#FTSE #WallSt

The only thing funnier than my recent Diabetes T2 diagnosis are recent FTSE movements. With Coeliac disease (the gluten thing) along with egg and shellfish allergies already compromising food choices, the inclusion of diabetes has brought chaos into Xmas dinner plans. But on the plus side, I get to play with all the packaging and wrapping paper while everyone eats!

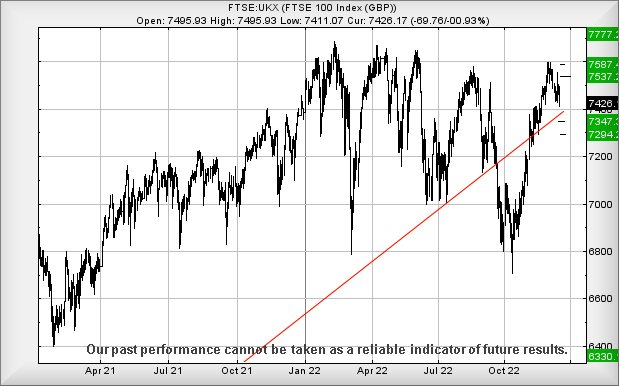

This little hint of frustration with the FTSE comes, thanks to recent market movements. We’d been hoping the rally which started in November would continue but, thanks to politicians and interest rate manipulation, it starts to look like the UK index is fated to follow other markets into a downward spiral. With Wall St, for instance, we shall not be surprised if it visits 32,300 sometime soon. Dangerously, should such a level break, the US index could easily lose a further 2,000 points before bouncing. At risk of being ridiculous, it almost feels like those who spent October predicting recession in 2023 are now doing their hardest to actually cause such a mess, thanks to the markets opting to ignore their predictions and trundle upwards. Currently, the writing is on the wall, we’re just not 100% certain it’s in indelible ink. Should Wall St wander below 32,850, the chances of severe reversals increase dramatically.

Near term for the FTSE, movement below 7410 looks troubling, coming with the risk of triggering reversal to an initial 7347 points. If broken, our secondary calculates at 7294 points and hopefully a bounce capable of propelling the index above Red again. From a “charty” stance, this would be very good news for the future.

Our converse stance for the FTSE requires the UK index to exceed 7495 points as this should trigger emergency recovery to an initial 7537 points. Our secondary is a little worrying, calculating at 7587 points and matching recent previous highs. This, essentially, telegraphs the risk of a glass ceiling at the 7600 level and hints optimism should stay on the back burner until the UK manages to close above such a level.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:45:44PM | BRENT | 81.57 | 81.12 | 80.08 | 82.56 | 83.2 | 83.9 | 81.6 | |||

| 9:47:58PM | GOLD | 1777.24 | 1773 | 1767 | 1786 | 1796 | 1802 | 1786 | Success | ||

| 9:50:43PM | FTSE | 7445.01 | 7407 | 7396 | 7455 | 7494 | 7503 | 7458 | Success | ||

| 10:05:05PM | STOX50 | 3839 | 3825 | 3806 | 3861 | 3875 | 3880 | 3848 | |||

| 10:17:44PM | GERMANY | 13974.98 | 13955 | 13851 | 14077 | 14190 | 14236 | 14040 | Success | ||

| 10:27:36PM | US500 | 3892 | 3876 | 3813 | 3910 | 3961 | 3985 | 3921 | Success | ||

| 10:37:22PM | DOW | 33165.5 | 32994 | 32637 | 33220 | 33768 | 34005 | 33503 | Success | ||

| 10:41:32PM | NASDAQ | 11343 | 11292 | 11160 | 11389 | 11622 | 11742 | 11519 | Success | ||

| 10:44:59PM | JAPAN | 27670 | 27627 | 27527 | 27752 | 27873 | 27912 | 27787 | Success |

15/12/2022 FTSE Closed at 7426 points. Change of -0.92%. Total value traded through LSE was: £ 5,074,557,667 a change of -3.77%

14/12/2022 FTSE Closed at 7495 points. Change of -0.09%. Total value traded through LSE was: £ 5,273,114,917 a change of -15.16%

13/12/2022 FTSE Closed at 7502 points. Change of 0.77%. Total value traded through LSE was: £ 6,215,222,839 a change of 28.4%

12/12/2022 FTSE Closed at 7445 points. Change of -0.41%. Total value traded through LSE was: £ 4,840,427,704 a change of -2.03%

9/12/2022 FTSE Closed at 7476 points. Change of 0.05%. Total value traded through LSE was: £ 4,940,691,101 a change of -3.99%

8/12/2022 FTSE Closed at 7472 points. Change of -0.23%. Total value traded through LSE was: £ 5,146,170,093 a change of -10.96%

7/12/2022 FTSE Closed at 7489 points. Change of -0.43%. Total value traded through LSE was: £ 5,779,316,344 a change of 0.25%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:IPF International Personal Finance** **LSE:TRN The Trainline** **

********

Updated charts published on : Aston Martin, Asos, Cellular Goods, Carnival, International Personal Finance, The Trainline,

LSE:AML Aston Martin. Close Mid-Price: 169.65 Percentage Change: + 4.53% Day High: 170.85 Day Low: 155.85

Further movement against Aston Martin ABOVE 170.85 should improve acceler ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos Close Mid-Price: 510.5 Percentage Change: -4.58% Day High: 532.5 Day Low: 509

Weakness on Asos below 509 will invariably lead to 444 with secondary, if ……..

</p

View Previous Asos & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 1.02 Percentage Change: -4.65% Day High: 1.07 Day Low: 1.02

Weakness on Cellular Goods below 1. will invariably lead to 0.79p with se ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 620.4 Percentage Change: -2.45% Day High: 637.2 Day Low: 615.8

Continued weakness against CCL taking the price below 615.8 calculates as ……..

</p

View Previous Carnival & Big Picture ***

LSE:IPF International Personal Finance Close Mid-Price: 71.1 Percentage Change: -5.20% Day High: 73.1 Day Low: 70.5

In the event International Personal Finance experiences weakness below 70 ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 292.9 Percentage Change: -3.27% Day High: 299.2 Day Low: 292.3

Things are looking dodgy for TRN, perhaps the markets deciding a company w ……..

</p

View Previous The Trainline & Big Picture ***