#Gold #WallSt For some reason, the location of Top Gears racing track was never of interest, often the backdrop of interesting aircraft proving more interesting than a celebrity giving their excuses for a terrible lap before their circuit is complete. A personal guilty secret; despite hating flying, I’m an utter aircraft nerd. Discovering AFC Energy are based at Dunsfold Aerodrome provoked a surge of envy, a working environment surrounded by interesting planes, along with fast cars constantly trying to do decent lap times.

But despite their enviable location, we must concede AFC appear to be doing solid work in the hydrogen fuel cell department, if their website is to be believed. Of all the green initiatives, anything which involves hydrogen, regarded as the most abundant element in the universe, deserves close attention.

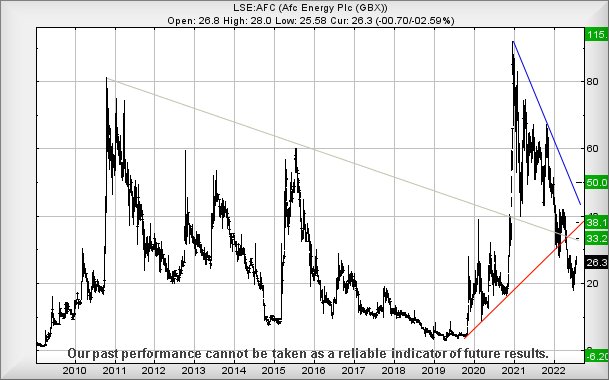

Since 2009, AFC’s share price has enjoyed a roller coaster ride, lots of false starts and sharp reversals tending indicate they’ve been the focus of internet chatroom ‘enhanced optimism’ campaigns. Even the recent surge to 92p in 2020 appears to be suffering the usual payback, the price currently at 26p and making us question whether the recent slip down to 19p shall be regarded as “bottom”. We certainly hope so as the only drop target we can now calculate below 19p is prefaced with a minus sign!

Our suspicion is the price has bottomed on the current cycle, making us think 28.5p can be viewed as a potential trigger, one which if bettered allows for gains in the direction of a near term 33p. In the event 33p is exceeded, our secondary calculates at 38p, returning the price above a prior, argumentative, uptrend.

Thanks to AFC’s historical shenanigans, there are now some fascinating potentials we can give, should 38p be exceeded sometime in the future. We could tie ourselves in knots trying to explain a stream of different numbers but, essentially, with closure above 38p, the share price makes a careful step into territory where a phase of growth to a future 115p calculates as possible, a new all time high.

If we judge by the emails received, it appears a few folk think “something” is happening with AFC and as a result, it’s probably worth keeping an eye on them.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:51:38PM | BRENT | 99.9 | Success | ||||||||

| 9:54:33PM | GOLD | 1772.43 | 1758 | 1755 | 1748 | 1767 | 1776 | 1779 | 1784 | 1766 | ‘cess |

| 9:58:59PM | FTSE | 7415 | ‘cess | ||||||||

| 10:16:15PM | STOX50 | 3711 | |||||||||

| 10:18:20PM | GERMANY | 13486 | Sorry | ||||||||

| 10:19:56PM | US500 | 4120 | ‘cess | ||||||||

| 10:21:55PM | DOW | 32804 | 32637 | 32540 | 32397 | 32828 | 32971 | 32998 | 33102 | 32804 | |

| 10:24:30PM | NASDAQ | 12952 | ‘cess | ||||||||

| 10:26:02PM | JAPAN | 27896 |

1/08/2022 FTSE Closed at 7413 points. Change of -0.13%. Total value traded through LSE was: £ 3,802,113,332 a change of -37.81%

29/07/2022 FTSE Closed at 7423 points. Change of 1.06%. Total value traded through LSE was: £ 6,113,428,375 a change of 2.61%

28/07/2022 FTSE Closed at 7345 points. Change of -0.04%. Total value traded through LSE was: £ 5,958,117,609 a change of -17.71%

