Natwest (LSE:NWG)

#Brent #Dax Top Gear on Sunday managed to pull off something extraordinary. Their competition, going from thousands of entrants down to a final sixteen, then four winners was extraordinary, culminating in a GT race in a McLaren 570. Had this been on any other channel, the greed of a “reality show” potential would have dragged it out to be a series, but instead, we were gifted some quite interesting telly without it feeling rushed.

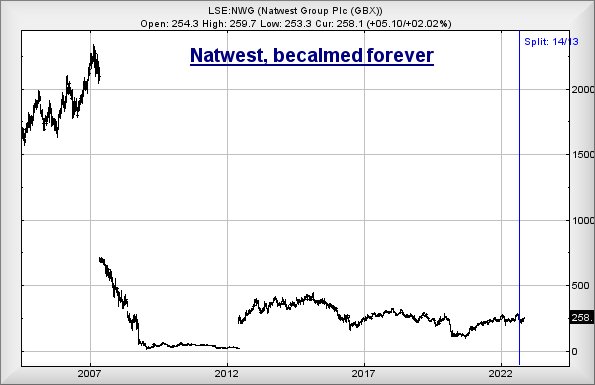

If only the Retail Banking sector share prices could learn from this process. It was once said investing was a 7 year cycle game but we’re nearly at 14 years, since Natwest hit their low of 9.8p back in 2009 and, disregarding the 10:1 share consolidation in 2012, it’s only trading around 25.8p currently. Perhaps, rather than bank managers, they should employ Top Gear producers in an effort to get things moving.

Three weeks ago, we reviewed this share, speculating on the potential of movement above 237 triggering a lift to 254p. With something akin to a festive season miracle, the trigger was hit and their price obligingly moved to target, even exceeding it slightly. Visually, the share price is now on the edge of some Big Picture movement potentials. First though, we need revised the relatively near term chances. Above just 260p calculates with the potential of a lift now to an initial 266p with secondary, if exceeded, a slightly less certain ambition at 284p. While 284p looks quite a pretty target, neatly matching the highs achieved in August, we need CLOSURE above 284p to start taking Natwest seriously.

The requirement for closure makes sense, if viewing the downtrend since 2018 as this shall embed the share price above the trend, giving considerable hope as it will move the price into a region where the Big Picture calculates with an initial 320 with secondary, if bettered, a long term 394p.

For things to revert to type for Natwest, their share price needs tumble below 233p as this risks triggering reversal to an initial 207 with secondary, if broken, at 209p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:13:05PM | BRENT | 87.61 | 85.48 | 84.65 | 82.88 | 87.62 | 88.75 | 89.19 | 89.72 | 87 | Success |

| 9:15:21PM | GOLD | 1748 | ‘cess | ||||||||

| 9:17:44PM | FTSE | 7398.06 | Success | ||||||||

| 9:20:59PM | STOX50 | 3934.3 | Success | ||||||||

| 9:23:08PM | GERMANY | 14443.24 | 14343 | 14307 | 14256 | 14409 | 14460 | 14495 | 14545 | 14365 | ‘cess |

| 9:24:49PM | US500 | 3952 | |||||||||

| 9:26:36PM | DOW | 33638.4 | |||||||||

| 9:28:19PM | NASDAQ | 11635 | |||||||||

| 9:30:43PM | JAPAN | 27957 |

18/11/2022 FTSE Closed at 7385 points. Change of 0.53%. Total value traded through LSE was: £ 5,283,705,968 a change of 16.51%

17/11/2022 FTSE Closed at 7346 points. Change of -0.31%. Total value traded through LSE was: £ 4,534,930,132 a change of -10.24%

15/11/2022 FTSE Closed at 7369 points. Change of -0.22%. Total value traded through LSE was: £ 5,052,481,735 a change of -8.73%

14/11/2022 FTSE Closed at 7385 points. Change of 0.92%. Total value traded through LSE was: £ 5,535,819,308 a change of -22.5%

11/11/2022 FTSE Closed at 7318 points. Change of -0.77%. Total value traded through LSE was: £ 7,142,834,234 a change of 9.63%

10/11/2022 FTSE Closed at 7375 points. Change of 1.08%. Total value traded through LSE was: £ 6,515,510,532 a change of 60.71%

9/11/2022 FTSE Closed at 7296 points. Change of -0.14%. Total value traded through LSE was: £ 4,054,252,272 a change of -13.25%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CAR Carclo** **LSE:CNA Centrica** **LSE:ECO ECO (Atlantic) O & G** **LSE:IGAS Igas Energy** **LSE:LLOY Lloyds Grp.** **LSE:NWG Natwest** **

********

Updated charts published on : Carclo, Centrica, ECO (Atlantic) O & G, Igas Energy, Lloyds Grp., Natwest,

LSE:CAR Carclo Close Mid-Price: 15.47 Percentage Change: -1.75% Day High: 0 Day Low: 0

Continued weakness against CAR taking the price below 14 with secondary, ……..

</p

View Previous Carclo & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 93 Percentage Change: + 1.42% Day High: 96.22 Day Low: 92.4

Target met. Continued trades against CNA with a mid-price ABOVE 96.22 sho ……..

</p

View Previous Centrica & Big Picture ***

LSE:ECO ECO (Atlantic) O & G Close Mid-Price: 17.5 Percentage Change: -58.33% Day High: 22.5 Day Low: 16

Target met. If ECO (Atlantic) O & G experiences continued weakness below ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 21.1 Percentage Change: -11.34% Day High: 25.4 Day Low: 21.1

Target met. Weakness on Igas Energy below 21.1 will invariably lead to 20 ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 45.48 Percentage Change: + 2.38% Day High: 45.66 Day Low: 44.53

Continued trades against LLOY with a mid-price ABOVE 45.66 should improve ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 258.1 Percentage Change: + 2.02% Day High: 259.7 Day Low: 253.3

Further movement against Natwest ABOVE 259.7 should improve acceleration ……..

</p

View Previous Natwest & Big Picture ***