#FTSE #Nasdaq

By unspoken agreement, when my wife arrived home from an expedition to the mainland, I’m always “on duty”, able to help unload whatever garbage she’s bought from garden centres, home hardware stores, and of course, Tesco. But today, she drove up the driveway and despite me working with the garden strimmer, felt able to empty the card on her own. The reason was quite simple. We’ve a petrol strimmer and there’s a Big Rule with petrol driven garden machines. Once you’ve got the things started, under no circumstances dare you stop the engine unless you want a fight with the pull chord.In a fit of inspiration, came the realisation the stock market is nothing like a garden strimmer.

Due to the machines warped sense of humour, once started you must keep it going whereas with the stock market, there is no reason to always have a play in place. Often (like currently) quite the opposite applies and deciding to step away can often be the most important winning trade. Many traders will doubtless not talk about these incidents, substantial losses caused by a feeling they “had” to trade despite a small voice saying the opposite. In-house, we’ve currently got a hysterical pretend position with one of the Spread Bet organisations. For reasons which should be obvious, we maintain several demo accounts as it can prove quite surprising how different organisations present the futures markets. The numbers never vary that greatly but it can prove a mild shock, when ‘after hours’ market spikes occur as some providers exaggerate just a little.

Our in-house faux pas occurred toward the end of January, a spur of the moment decision to “buy” Nasdaq at 13,807, thanks to a spike down on one of the demo platforms. Of course, as it was a pretend trade, it was also completely forgotten about until this evening, when a glance at that particular Spread Bet platform revealed the trade was now 1,000 points down. Placing even a demo trade, out of boredom, was silly, especially one which had neither a Stop Loss order nor a Close Position & Profit order.

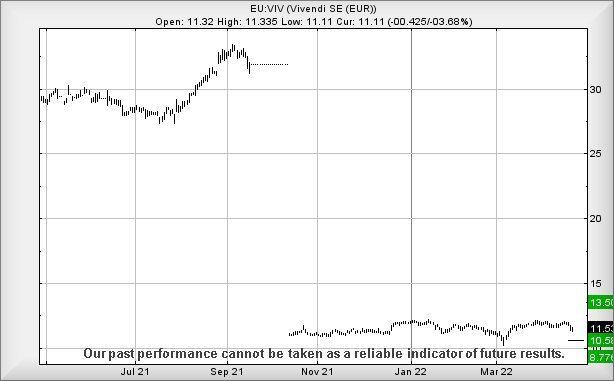

To escape the above epiphany and return to the real world, our glance at various European shares revealed Vivendi appear on the edge of some troubling behaviour. Since their parting of ways with Universal Music last year, the share price has described a pretty boring path, fluttering around the 10-12€ level. However, it appears to be knocking on the door of some dramatics at present, the share price needing below 11.05€ to trigger reversals to an initial 10.5.

It’s crucial to note, should 10.5 break, there’s a very real risk for ongoing reversal down to a bottom of 8.77€, hopefully a level the share price decides to bounce. From a Big Picture perspective, the share is already lurching around at bottom levels, resulting in a mild hope 10.5 may be deemed “bottom” and with any bounce capable of bettering 12.2€, travel to 13.5 calculates as possible.

Perhaps worth keeping an eye on.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:17:41PM | FTSE | 7311 | 7300 | 7260 | 7185 | 7388 | 7461 | 7499 | 7513 | 7391 | Shambles |

| 10:20:10PM | BRENT | 105.07 | |||||||||

| 10:22:07PM | GOLD | 1905.62 | |||||||||

| 10:23:48PM | FRANCE | 6369.2 | |||||||||

| 10:26:48PM | GERMANY | 13566.45 | Success | ||||||||

| 10:31:02PM | US500 | 4149.77 | Success | ||||||||

| 10:33:15PM | DOW | 33235 | ‘cess | ||||||||

| 10:35:59PM | NASDAQ | 12838.87 | 12792 | 12702 | 12473 | 12932 | 13225 | 13257 | 13411 | 13093 | ‘cess |

| 10:38:28PM | JAPAN | 25998 | Success |

26/04/2022 FTSE Closed at 7386 points. Change of 0.08%. Total value traded through LSE was: £ 7,501,270,625 a change of 7.74%

25/04/2022 FTSE Closed at 7380 points. Change of -1.87%. Total value traded through LSE was: £ 6,962,693,363 a change of 2.9%

22/04/2022 FTSE Closed at 7521 points. Change of -1.39%. Total value traded through LSE was: £ 6,766,539,663 a change of -21.54%

21/04/2022 FTSE Closed at 7627 points. Change of -0.03%. Total value traded through LSE was: £ 8,624,086,669 a change of 11.51%

20/04/2022 FTSE Closed at 7629 points. Change of 0.37%. Total value traded through LSE was: £ 7,734,053,627 a change of 26.25%

19/04/2022 FTSE Closed at 7601 points. Change of -100%. Total value traded through LSE was: £ 6,126,164,773 a change of 0%

14/04/2022 FTSE Closed at 7616 points. Change of 0%. Total value traded through LSE was: £ 6,624,976,338 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:CCL Carnival** **LSE:EZJ EasyJet** **LSE:IQE IQE** **LSE:OCDO Ocado Plc** **LSE:RR. Rolls Royce** **LSE:SRP Serco** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Asos, Carnival, EasyJet, IQE, Ocado Plc, Rolls Royce, Serco, Taylor Wimpey,

LSE:ASC Asos Close Mid-Price: 1334 Percentage Change: -4.71% Day High: 1430 Day Low: 1331

In the event Asos experiences weakness below 1331 it calculates with a dr ……..

</p

View Previous Asos & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1284 Percentage Change: -2.13% Day High: 1357 Day Low: 1280.5

Perhaps above 1470 shall give hope, hinting at the potential of recovery t ……..

</p

View Previous Carnival & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 553.2 Percentage Change: -2.67% Day High: 585 Day Low: 553.2

Easyjet feels like it is awaiting an excuse to head upward as movement now ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IQE IQE Close Mid-Price: 30.5 Percentage Change: -3.94% Day High: 32.6 Day Low: 30.5

If IQE experiences continued weakness below 30.5, it will invariably lead ……..

</p

View Previous IQE & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 950 Percentage Change: -8.30% Day High: 1048 Day Low: 950.6

Target met. Weakness on Ocado Plc below 950.6 will invariably lead to 941 ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 84.11 Percentage Change: -3.13% Day High: 89.01 Day Low: 84.19

Continued weakness against RR. taking the price below 84.19 calculates as ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SRP Serco Close Mid-Price: 149.7 Percentage Change: -0.20% Day High: 153.9 Day Low: 149.1

In the event of Serco enjoying further trades beyond 153.9, the share sho ……..

</p

View Previous Serco & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 128.75 Percentage Change: + 0.55% Day High: 133.4 Day Low: 129.05

Now below 128 looks troubling, calculating with the potential of weakness ……..

</p

View Previous Taylor Wimpey & Big Picture ***