#Brent #Dax

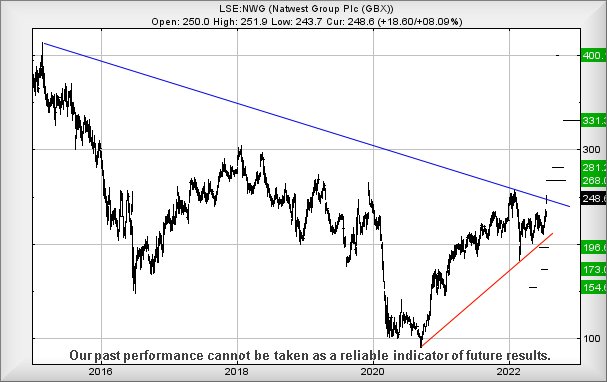

As the entire nation rejoices at Boris Johnston successfully getting someone else to pay for his wedding party, we can sidle into the holiday month with another miracle, mostly un-noticed. Natwest achieved our 248p target from 3 weeks ago, quite literally opting to close the final trading day of July exactly at our target level. As they say in Scotland, “our gobs were smacked!”

It’s worth paying a little attention to movements in the preceding week. Monday proved some early interest, the share price closing the session at 230.2p, just 2/10th of a penny above our trigger level but hey, we’ll take it, the scene effectively set for what was coming. Their Interim Results on Friday thus fell on fertile ground, higher operating profits and a lift in dividend jollying up the party quite nicely. It all proved quite surreal, the share price closing on Thursday at exactly our 230p trigger, then closing on Friday at our 248p target, also achieving a day high of 251.9p. Perhaps very importantly, Natwest share price has now closed a session above Blue on the chart, a downtrend which dates back to 2015. Currently this trend line is sitting around 247.149p, therefore we’re allowed to express further optimism due to the market closing the day at 248.6p.

Folk of a fragile nature may with to sit down for the next bit…

Apparently, now above 252p threatens triggering further recovery to an initial 268p. If exceeded, our secondary calculation works out at 281p.

Either one of these target levels “risks” proving quite significant for the longer term, each hopefully capable of permitting the share price to actually CLOSE a session above 257p. From a really big picture perspective, this is liable to prove quite a big deal, doing the unthinkable by elevating a UK retail bank into the realms of three previously unspeakable words. Long Term Hold. All joking aside, closure above 257p allows us to discuss Natwest at 400p without a giggle similar to describing Max Verstappen as 2021’s Formula 1 World Champion.

We’d be remiss if we didn’t dilute this drooling optimism with some common sense. Natwest needs slump below Red (210p) to spoil all the above calculations.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 3:16:36PM | BRENT | 103.91 | 101.9 | 101.5 | 99.8 | 103.08 | 106.6 | 106.91 | 108.29 | 104.6 | Success |

| 3:24:38PM | GOLD | 1766 | ‘cess | ||||||||

| 3:51:36PM | FTSE | 7450 | ‘cess | ||||||||

| 3:56:30PM | STOX50 | 3730 | ‘cess | ||||||||

| 2:39:04PM | GERMANY | 13546 | 13336 | 13280 | 13189 | 13450 | 13553 | 13624 | 13709 | 13407 | ‘cess |

| 2:51:12PM | US500 | 4129.57 | ‘cess | ||||||||

| 2:55:51PM | DOW | 32852 | ‘cess | ||||||||

| 3:00:00PM | NASDAQ | 12949 | ‘cess |

29/07/2022 FTSE Closed at 7423 points. Change of 1.06%. Total value traded through LSE was: £ 6,113,428,375 a change of 2.61%

28/07/2022 FTSE Closed at 7345 points. Change of -0.04%. Total value traded through LSE was: £ 5,958,117,609 a change of -17.71%

27/07/2022 FTSE Closed at 7348 points. Change of 0.57%. Total value traded through LSE was: £ 7,240,157,901 a change of 9.37%

26/07/2022 FTSE Closed at 7306 points. Change of 0%. Total value traded through LSE was: £ 6,619,636,706 a change of 9.19%

25/07/2022 FTSE Closed at 7306 points. Change of 0.41%. Total value traded through LSE was: £ 6,062,435,734 a change of 37.23%

22/07/2022 FTSE Closed at 7276 points. Change of 0.08%. Total value traded through LSE was: £ 4,417,687,866 a change of -18.83%

