#FTSE #Gold

Liz Truss, serving as Prime Minister under more British monarchs in the last 70 years than any other PM, didn’t rock the FTSE with news of her retreat. The FTSE went up a bit, matching the days previous high, then fell. Also, GBPUSD spiked, then fell. The conclusion drawn suggests no-one was impressed, doubtless worrying which Muppet is next? Or maybe not…

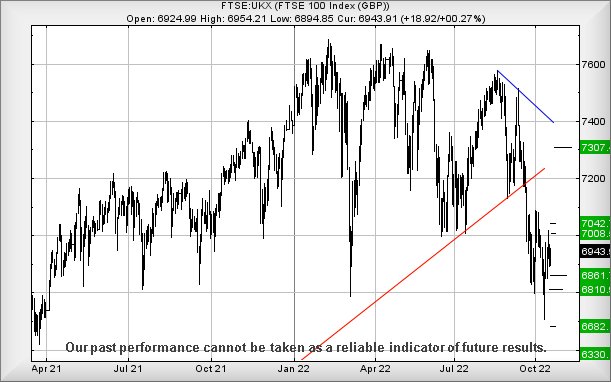

We’ve a bit of a problem with the FTSE movement as it coincided with similar movements everywhere else. Even Bitcoin USD enjoyed a little spike before falling back again, clearly a market which would ignore the travails of the UK and its inability to discover politicians capable of governing. The chart immediately below shows the lack of impact on the 20th October, a day which will not go down in history.

As for the FTSE near term, below 6894 looks capable of trouble (as long as it isn’t in the opening seconds of Friday), potentially able to provoke reversal to an initial 6861 points with secondary, if broken, a hopeful bottom of 6810 points. Visually, this would make a lot of sense, given movements during the last few weeks. There is the potential for serious dramatics, should the FTSE discover a reason to close a session below 6810 points as a cycle downhill to 6330 points shall look inevitable.

However, we can admit our converse scenario looks more probable. Movement now above 6969 points should trigger market recovery to an initial 7008 points with secondary, if bettered, calculating at a more useful 7042 points. To escape from the index’ current spiral of doom, the FTSE still needs above 7200. Quite crucially, in the even the FTSE invents justification to close above 7042 points, a major box is ticked in a series of arguments promoting surprise UK market recovery.

Have a good weekend and enjoy the American GP, this one thankfully being from the Circuit of the Americas.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:58:10PM | BRENT | 91.44 | 90.6 | 89.47 | 91.78 | 92.42 | 93.43 | 91.52 | Success | ||

| 10:00:31PM | GOLD | 1628.56 | 1622 | 1617 | 1635 | 1639 | 1648 | 1630 | ‘cess | ||

| 10:02:46PM | FTSE | 6925 | 6886 | 6869 | 6919 | 6954 | 6977 | 6913 | |||

| 10:05:47PM | STOX50 | 3470 | 3441 | 3426 | 3479 | 3501 | 3508 | 3462 | |||

| 10:08:21PM | GERMANY | 12668 | 12648 | 12630 | 12702 | 12790 | 12826 | 12742 | Shambles | ||

| 10:10:53PM | US500 | 3667 | 3654 | 3628 | 3698 | 3736 | 3772 | 3678 | Shambles | ||

| 10:14:18PM | DOW | 30385 | 30248 | 30182 | 30439 | 30585 | 30863 | 30401 | |||

| 10:17:49PM | NASDAQ | 11024 | 10980 | 10912 | 11110 | 11184 | 11204 | 11066 | Shambles | ||

| 10:20:18PM | JAPAN | 27015 | 26855 | 26741 | 27044 | 27286 | 27331 | 27038 | Shambles |

20/10/2022 FTSE Closed at 6943 points. Change of 0.27%. Total value traded through LSE was: £ 5,436,111,933 a change of 16.23%

19/10/2022 FTSE Closed at 6924 points. Change of -0.17%. Total value traded through LSE was: £ 4,677,060,342 a change of 1.53%

18/10/2022 FTSE Closed at 6936 points. Change of 0.23%. Total value traded through LSE was: £ 4,606,547,755 a change of 0%

17/10/2022 FTSE Closed at 6920 points. Change of 0.9%. Total value traded through LSE was: £ 4,606,393,574 a change of -22.77%

14/10/2022 FTSE Closed at 6858 points. Change of 0.12%. Total value traded through LSE was: £ 5,964,231,785 a change of 0.52%

13/10/2022 FTSE Closed at 6850 points. Change of 0.35%. Total value traded through LSE was: £ 5,933,139,923 a change of 16.34%

12/10/2022 FTSE Closed at 6826 points. Change of -0.86%. Total value traded through LSE was: £ 5,099,638,855 a change of -0.72%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BARC Barclays** **LSE:CEY Centamin** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:IGAS Igas Energy** **LSE:OCDO Ocado Plc** **

********

Updated charts published on : Asos, Barclays, Centamin, Fresnillo, Hikma, Igas Energy, Ocado Plc,

LSE:ASC Asos Close Mid-Price: 537 Percentage Change: -2.36% Day High: 564 Day Low: 522

All Asos needs are mid-price trades ABOVE 564 to improve acceleration tow ……..

</p

View Previous Asos & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 145.34 Percentage Change: + 0.72% Day High: 148.5 Day Low: 142.2

In the event Barclays experiences weakness below 142.2 it calculates with ……..

</p

View Previous Barclays & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 88.66 Percentage Change: + 6.82% Day High: 88.82 Day Low: 82

Further movement against Centamin ABOVE 88.82 should improve acceleration ……..

</p

View Previous Centamin & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 713.6 Percentage Change: + 3.96% Day High: 716.4 Day Low: 679

If Fresnillo experiences continued weakness below 679, it will invariably ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1210.5 Percentage Change: -1.82% Day High: 1231 Day Low: 1200

Target met. Continued weakness against HIK taking the price below 1200 ca ……..

</p

View Previous Hikma & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 34 Percentage Change: -6.59% Day High: 42.8 Day Low: 32.5

Target met. If Igas Energy experiences continued weakness below 32.5, it ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 493.9 Percentage Change: + 3.33% Day High: 501.4 Day Low: 469.6

All Ocado Plc needs are mid-price trades ABOVE 501.4 to improve accelerat ……..

</p

View Previous Ocado Plc & Big Picture ***