27/07/2022 FTSE Closed at 7348 points. Change of 0.57%. Total value traded through LSE was: £ 7,240,157,901 a change of 9.37%

26/07/2022 FTSE Closed at 7306 points. Change of 0%. Total value traded through LSE was: £ 6,619,636,706 a change of 9.19%

25/07/2022 FTSE Closed at 7306 points. Change of 0.41%. Total value traded through LSE was: £ 6,062,435,734 a change of 37.23%

22/07/2022 FTSE Closed at 7276 points. Change of 0.08%. Total value traded through LSE was: £ 4,417,687,866 a change of -18.83%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:CASP Caspian** **LSE:CBX Cellular Goods** **LSE:GENL Genel** **LSE:GLEN Glencore Xstra** **LSE:HSBA HSBC** **LSE:IGAS Igas Energy** **LSE:IPF International Personal Finance** **LSE:IQE IQE** **LSE:NWG Natwest** **LSE:OCDO Ocado Plc** **LSE:TRN The Trainline** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : BALFOUR BEATTY, Caspian, Cellular Goods, Genel, Glencore Xstra, HSBC, Igas Energy, International Personal Finance, IQE, Natwest, Ocado Plc, The Trainline, Zoo Digital,

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 282.6 Percentage Change: + 0.71% Day High: 284.2 Day Low: 278.6

Continued trades against BBY with a mid-price ABOVE 284.2 should improve ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 3.3 Percentage Change: -1.49% Day High: 3.35 Day Low: 3.25

If Caspian experiences continued weakness below 3.25, it will invariably ……..

</p

View Previous Caspian & Big Picture ***

LSE:CBX Cellular Goods. Close Mid-Price: 1.55 Percentage Change: + 29.17% Day High: 1.6 Day Low: 1.15

Target met. In the event of Cellular Goods enjoying further trades beyond ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 145.8 Percentage Change: + 0.55% Day High: 150 Day Low: 145

All Genel needs are mid-price trades ABOVE 150 to improve acceleration to ……..

</p

View Previous Genel & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 460.7 Percentage Change: -0.25% Day High: 472.75 Day Low: 455.35

All Glencore Xstra needs are mid-price trades ABOVE 472.75 to improve acc ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 545.2 Percentage Change: + 6.13% Day High: 557.8 Day Low: 536.2

Continued trades against HSBA with a mid-price ABOVE 557.8 should improve ……..

</p

View Previous HSBC & Big Picture ***

LSE:IGAS Igas Energy. Close Mid-Price: 41.5 Percentage Change: + 8.50% Day High: 41.6 Day Low: 39

Further movement against Igas Energy ABOVE 41.6 should improve accelerati ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 100 Percentage Change: + 3.95% Day High: 100 Day Low: 93

All International Personal Finance needs are mid-price trades ABOVE 100 t ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:IQE IQE. Close Mid-Price: 44.55 Percentage Change: + 1.48% Day High: 45.2 Day Low: 44.35

Continued trades against IQE with a mid-price ABOVE 45.2 should improve t ……..

</p

View Previous IQE & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 251.7 Percentage Change: + 1.25% Day High: 255.7 Day Low: 250

Continued trades against NWG with a mid-price ABOVE 255.7 should improve ……..

</p

View Previous Natwest & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 876 Percentage Change: + 4.36% Day High: 888.2 Day Low: 828.6

In the event of Ocado Plc enjoying further trades beyond 888.2, the share ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 402.4 Percentage Change: + 1.56% Day High: 403.1 Day Low: 394.7

All The Trainline needs are mid-price trades ABOVE 403.1 to improve accel ……..

</p

View Previous The Trainline & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 136 Percentage Change: + 6.67% Day High: 137.5 Day Low: 127.5

Target met. Further movement against Zoo Digital ABOVE 137.5 should impro ……..

</p

View Previous Zoo Digital & Big Picture ***