#FTSE #Gold

We reviewed #Bitcoin a month ago, speculating it was heading to $21,400. As hysteria in the media confirms, the crypto has indeed achieved this target level, ensuring the world has ended for some traders. However, we’ve spotted something which may prove important in the spiral to oblivion!

Regular readers will know we habitually give a primary, then a secondary, target.

The reason for this is pretty straightforward, generally a price will not go directly to a target level. Instead, sometimes it will stutter around the primary target until sufficient number of suckers believe it’s not dropping further. Then it drops further.

However, we always throw in an important caveat, generally suggesting “our secondary, if initial target is broken, works out at XYZ”. There’s a little more to this statement than just giving ourselves some wiggle room as it’s often critical how a price behaves at a target level, if we’re going to be given a clue to future behaviour. In the case of Bitcoin, our argument was along the lines of “If $21,410 breaks, our longer term secondary calculates at $13,800.

When we zoom in and look at how Bitcoin has behaved, there are a few interesting facets to the crypto fall from grace which perhaps imply it’s not intending a return to price levels last seen toward the end of 2020. With share prices, this sort of thing is a fairly big deal, so we’re obviously fascinated to see how the logic applies to crypto.

The chart extract above highlights something which may prove fascinating. The initial drop for Bitcoin failed to break our 21,400 target, instead bouncing (slightly) around 21,900. The next day. it indeed broke our target but closed above. Similarly on day three. Without a doubt, our target level has validity but it took a fourth session before Bitcoin finally immolated itself. When this sort of thing occurs with share prices, we tend toward considerable caution with expectations for our secondary to make an appearance. Instead, we start looking for early logic which shall indicate surprise recovery. At time of writing, Bitcoin is trading around 20,400, needing “only” to jump $2,000 above $22,400 to suggest it’s all been a bad dream and some recovery is happening!

Who knows, perhaps Bitcoin shall again surprise everyone…

FTSE for Friday

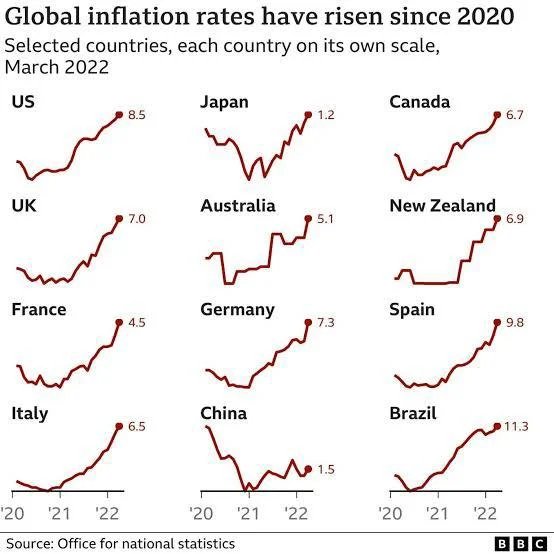

For a while in 2021, we quite liked the way the FTSE was behaving. Generally, the UK market was proving strong, while European markets were experiencing difficulty. Unfortunately, the UK has reverted to “type”, indulging in some truly awful dramatics just because everyone else is doing it. A graphic from the UK state broadcaster, the BBC, rather neatly encapsulates just how vile things are presently. It remains an ongoing puzzle just how Governments intend curb inflation by increasing interest rates, creating further pressure for prices to increase. Instead, why are Japan & China not being examined to discover the cause of their parsimonious inflation rates. If it means eating more rice, our household are completely on board as we already purchase Thai Jasmine rice by the 12kg sack. (We like rice)

The FTSE is certainly in a problematic position, breaking the uptrend since the Covid-19 low

and also failing to better the high of 2020, a point in time when ‘Pandemic’ was just a useful Scrabble word. More frightening, market movements during June are starting to feel dangerously reminiscent of 2008, a point in time which was quite scary. If that’s the case, we’re only perhaps witnessing the opening salvoes of some troubled times.

