#Brent #NK225

Abrdn Plc, previously known as Standard Life Aberdeen, possibly enjoy one of the most boring Wikipedia pages for a company which is a core member of the FTSE 100. Usually, there are scraps of gossip, hints of a little corruption, mentions of court cases. But Abrdn (pronounced Aberdeen) appear to be quite staid and sober.

Aside from their name, 5 letters and useless for Wordle, there seems to be nothing to criticise. Though, had Wikipedia been honest, they could have mentioned the absolute nightmare of parking anywhere close to the companies prestigious Edinburgh address, an area aggressively patrolled by battalions of goose stepping traffic wardens. The only other thing to dislike is the company share price movements over the last year.

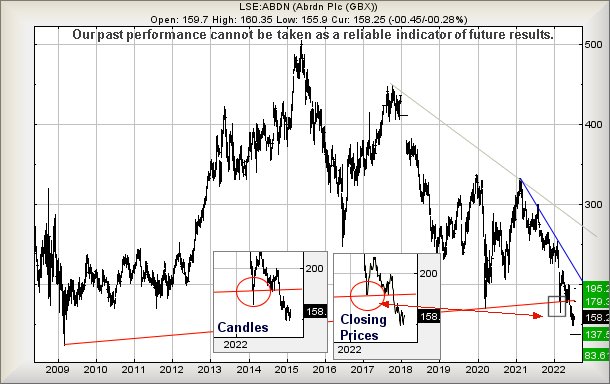

Curiously, we often moan about breaks below a major trend line often proving to be an early warning of impending trouble and, in the case of Abrdn, the chart inset shows exactly such a calamity in March this year. On the 7th and 8th of the month, the share price twice ventured below the long term uptrend, one which also dates back 13 years to March 9th, 2009. But despite intraday traffic below this particular trend, extreme care was taken to ensure the price closed above the trend during each session.

This movement certainly justified a raised eyebrow as the market looked like it had plans for Abrdn share price. Had we just spotted a genuine signal for some future reversals?

It took until June before the share price finally enacted firm reversals below the trend.

The situation now suggests further weakness below 148p could reach 137p, a price level by which we’d hope for a strong and solid bounce. Our longer term secondary target in this instance works out at 83p. But there’s a massive danger if the price wanders below 137p as we calculate it as entering a zone where our “ultimate bottom” paints a line at an absurd and impossible looking 15p!

However, Abrdn Plc are hopefully unlikely to follow the example being set by the UK’s banking sector, ideally proving capable of the market noticing the predicament it has placed the share price in, thereby enacting emergency recovery to back away from the danger. In this scenario, we shall take movement above just 165.5p as providing the first signs of confidence as this should trigger a surge to an initial 179p with secondary, if bettered, calculating at 195p, a true “step away from the ledge” moment.

We shall need revisit our calculations, should 195p make an appearance.

For this reason, we suspect Abrdn shall prove worth watching anytime now.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:39:30PM | BRENT | 103.36 | 101.9 | 99.59 | 85.19 | 104.75 | 104.23 | 104.995 | 106.01 | 103.3 | |

| 9:41:10PM | GOLD | 1696.24 | Success | ||||||||

| 9:43:56PM | FTSE | 7248.21 | ‘cess | ||||||||

| 9:45:48PM | STOX50 | 3565.3 | |||||||||

| 9:47:44PM | GERMANY | 13194 | |||||||||

| 10:12:28PM | US500 | 3952 | ‘cess | ||||||||

| 10:14:33PM | DOW | 31824 | ‘cess | ||||||||

| 10:17:03PM | NASDAQ | 12402 | Success | ||||||||

| 10:19:09PM | JAPAN | 27559 | 27474 | 27405 | 27289 | 27600 | 27752 | 27783 | 27885 | 27584 | Success |

20/07/2022 FTSE Closed at 7264 points. Change of -0.44%. Total value traded through LSE was: £ 6,333,828,189 a change of 35.6%

19/07/2022 FTSE Closed at 7296 points. Change of 1.01%. Total value traded through LSE was: £ 4,670,793,885 a change of -13.24%

