#FTSE #GOLD

Due to an obligatory family event, we skipped Wednesday evening’s report in favour of an evening in a restaurant. It’s funny, everything felt like the few years were a distant memory, even though we’ve not taken an evening off since Nov 2019. For the first time since the pandemic era, everything felt normal with the world and as always, the only problem with a family gathering is family turn up.

One bright bit of news appeared on Thursday to help diminish a Merlot hangover, as shown in the graphic below. It proudly trumpets the news of next year probably going to be pretty bad with the UK underperforming every other economy. A similar theme has been emerging across the media, a broad expectation 2023 will doubtless be “a bit rubbish”. We’d like to point out something quite surprising about these economic forecasts. They are almost always wrong!.

As countries emerged from the pain of lockdown, it was widely projected the UK was going to recover faster and better than virtually everywhere else with lots of colourful graphics supporting the notion. News the UK has recovered more slowly than everywhere else hasn’t proven to be a surprise, our GDP standing alone in showing a reduction against the year pre-Covid. Everywhere else has gained. Now, with the genius’s who feed the rumour mill which drives headlines entering overdrive in favouring future misery, it’s pretty certain next year shall yield some pleasant surprises despite the UK governments ongoing attempts to trash the economy. Who knows, maybe the politician who’s doing time in a jungle shall become the next Prime Minister, when the job again becomes vacant.

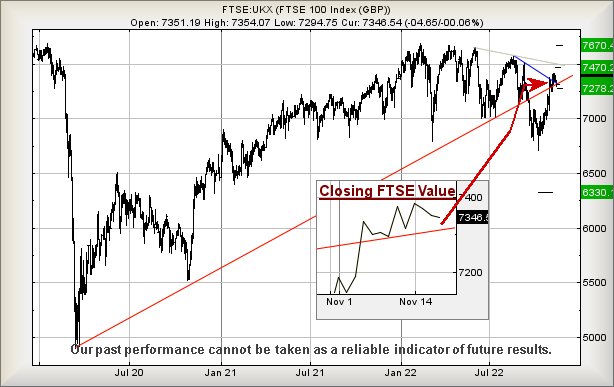

As for the FTSE, since the index exceeded our weird trend break trigger level around 7180, everything has worked out pretty much as expected with the index proving quite well behaved. Better still, the index value has again regained the Red pandemic uptrend on the chart and as the chart inset highlights, some effort is being made to ensure the index remains solidly above Red. Common sense suggests in the event of the FTSE somehow discovering an excuse to CLOSE below Red, some bad times may be ahead. Currently, this requires the FTSE to end a day below 7310 points.

For the immediate future, the UK index needs exceed 7360 points to hopefully trigger recovery to an initial 7397 points. If exceeded, our secondary for the longer term (or later that day) calculates at 7436 points. Such a target level is within reaching distance of a Big Picture ambition, currently exerting an attraction at 7470 points. We do anticipate some hesitation at the 7470 level, if it ever bothers to make an appearance. This suspicion is due to a further calculation 200 points higher, finally taking the UK within sneezing distance of joining the rest of the world and leaving the pandemic behind. For our near term targets, if triggered, a fairly reasonable 7320 points.

Our alternate scenario, should the index break 7320 points, has the potential of reversal to an initial modest 7308 points with secondary, if broken, at 7278 points and a very possible bounce.

Have a good weekend and do enjoy the last GP of the year.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 9:41:23PM | BRENT | 89.43 | 88.85 | 88.58 | 90.12 | 92.13 | 93.05 | 90.95 | ||

| 9:42:43PM | GOLD | 1761.12 | 1754 | 1750 | 1763 | 1771 | 1773 | 1764 | ||

| 9:44:27PM | FTSE | 7377.62 | 7332 | 7315 | 7362 | 7378 | 7383 | 7352 | ||

| 9:46:28PM | STOX50 | 3903 | 3841 | 3827 | 3870 | 3883 | 3911 | 3871 | ||

| 9:47:52PM | GERMANY | 14340 | 14143 | 14076 | 14244 | 14385 | 14423 | 14276 | ||

| 9:53:26PM | US500 | 3952 | 3920 | 3903 | 3959 | 3982 | 3989 | 3952 | ||

| 9:55:33PM | DOW | 33559 | 33277 | 33261 | 33399 | 33696 | 33858 | 33500 | ||

| 9:56:56PM | NASDAQ | 11716 | 11566 | 11516 | 11650 | 11785 | 11872 | 11672 | ||

| 9:58:55PM | JAPAN | 27964 | 27844 | 27782 | 27946 | 28024 | 28101 | 27880 |

17/11/2022 FTSE Closed at 7346 points. Change of -0.31%. Total value traded through LSE was: £ 4,534,930,132 a change of -10.24%

15/11/2022 FTSE Closed at 7369 points. Change of -0.22%. Total value traded through LSE was: £ 5,052,481,735 a change of -8.73%

14/11/2022 FTSE Closed at 7385 points. Change of 0.92%. Total value traded through LSE was: £ 5,535,819,308 a change of -22.5%

11/11/2022 FTSE Closed at 7318 points. Change of -0.77%. Total value traded through LSE was: £ 7,142,834,234 a change of 9.63%

10/11/2022 FTSE Closed at 7375 points. Change of 1.08%. Total value traded through LSE was: £ 6,515,510,532 a change of 60.71%

9/11/2022 FTSE Closed at 7296 points. Change of -0.14%. Total value traded through LSE was: £ 4,054,252,272 a change of -13.25%

8/11/2022 FTSE Closed at 7306 points. Change of -100%. Total value traded through LSE was: £ 4,673,301,102 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:EZJ EasyJet** **LSE:LLOY Lloyds Grp.** **LSE:NWG Natwest** **LSE:ODX Omega Diags** **

********

Updated charts published on : AFC Energy, EasyJet, Lloyds Grp., Natwest, Omega Diags,

LSE:AFC AFC Energy Close Mid-Price: 18 Percentage Change: -0.33% Day High: 18.8 Day Low: 17

If AFC Energy experiences continued weakness below 17, it will invariably ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 388.9 Percentage Change: -0.49% Day High: 400.6 Day Low: 378.9

Weakness on EasyJet below 378.9 will invariably lead to 318 with seconda ……..

</p

View Previous EasyJet & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 44.42 Percentage Change: + 2.99% Day High: 44.77 Day Low: 42.84

All Lloyds Grp. needs are mid-price trades ABOVE 44.77 to improve acceler ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 253 Percentage Change: + 2.47% Day High: 253.3 Day Low: 246.2

Target met. In the event of Natwest enjoying further trades beyond 253.3, ……..

</p

View Previous Natwest & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 4.05 Percentage Change: -1.22% Day High: 4.3 Day Low: 3.75

Target met. All Omega Diags needs are mid-price trades ABOVE 4.3 to impro ……..

</p

View Previous Omega Diags & Big Picture ***