The immediate situation suggests weakness now below 7039 points threaten ongoing reversal to 7001 points, a market level at which we’d hope for a bounce – in normal circumstances. Our secondary, should the initial target break, calculates at 6782 points. We cannot suggest the secondary as a ‘longer term’ thing, thanks to current market movements proving painfully wide.

Our alternate scenario, if searching for gains, comes should the FTSE manage to exceed 7080 points as apparently, this risks triggering a surprise movement to 7136 points. Should this initial target be exceeded, our secondary calculates at 7200 points. This secondary level should prove a really big deal, given it matches the point of trend break. Market closure above such a level shall indicate, quite firmly, the immediate drop cycle is probably over.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:46:11PM | BRENT | 117.61 | 114 | 113.23 | 116.9 | 118.7 | 120.015 | 116.2 | ‘cess | ||

| 9:48:28PM | GOLD | 1857 | 1815 | 1780 | 1849 | 1858 | 1860 | 1843 | Success | ||

| 9:56:06PM | FTSE | 7022 | 6991 | 6939 | 7096 | 7116 | 7128 | 7043 | Success | ||

| 9:58:32PM | FRANCE | 5852 | 5835 | 5805 | 5908 | 5932 | 5938 | 5878 | Success | ||

| 10:01:05PM | GERMANY | 13013 | 12946 | 12874 | 13020 | 13162 | 13186 | 13066 | Success | ||

| 10:19:48PM | US500 | 3676 | 3635 | 3616 | 3689 | 3690 | 3712 | 3648 | Success | ||

| 10:22:07PM | DOW | 30004 | 29732 | 29505 | 29907 | 30294 | 30501 | 30030 | ‘cess | ||

| 10:24:26PM | NASDAQ | 11177 | 11020 | 10887 | 11596 | 11463 | 11571 | 11235 | ‘cess | ||

| 10:28:15PM | JAPAN | 25715 | 25585 | 25486 | 25787 | 26055 | 26200 | 25700 | Success |

16/06/2022 FTSE Closed at 7044 points. Change of -3.15%. Total value traded through LSE was: £ 9,051,276,874 a change of 32.71%

15/06/2022 FTSE Closed at 7273 points. Change of 1.2%. Total value traded through LSE was: £ 6,820,318,073 a change of -14.4%

14/06/2022 FTSE Closed at 7187 points. Change of -0.25%. Total value traded through LSE was: £ 7,967,426,420 a change of 8.5%

13/06/2022 FTSE Closed at 7205 points. Change of -1.53%. Total value traded through LSE was: £ 7,343,380,444 a change of 22%

10/06/2022 FTSE Closed at 7317 points. Change of -2.13%. Total value traded through LSE was: £ 6,019,204,674 a change of -10.01%

9/06/2022 FTSE Closed at 7476 points. Change of -1.54%. Total value traded through LSE was: £ 6,688,998,845 a change of -1.03%

8/06/2022 FTSE Closed at 7593 points. Change of -0.07%. Total value traded through LSE was: £ 6,758,685,339 a change of -1.74%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:CCL Carnival** **LSE:DDDD 4D Pharma** **LSE:EXPN Experian** **LSE:HIK Hikma** **LSE:HL. Hargreaves Lansdown** **LSE:HUR Hurrican Energy** **LSE:IAG British Airways** **LSE:IHG Intercontinental Hotels Group** **LSE:IPF International Personal Finance** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:JET Just Eat** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:OXIG Oxford Instruments** **LSE:RKH Rockhopper** **LSE:SPX Spirax** **

********

Updated charts published on : Aston Martin, Asos, Carnival, 4D Pharma, Experian, Hikma, Hargreaves Lansdown, Hurrican Energy, British Airways, Intercontinental Hotels Group, International Personal Finance, ITM Power, Intertek, ITV, Just Eat, Lloyds Grp., Marks and Spencer, Rockhopper, Spirax,

LSE:AML Aston Martin Close Mid-Price: 468.7 Percentage Change: -8.13% Day High: 516.6 Day Low: 466.3

Target met. If Aston Martin experiences continued weakness below 466.3, i ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos Close Mid-Price: 783.5 Percentage Change: -32.46% Day High: 1040 Day Low: 775

Target met. Weakness on Asos below 775 will invariably lead to 645 with s ……..

