#Brent #STOXX50

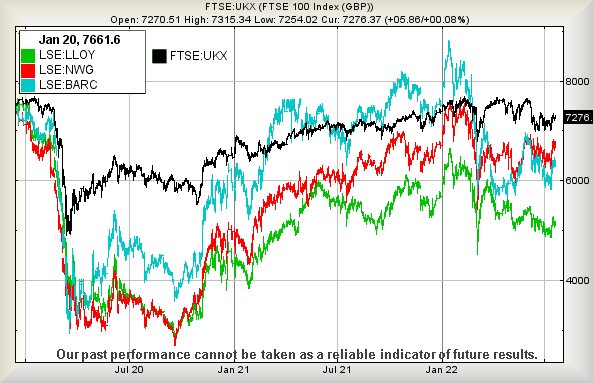

As always, we’re frustrated with Lloyds. When we glance at the FTSE, since the start of 2020 before the pandemic, the index is down 4.3%. In the same period, Lloyds Banking share price is down 31.7%! Surely the retail banks must discover an excuse to exhibit some recovery, if only to mirror FTSE movements. Even Barclays share price is down by 15% compared with the start of 2020 whereas Natwest has only suffered a 5.4% price discount.

Technically speaking, it’s all just not fair. In fairness to Natwest, there’s a constant feeling the market simply cannot be bothered with Natwest dramatics and this, unfortunately, tends suggest should any recovery occur, we will find Natwest sneaking behind the bicycle shed for a smoke, while the rest of the retail banks pedal off into the distance. Traditionally, we do tend be quite sceptical about Natwest. But in the case of Lloyds, if there’s any truth in an argument a price needs go down before it can go up, with a 31.7% reduction, maybe it’s poised to display some surprise behaviour at some point in the future. We shall continue to hope. The pretty chart below illustrates quite painfully the lack of excitement with Lloyds Bank. Maybe the recent order from the banking authority demanding they display customer satisfaction statistics in branches will make all the difference to the company shares…

Currently, we notice a few commentators refer to Lloyds shares as “cheap”, something which makes us cringe, often the kiss of death to a share price. Remember, the #1 Rule in the marketplace is a lack of any guarantee. But in our hunt for sanity with Lloyds, we’re now inclined to allocate 47.3p as a potential trigger level, one which should finally give early warning the price is coming out of the gutter and making an attempt to head upward. Should the market deign to sprinkle some pixy dust on such a trigger, the Big Picture now suggests the potential for strong movement as the Longer Term view currently calculates movement above 47.3p as capable of reaching for an initial 63p, essentially a return to the pre-Pandemic price level. Our secondary, should the initial be exceeded, works out at 76p and a visit to price levels not witnessed since 2014. Visually, our 63p ambition is believable but the jury is firmly “out” on the secondary.

Unfortunately, there’s always an alternate scenario. In the event Lloyds share price opts to wear big clown shoes and a red nose, below 41p looks especially dangerous as there’s a real risk such a trigger shall provoke reversal to 34p next with secondary, if broken, at 27p and hopefully a bounce from the clown trampoline.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 2:46:50PM | BRENT | 99.4 | 98.34 | 96.58 | 88.94 | 101.7 | 102.2 | 103.5 | 105.22 | 99.4 |

| 2:56:16PM | GOLD | 1728 | ||||||||

| 3:21:45PM | FTSE | 7250 | ||||||||

| 3:26:53PM | STOX50 | 3581 | 3564 | 3544 | 3517 | 3585 | 3625 | 3631 | 3651 | 3595 |

| 3:40:33PM | GERMANY | 13175 | ||||||||

| 4:59:33PM | US500 | 3961 | ||||||||

| 5:01:38PM | DOW | 31900 | ||||||||

| 5:03:57PM | NASDAQ | 12397 | ||||||||

| 5:05:58PM | JAPAN | 27704 |

22/07/2022 FTSE Closed at 7276 points. Change of 0.08%. Total value traded through LSE was: £ 4,417,687,866 a change of -18.83%

21/07/2022 FTSE Closed at 7270 points. Change of 0.08%. Total value traded through LSE was: £ 5,442,605,910 a change of -14.07%

20/07/2022 FTSE Closed at 7264 points. Change of -0.44%. Total value traded through LSE was: £ 6,333,828,189 a change of 35.6%

19/07/2022 FTSE Closed at 7296 points. Change of 1.01%. Total value traded through LSE was: £ 4,670,793,885 a change of -13.24%

18/07/2022 FTSE Closed at 7223 points. Change of 0.89%. Total value traded through LSE was: £ 5,383,848,988 a change of -4.09%

15/07/2022 FTSE Closed at 7159 points. Change of 1.7%. Total value traded through LSE was: £ 5,613,237,251 a change of -3.92%

14/07/2022 FTSE Closed at 7039 points. Change of -1.63%. Total value traded through LSE was: £ 5,842,341,415 a change of 1.71%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:EXPN Experian** **LSE:IGG IG Group** **LSE:SPX Spirax** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Aston Martin, Asos, Experian, IG Group, Spirax, Taylor Wimpey,

LSE:AML Aston Martin Close Mid-Price: 483.6 Percentage Change: -8.69% Day High: 533.2 Day Low: 460

Perhaps it all depends on this weekends racing but AML share price looks t ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos. Close Mid-Price: 1157 Percentage Change: + 3.03% Day High: 1181 Day Low: 1121

Target met. Further movement against Asos ABOVE 1181 should improve accel ……..

</p

View Previous Asos & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2834 Percentage Change: -0.04% Day High: 2875 Day Low: 2825

Further movement against Experian ABOVE 2875 should improve acceleration ……..

</p

View Previous Experian & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 775 Percentage Change: -1.02% Day High: 795 Day Low: 769.5

In the event of IG Group enjoying further trades beyond 795, the share sh ……..

</p

View Previous IG Group & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 11335 Percentage Change: + 0.04% Day High: 11505 Day Low: 11245

Target met. Further movement against Spirax ABOVE 11505 should improve ac ……..

</p

View Previous Spirax & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 126.2 Percentage Change: + 0.24% Day High: 126.75 Day Low: 124

In the event of Taylor Wimpey enjoying further trades beyond 126.75, the ……..

</p

View Previous Taylor Wimpey & Big Picture ***