#FTSE #Nasdaq

Uranium shares are lacking in the UK markets, perhaps due to nothing in the country enjoying a decent half-life. Watching UK Govt ministerial careers now being measuring in days, gives a reasonable clue. But on the Nasdaq and Australian exchanges, we didn’t need dig too far to uncover a couple of glowing prospects. It’s probably important to mention, UEC share price is in US Dollars, Bannerman is priced in Australian Dollars.

We appear to have a few customers fascinated by uranium, doubtless due to a reasonable expectation for clean and cheap nuclear power to become rather more important than others in the years ahead. It’d almost be funny, if it were not the public paying the literal cost of many “green initiatives” which make for great headlines and political photo opportunities. But tried and tested nuclear power was almost abandoned after it became fashionable to refer to the tsunami nuclear incident as ‘The Fukushima Disaster’. The Japanese government now confirm one single person died from radiation related illness.

We think a visit to the Bannerman website is time well spent, their activities fascinating and obviously, they highlight themselves as “world leading” in the area of nuclear safety. It’d be silly to expect otherwise from any organisation in this field. The company introduced a 1:10 share split at the end of July, a direction of split we’ve come to loathe from the UK markets as it’s primarily used to conceal a failing share price. In the case of Bannerman, their share price has been sound asleep since 2012, trading below the dollar level.

Being unfamiliar with Australian exchange share price behaviour following this bias of split (we’ll take your 10 shares and give you a brand new shiny single share), it’d be unfair of us to anticipate the worst for the future. Instead, we’re inclined to mild optimism and suspect, should this exceed our next trigger at 2.25 AUD, some price recovery to an initial 2.8 is expected with secondary, if bettered, at a longer term 4.97 AUD.

Should their share price intend something awful, below 1.6 should suffice as this comes with the threat of the share price halving.

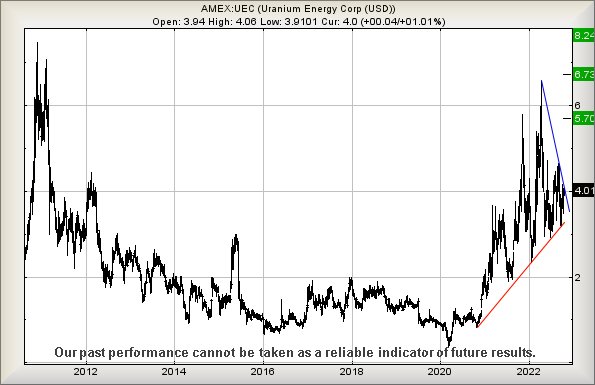

Uranium Energy Corp (AMEX:UEC) Clearly a little more hopeful than their Australian counterpart’s share price, UEC look poised for some action. After a glance through their website, we were pleased to note there’s no mention of Homer Simpson nor the town of Springfield, calling into question the documentary credentials of “The Simpsons” on telly. But to be fair, UEC mine uranium, selling the stuff to the folk who actually use it.

Our inclination is to regard 4.25 as a potential trigger for any future growth cycle.

Above 4.25 calculates with the potential of movement to an initial US $5.70 with our secondary, if bettered, at a new high of $6.70. Despite such a secondary ambition effectively matching the highs of 2011, should the share price manage to close a session in the future above 6.70, some truly impressive long term potentials open up.

Of the two companies discussed, both are worth watching but for early potentials, we suspect UEC shall prove most interesting.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:01:10PM | BRENT | 91.2 | |||||||||

| 10:03:54PM | GOLD | 1629.75 | 1627 | 1623 | 1612 | 1638 | 1647 | 1650 | 1657 | 1637 | Success |

| 10:05:44PM | FTSE | 6931 | ‘cess | ||||||||

| 10:07:38PM | STOX50 | 3472.4 | |||||||||

| 10:19:21PM | GERMANY | 12742.83 | |||||||||

| 10:27:10PM | US500 | 3697 | |||||||||

| 10:35:54PM | DOW | 30483.7 | |||||||||

| 10:37:34PM | NASDAQ | 11099 | 11000 | 10915 | 10776 | 11164 | 11246 | 11351 | 11468 | 11085 | |

| 10:39:22PM | JAPAN | 27057 |

19/10/2022 FTSE Closed at 6924 points. Change of -0.17%. Total value traded through LSE was: £ 4,677,060,342 a change of 1.53%

18/10/2022 FTSE Closed at 6936 points. Change of 0.23%. Total value traded through LSE was: £ 4,606,547,755 a change of 0%

17/10/2022 FTSE Closed at 6920 points. Change of 0.9%. Total value traded through LSE was: £ 4,606,393,574 a change of -22.77%

14/10/2022 FTSE Closed at 6858 points. Change of 0.12%. Total value traded through LSE was: £ 5,964,231,785 a change of 0.52%

13/10/2022 FTSE Closed at 6850 points. Change of 0.35%. Total value traded through LSE was: £ 5,933,139,923 a change of 16.34%

12/10/2022 FTSE Closed at 6826 points. Change of -0.86%. Total value traded through LSE was: £ 5,099,638,855 a change of -0.72%

11/10/2022 FTSE Closed at 6885 points. Change of -1.06%. Total value traded through LSE was: £ 5,136,859,995 a change of 18.36%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BARC Barclays** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:IGAS Igas Energy** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:RR. Rolls Royce** **LSE:TLW Tullow** **

********

Updated charts published on : Asos, Barclays, Fresnillo, Hikma, Igas Energy, Intertek, ITV, Rolls Royce, Tullow,

LSE:ASC Asos. Close Mid-Price: 550 Percentage Change: + 12.24% Day High: 562.5 Day Low: 476.2

Further movement against Asos ABOVE 562.5 should improve acceleration tow ……..

</p

View Previous Asos & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 144.3 Percentage Change: -2.17% Day High: 146.8 Day Low: 143.22

Weakness on Barclays below 143.22 will invariably lead to 140 with second ……..

</p

View Previous Barclays & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 686.4 Percentage Change: -2.72% Day High: 714.8 Day Low: 684.2

In the event Fresnillo experiences weakness below 684.2 it calculates wit ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1233 Percentage Change: -0.68% Day High: 1250 Day Low: 1213

Weakness on Hikma below 1213 will invariably lead to 1200 with secondary ……..

</p

View Previous Hikma & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 36.4 Percentage Change: -4.21% Day High: 38.8 Day Low: 34.3

In the event Igas Energy experiences weakness below 34.3 it calculates wi ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 3724 Percentage Change: -1.48% Day High: 3812 Day Low: 3729

Further movement against Intertek ABOVE 3812 should improve acceleration ……..

</p

View Previous Intertek & Big Picture ***

LSE:ITV ITV. Close Mid-Price: 67.68 Percentage Change: + 2.48% Day High: 69.16 Day Low: 65.34

In the event of ITV enjoying further trades beyond 69.16, the share shoul ……..

</p

View Previous ITV & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 74 Percentage Change: -0.38% Day High: 75.64 Day Low: 72.6

Surely someone must notice the serious danger now making itself apparent w ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:TLW Tullow. Close Mid-Price: 37.48 Percentage Change: + 1.90% Day High: 37.76 Day Low: 35.8

Target met. Continued weakness against TLW taking the price below 35.8 ca ……..

</p

View Previous Tullow & Big Picture ***