</p

View Previous Asos & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 654.8 Percentage Change: -10.08% Day High: 730.4 Day Low: 652.8

Target met. Continued weakness against CCL taking the price below 652.8 c ……..

</p

View Previous Carnival & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 23.8 Percentage Change: -7.21% Day High: 26.15 Day Low: 23.25

Weakness on 4D Pharma below 23.25 will invariably lead to 18 with seconda ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2293 Percentage Change: -2.47% Day High: 2344 Day Low: 2266

Continued weakness against EXPN taking the price below 2266 calculates as ……..

</p

View Previous Experian & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1485 Percentage Change: -2.17% Day High: 1515.5 Day Low: 1466

In the event Hikma experiences weakness below 1466 it calculates with a d ……..

</p

View Previous Hikma & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 762.6 Percentage Change: -3.42% Day High: 787.6 Day Low: 760

Weakness on Hargreaves Lansdown below 760 will invariably lead to 513 wit ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:HUR Hurrican Energy Close Mid-Price: 7.1 Percentage Change: -4.05% Day High: 7.93 Day Low: 6.74

Continued weakness against HUR taking the price below 6.74 calculates as ……..

</p

View Previous Hurrican Energy & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 109.22 Percentage Change: -7.20% Day High: 118.24 Day Low: 109.48

In the event British Airways experiences weakness below 109.48 it calcul ……..

</p

View Previous British Airways & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 4238 Percentage Change: -4.70% Day High: 4431 Day Low: 4231

If Intercontinental Hotels Group experiences continued weakness below 423 ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 76.8 Percentage Change: + 0.39% Day High: 76.9 Day Low: 75.5

Weakness on International Personal Finance below 75.5 will invariably lea ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 205.8 Percentage Change: -3.33% Day High: 219.2 Day Low: 201.4

Continued weakness against ITM taking the price below 201.4 calculates as ……..

</p

View Previous ITM Power & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4202 Percentage Change: -1.18% Day High: 4231 Day Low: 4141

In the event Intertek experiences weakness below 4141 it calculates with ……..

</p

View Previous Intertek & Big Picture ***

LSE:ITV ITV Close Mid-Price: 65.24 Percentage Change: -6.83% Day High: 70.28 Day Low: 64.88

Continued weakness against ITV taking the price below 64.88 calculates as ……..

</p

View Previous ITV & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1369.2 Percentage Change: -10.15% Day High: 1507.8 Day Low: 1356.2

Target met. Weakness on Just Eat below 1356.2 will invariably lead to 130 ……..

</p

View Previous Just Eat & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 42.24 Percentage Change: -4.14% Day High: 44.12 Day Low: 42.16

Continued weakness against LLOY taking the price below 42.16 calculates a ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 132.5 Percentage Change: -4.71% Day High: 137.9 Day Low: 129.6

In the event Marks and Spencer experiences weakness below 129.6 it calcul ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 1986 Percentage Change: -8.48% Day High: 2165 Day Low: 1956

Target met. If Oxford Instruments experiences continued weakness below 19 ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RKH Rockhopper Close Mid-Price: 7.25 Percentage Change: -8.92% Day High: 7.3 Day Low: 6.94

Target met. Weakness on Rockhopper below 6.94 will invariably lead to 6p ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 9168 Percentage Change: -3.45% Day High: 9456 Day Low: 9048

In the event Spirax experiences weakness below 9048 it calculates with a ……..

</p

View Previous Spirax & Big Picture ***