21/07/2022 FTSE Closed at 7270 points. Change of 0.08%. Total value traded through LSE was: £ 5,442,605,910 a change of -14.07%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:CASP Caspian** **LSE:DGE Diageo** **LSE:EXPN Experian** **LSE:GLEN Glencore Xstra** **LSE:IGG IG Group** **LSE:IPF International Personal Finance** **LSE:IQE IQE** **LSE:ITRK Intertek** **LSE:NWG Natwest** **LSE:OPG OPG Power Ventures** **LSE:PMG Parkmead** **LSE:SPX Spirax** **LSE:SRP Serco** **LSE:TRN The Trainline** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : BALFOUR BEATTY, BP PLC, British Telecom, Caspian, Diageo, Experian, Glencore Xstra, IG Group, International Personal Finance, IQE, Intertek, Natwest, OPG Power Ventures, Parkmead, Spirax, Serco, The Trainline, Taylor Wimpey, Vodafone, Zoo Digital,

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 280.6 Percentage Change: + 1.96% Day High: 282.8 Day Low: 276.6

Further movement against BALFOUR BEATTY ABOVE 282.8 should improve accele ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 400 Percentage Change: + 2.72% Day High: 404.88 Day Low: 386.15

In the event of BP PLC enjoying further trades beyond 404.88, the share s ……..

</p

View Previous BP PLC & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 161.8 Percentage Change: -0.03% Day High: 165.1 Day Low: 154.75

Target met. Continued weakness against BT.A taking the price below 154.75 ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 3.35 Percentage Change: -2.90% Day High: 3.45 Day Low: 3.35

In the event Caspian experiences weakness below 3.35 it calculates with a ……..

</p

View Previous Caspian & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3882 Percentage Change: + 0.44% Day High: 3930 Day Low: 3872.5

In the event of Diageo enjoying further trades beyond 3930, the share sho ……..

</p

View Previous Diageo & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 2863 Percentage Change: + 1.89% Day High: 2883 Day Low: 2791

All Experian needs are mid-price trades ABOVE 2883 to improve acceleratio ……..

</p

View Previous Experian & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 461.85 Percentage Change: + 2.78% Day High: 463.6 Day Low: 439

Continued trades against GLEN with a mid-price ABOVE 463.6 should improve ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 796 Percentage Change: + 0.51% Day High: 810 Day Low: 790

Target met. All IG Group needs are mid-price trades ABOVE 810 to improve ……..

</p

View Previous IG Group & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 96.2 Percentage Change: + 3.44% Day High: 97 Day Low: 94.9

Further movement against International Personal Finance ABOVE 97 should i ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:IQE IQE. Close Mid-Price: 43.9 Percentage Change: + 1.97% Day High: 44.25 Day Low: 43.05

All IQE needs are mid-price trades ABOVE 44.25 to improve acceleration to ……..

</p

View Previous IQE & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4376 Percentage Change: -1.97% Day High: 4411 Day Low: 4085

Target met. Continued weakness against ITRK taking the price below 4085 c ……..

</p

View Previous Intertek & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 248.6 Percentage Change: + 8.09% Day High: 251.9 Day Low: 243.7

Target met. Further movement against Natwest ABOVE 251.9 should improve a ……..

</p

View Previous Natwest & Big Picture ***

LSE:OPG OPG Power Ventures. Close Mid-Price: 7.05 Percentage Change: + 4.44% Day High: 7.2 Day Low: 6.75

In the event of OPG Power Ventures enjoying further trades beyond 7.2, th ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:PMG Parkmead. Close Mid-Price: 67 Percentage Change: + 3.08% Day High: 70.8 Day Low: 64

Target met. Continued trades against PMG with a mid-price ABOVE 70.8 shou ……..

</p

View Previous Parkmead & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 11935 Percentage Change: + 2.89% Day High: 12045 Day Low: 11665

Target met. All Spirax needs are mid-price trades ABOVE 12045 to improve ……..

</p

View Previous Spirax & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 188.3 Percentage Change: + 0.32% Day High: 190.3 Day Low: 187.5

Target met. Further movement against Serco ABOVE 190.3 should improve acc ……..

</p

View Previous Serco & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 396.2 Percentage Change: + 3.80% Day High: 395 Day Low: 380.1

Further movement against The Trainline ABOVE 395 should improve accelerat ……..

</p

View Previous The Trainline & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 127.1 Percentage Change: + 0.55% Day High: 129 Day Low: 126.25

Continued trades against TW. with a mid-price ABOVE 129 should improve th ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 120.8 Percentage Change: + 1.68% Day High: 122.02 Day Low: 117.98

If Vodafone experiences continued weakness below 117.98, it will invariab ……..

</p

View Previous Vodafone & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 127.5 Percentage Change: + 2.00% Day High: 131 Day Low: 125

In the event of Zoo Digital enjoying further trades beyond 131, the share ……..

</p

View Previous Zoo Digital & Big Picture ***