reversals.

Currently, below just 7515 points looks capable of triggering reversal to an initial 7437 points. Should this level break, our secondary calculates at an odd 7347 points and a hopeful bounce. The juxtaposition of target numbers wasn’t an accident, nor was it contrived. Until now, we’d been suspecting short positions to underperform but, as the chart shows, the UK index has now broken below its immediate uptrend, so we can only suspect the worst. Unfortunately, the tightest stop of 7575 reflects with potential

However, if we reflect on a potential gain scenario, a quite different picture emerges as above 7575 (okay, we prefer Thursdays high of 7596 points), the UK market shall be viewed as heading to an initial 7620 points with secondary, if exceeded, a more interesting longer term 7732 points. This secondary is a really big deal, once again dumping the UK in a zone which threatens future growth toward the 8100 point level.

Have a good weekend, enjoy playing in the snow, and ponder the question, why do chocolate Easter eggs no longer have chocolate goodies inside them?

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:29:04PM | FTSE | 7500 | 7481 | 7471 | 7529 | 7594 | 7614 | 7549 | ‘cess | ||

| 9:30:50PM | BRENT | 105.2 | 103.92 | 102.895 | 107 | 108.71 | 109.86 | 105.25 | ‘cess | ||

| 9:32:25PM | GOLD | 1937.64 | 1919 | 1917 | 1927 | 1950 | 1956 | 1937 | ‘cess | ||

| 9:46:54PM | FRANCE | 6623 | 6617 | 6590 | 6656 | 6725 | 6743 | 6695 | Success | ||

| 9:54:45PM | GERMANY | 14375 | 14314 | 14220 | 14450 | 14502 | 14540 | 14388 | |||

| 9:57:15PM | US500 | 4547.04 | 4531 | 4517 | 4551 | 4563 | 4570 | 4544 | Success | ||

| 9:59:58PM | DOW | 34796.8 | 34693 | 34594 | 34813 | 34944 | 35022 | 34839 | Success | ||

| 10:02:34PM | NASDAQ | 14918.12 | 14852 | 14807 | 14958 | 14972 | 15011 | 14952 | Success | ||

| 10:04:24PM | JAPAN | 27558 | 27510 | 27464 | 27722 | 27916 | 27990 | 27741 | Shambles |

31/03/2022 FTSE Closed at 7515 points. Change of -0.83%. Total value traded through LSE was: £ 6,501,691,261 a change of -12.58%

30/03/2022 FTSE Closed at 7578 points. Change of 0.54%. Total value traded through LSE was: £ 7,437,044,011 a change of -7.97%

29/03/2022 FTSE Closed at 7537 points. Change of 0.86%. Total value traded through LSE was: £ 8,081,315,259 a change of 39.66%

28/03/2022 FTSE Closed at 7473 points. Change of -0.13%. Total value traded through LSE was: £ 5,786,403,389 a change of -6.97%

25/03/2022 FTSE Closed at 7483 points. Change of 0.21%. Total value traded through LSE was: £ 6,219,662,517 a change of -9.68%

24/03/2022 FTSE Closed at 7467 points. Change of 0.09%. Total value traded through LSE was: £ 6,886,600,225 a change of 4.56%

23/03/2022 FTSE Closed at 7460 points. Change of -0.21%. Total value traded through LSE was: £ 6,586,106,936 a change of -2.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:FOXT Foxtons** **LSE:IGAS Igas Energy** **LSE:NG. National Glib** **LSE:RMG Royal Mail** **LSE:SCLP Scancell** **LSE:TRN The Trainline** **

********

Updated charts published on : Avacta, Astrazeneca, Foxtons, Igas Energy, National Glib, Royal Mail, Scancell, The Trainline,

LSE:AVCT Avacta. Close Mid-Price: 74 Percentage Change: + 4.96% Day High: 79 Day Low: 71

Further movement against Avacta ABOVE 79 should improve acceleration towa ……..

</p

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca Close Mid-Price: 10132 Percentage Change: -0.28% Day High: 10262 Day Low: 10134

All Astrazeneca needs are mid-price trades ABOVE 10262 to improve acceler ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:FOXT Foxtons. Close Mid-Price: 43 Percentage Change: + 4.62% Day High: 43.55 Day Low: 40.45

Continued trades against FOXT with a mid-price ABOVE 43.55 should improve ……..

</p

View Previous Foxtons & Big Picture ***

LSE:IGAS Igas Energy. Close Mid-Price: 36 Percentage Change: + 25.87% Day High: 39 Day Low: 26.6

All Igas Energy needs are mid-price trades ABOVE 39 to improve accelerati ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1172.4 Percentage Change: + 0.43% Day High: 1179.6 Day Low: 1165.6

Continued trades against NG. with a mid-price ABOVE 1179.6 should improve ……..

</p

View Previous National Glib & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 329 Percentage Change: -4.78% Day High: 349.7 Day Low: 327.2

Continued weakness against RMG taking the price below 327.2 calculates as ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 10.62 Percentage Change: -4.49% Day High: 11.12 Day Low: 10.62

Continued weakness against SCLP taking the price below 10.62 calculates a ……..

</p

View Previous Scancell & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 250 Percentage Change: + 26.14% Day High: 250.8 Day Low: 220

Continued trades against TRN with a mid-price ABOVE 250.8 should improve ……..

</p

View Previous The Trainline & Big Picture ***