#Stoxx50 #SP500

True victory is when a grand-daughter says to her horrified mother, “Can we go outside tonight to look at the haemorrhoids? Grand-dad says he’s going to be taking photographs.” In my defence, meteor shower names are all vaguely similar, so inventing ‘The Haemorrhoid Meteor Shower’ amused. Of course, the child remembered tonight’s spectacular, asking her mum to go outside once it got dark.

The reality, with outside temperatures here in Argyll currently around -7c, is it’s too blooming cold to loiter with a camera. Despite a ski jacket, snow boots, bobble hat, and the inevitable surgical mask (hey, these things really keep your nose warm!), the idea of standing around for 30 minutes somehow fails to appeal. Currently, my phone is linked by bluetooth to a proper camera which is sitting outside and so far, I’ve seen nothing worth taking a photograph of. This is a bit similar to Argo Blockchain, a company with a chart we wish we could just skip past. Perhaps the number of email requests, asking for an update, may be an indication of something stirring. Or perhaps it’s showing a degree of panic at a share price following a similar trajectory to this evenings invisible meteors.

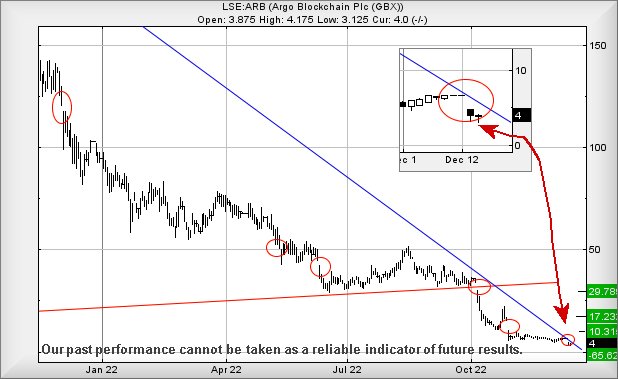

When we previously reviewed Argo Blockchain back in January of this year, we failed to be impressed and pointed out the dangers if it moved below 88p. By the end of the month, the share price had ticked all the boxes and started to tumble, eventually reaching out “ultimate bottom” of 49p during May 2022. We’d assigned this as an “ultimate bottom” simply because we couldn’t calculate lower without invoking minus signs. Following this calamity, time has not been kind to the share and it’s currently trading around 4p.

Perhaps some hope may be taken from recent Bitcoin price movements as it’s exhibiting early signs for a surprise recovery. LSE:ARB managed to mimic Bitcoin hysterics during the share price decline, so maybe there’s a chance for share price recovery, should Bitcoin decide to do something useful. Currently Bitcoin is suggesting it may abandon its attempts to visit the 13,000 dollar level as above 18,500 should provoke a lift to an initial 20,700 with secondary, if exceeded, a game changing 25,400. The secondary is a really big deal as, if attained, it confirms the immediate rot is over for Bitcoin. And a company like LSE:ARB should experience sharp share price recovery. At least, in a fair world, it would.

Another hopeful aspect of ARB comes from all the little Xmas bobbles we’ve decorated the chart with. This is a share where the market habitually forces the price down, six pretty major manipulation gaps in the last 12 months. Some attention is warranted with the inset on the chart, showing movement a couple of days ago, as the market worked hard to ensure ARB didn’t exceed the ruling Blue downtrend. It may be the case this shall prove important, if attempting to catch a surprise recovery. In the event the market allows this share price to close above Blue, we shall be inclined to assume the brakes are off, hoping a cycle to an initial 10.3p is commencing with secondary, if beaten, a longer term 17.2p.

We can count above these levels but, in this instance, will prefer to revisit the share if it actually does anything useful.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:38:21PM | BRENT | 82.95 | ‘cess | ||||||||

| 9:40:52PM | GOLD | 1806.89 | ‘cess | ||||||||

| 9:44:15PM | FTSE | 7476.08 | |||||||||

| 9:46:45PM | STOX50 | 3961.5 | 3941 | 3919 | 3881 | 3979 | 3986 | 4003 | 4024 | 3952 | |

| 9:48:50PM | GERMANY | 14408 | |||||||||

| 9:51:09PM | US500 | 4002.6 | 3962 | 3947 | 3884 | 4010 | 4070 | 4088 | 4106 | 4007 | Shambles |

| 9:54:56PM | DOW | 34041 | |||||||||

| 9:56:53PM | NASDAQ | 11771 | |||||||||

| 9:59:30PM | JAPAN | 27963 | ‘cess |

14/12/2022 FTSE Closed at 7495 points. Change of -0.09%. Total value traded through LSE was: £ 5,273,114,917 a change of -15.16%

13/12/2022 FTSE Closed at 7502 points. Change of 0.77%. Total value traded through LSE was: £ 6,215,222,839 a change of 28.4%

12/12/2022 FTSE Closed at 7445 points. Change of -0.41%. Total value traded through LSE was: £ 4,840,427,704 a change of -2.03%

9/12/2022 FTSE Closed at 7476 points. Change of 0.05%. Total value traded through LSE was: £ 4,940,691,101 a change of -3.99%

8/12/2022 FTSE Closed at 7472 points. Change of -0.23%. Total value traded through LSE was: £ 5,146,170,093 a change of -10.96%

7/12/2022 FTSE Closed at 7489 points. Change of -0.43%. Total value traded through LSE was: £ 5,779,316,344 a change of 0.25%

6/12/2022 FTSE Closed at 7521 points. Change of -0.61%. Total value traded through LSE was: £ 5,764,980,013 a change of 13.53%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:BP. BP PLC** **LSE:CBX Cellular Goods** **LSE:CEY Centamin** **LSE:EZJ EasyJet** **

********

Updated charts published on : Astrazeneca, BP PLC, Cellular Goods, Centamin, EasyJet,

LSE:AZN Astrazeneca. Close Mid-Price: 11400 Percentage Change: + 0.65% Day High: 11414 Day Low: 11144

Further movement against Astrazeneca ABOVE 11414 should improve accelerat ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 469.55 Percentage Change: -0.32% Day High: 475.55 Day Low: 467.55

In the event of BP PLC enjoying further trades beyond 475.55, the share s ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 1.07 Percentage Change: -12.24% Day High: 1.23 Day Low: 1.05

Target met. Continued weakness against CBX taking the price below 1.05 ca ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CEY Centamin Close Mid-Price: 108.45 Percentage Change: -1.72% Day High: 111.8 Day Low: 108.45

Target met. Further movement against Centamin ABOVE 111.8 should improve ……..

</p

View Previous Centamin & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 363.1 Percentage Change: -1.81% Day High: 368.1 Day Low: 358

Weakness on EasyJet below 358 will invariably lead to 323 with secondary ……..

</p

View Previous EasyJet & Big Picture ***