18/07/2022 FTSE Closed at 7223 points. Change of 0.89%. Total value traded through LSE was: £ 5,383,848,988 a change of -4.09%

15/07/2022 FTSE Closed at 7159 points. Change of 1.7%. Total value traded through LSE was: £ 5,613,237,251 a change of -3.92%

14/07/2022 FTSE Closed at 7039 points. Change of -1.63%. Total value traded through LSE was: £ 5,842,341,415 a change of 1.71%

13/07/2022 FTSE Closed at 7156 points. Change of -0.74%. Total value traded through LSE was: £ 5,744,207,139 a change of 25.49%

12/07/2022 FTSE Closed at 7209 points. Change of 0.18%. Total value traded through LSE was: £ 4,577,434,257 a change of 19.25%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:CCL Carnival** **LSE:CNA Centrica** **LSE:CPI Capita** **LSE:DARK Darktrace Plc** **LSE:EMG MAN** **LSE:EXPN Experian** **LSE:LLOY Lloyds Grp.** **LSE:POLY Polymetal** **LSE:RR. Rolls Royce** **LSE:SPX Spirax** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Asos, Carnival, Centrica, Capita, Darktrace Plc, MAN, Experian, Lloyds Grp., Polymetal, Rolls Royce, Spirax, Taylor Wimpey, Vodafone, Zoo Digital,

LSE:ASC Asos. Close Mid-Price: 1096 Percentage Change: + 5.49% Day High: 1105 Day Low: 1032

Target Met. This appears almost on the very of useful, needing above 1105 ……..

</p

View Previous Asos & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 781.6 Percentage Change: + 5.17% Day High: 786.2 Day Low: 739.4

Currently allowing mild optimism, CCL moving above 787 should promote reco ……..

</p

View Previous Carnival & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 87.82 Percentage Change: -0.86% Day High: 90.04 Day Low: 87.16

All Centrica needs are mid-price trades ABOVE 90.05 to improve acceleratio ……..

</p

View Previous Centrica & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 29.28 Percentage Change: + 2.74% Day High: 29.42 Day Low: 28.26

In the event of Capita enjoying further trades beyond 30, the share should ……..

</p

View Previous Capita & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 369 Percentage Change: + 4.98% Day High: 367.8 Day Low: 353.2

Now above 370 suggests the potential of recovery to 396 with secondary, if ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 268.6 Percentage Change: + 1.44% Day High: 269.6 Day Low: 264.3

Continued trades against EMG with a mid-price ABOVE 270 should improve the ……..

</p

View Previous MAN & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2759 Percentage Change: -0.76% Day High: 2802 Day Low: 2755

Continued trades against EXPN with a mid-price ABOVE 2803 should improve t ……..

</p

View Previous Experian & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 43.45 Percentage Change: -1.41% Day High: 44.42 Day Low: 43.07

Further movement against Lloyds Grp. ABOVE 44.5 should improve acceleratio ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:POLY Polymetal Close Mid-Price: 225 Percentage Change: -4.30% Day High: 270 Day Low: 210

“They” appear to be teasing with this but movement now above 270p apparent ……..

</p

View Previous Polymetal & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 92.03 Percentage Change: -1.94% Day High: 94.8 Day Low: 91.58

All Rolls Royce needs are mid-price trades ABOVE 95 to improve acceleratio ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 10895 Percentage Change: + 0.74% Day High: 10980 Day Low: 10800

Target Met. Now above 10980 calculates with the potential of 11566 next wi ……..

</p

View Previous Spirax & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 122.25 Percentage Change: + 1.33% Day High: 122.2 Day Low: 120.1

Continued trades against TW. with a mid-price ^ABOVE 123 should improve th ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 129.26 Percentage Change: -1.33% Day High: 132.04 Day Low: 129.34

Target Met. Now above 132.1 should trigger 134.7 next with secondary, if b ……..

</p

View Previous Vodafone & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 123 Percentage Change: + 4.24% Day High: 123 Day Low: 118

Ongoing traffic above 123 remains pointing at an initial 133 with secondar ……..

</p

View Previous Zoo Digital & Big Picture ***