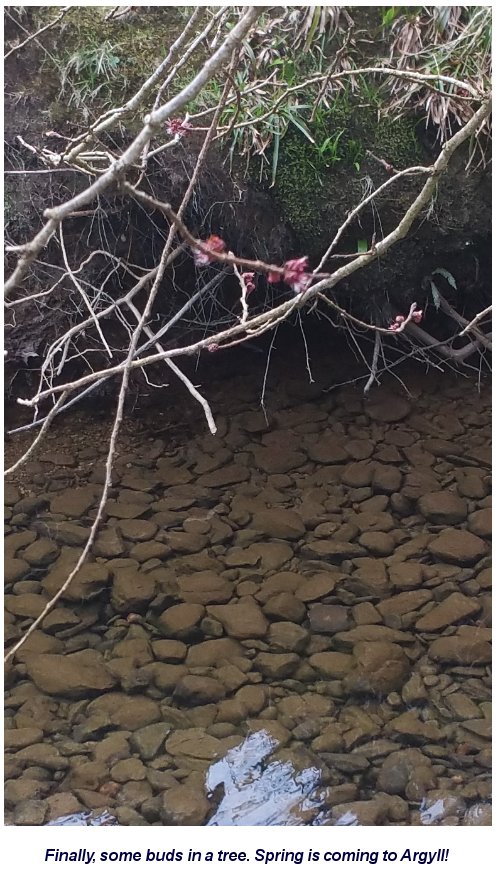

#BrentFutures #DAX Continuing our moan about the weather in Scotland, some early buds were spotted on a cherry blossom tree overhanging a garden pool. Maybe Spring is coming but during the night, we also saw -4c temperatures. Similarly, Lloyds Bank share price is currently exhibiting some tentative movements, perhaps teasing us of some good times ahead. Can we be confident?

If we continue to pretend optimism, apparently now above 45.55p should trigger a slow but steady, share price recovery toward an initial 53.5p, visually a truly remarkable result and an ambition capable of running into the Blue downtrend since the heady days before the pandemic. This sort of thing tends make the scenario believable but we’ve some doubts over our secondary calculation. We work out should 53.5p be exceeded, a secondary of 57.3p can be conjured.

Our worry about the secondary is it risks being quite game changing! It’s a high, higher than the previous high within the ruling downtrend, thus, in catchy market lingo, it’s an official “higher high”. This allows us to cough politely and grudgingly admit the Big Picture now exerts a longer term attraction at a future 77p, a return to levels not seen since 2015 and a more innocent time, when the UK chancellor was apparently working in the US, thanks to his Green Card credentials. Something distinctly fishy appears to be taking place with Ian Hyslop and Co being extremely careful with their words on the recent ‘Have I Got News For You’ telly show. Hopefully any impending implosion in the UK treasury fails to further damage the banking sector.

However, should the UK chancellor intend continue the illustrious political tradition of ruining the markets, Lloyds need only trade below 43.3p to risk triggering reversals to an initial 40.5p. If broken, our secondary calculates at 37.3p, breaking the immediate uptrend and risking a visit to a longer term “bottom” at 28p. Similar to everything going on in Downing St, the weight of movements against Lloyds share price is extremely messy but fast approaching a point where some solid movements shall become inevitable. Unfortunately, we lack confidence as to direction currently.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 1:51:03PM | BRENT | 102.42 | 98.34 | 95.655 | 87.37 | 102 | 104.35 | 105.585 | 108 | 100.7 | |

| 8:32:13PM | GOLD | 1947.64 | ‘cess | ||||||||

| 9:01:30PM | FTSE | 7650.67 | Success | ||||||||

| 9:03:58PM | FRANCE | 6509.5 | |||||||||

| 9:21:02PM | GERMANY | 14224 | 14135 | 14102 | 14028 | 14205 | 14326 | 14363 | 14475 | 14226 | |

| 9:22:43PM | US500 | 4492 | |||||||||

| 9:46:40PM | DOW | 34737 | ‘cess | ||||||||

| 9:48:31PM | NASDAQ | 14331 | |||||||||

| 9:50:29PM | JAPAN | 26998 |

8/04/2022 FTSE Closed at 7669 points. Change of 1.56%. Total value traded through LSE was: £ 5,560,387,967 a change of -14.51%

7/04/2022 FTSE Closed at 7551 points. Change of -0.47%. Total value traded through LSE was: £ 6,503,801,029 a change of -11.79%

6/04/2022 FTSE Closed at 7587 points. Change of -0.34%. Total value traded through LSE was: £ 7,373,306,998 a change of -8.37%

5/04/2022 FTSE Closed at 7613 points. Change of 0.73%. Total value traded through LSE was: £ 8,046,795,473 a change of 61.76%

4/04/2022 FTSE Closed at 7558 points. Change of 0.28%. Total value traded through LSE was: £ 4,974,492,195 a change of -8.16%

1/04/2022 FTSE Closed at 7537 points. Change of 0.29%. Total value traded through LSE was: £ 5,416,602,044 a change of -16.69%

31/03/2022 FTSE Closed at 7515 points. Change of -0.83%. Total value traded through LSE was: £ 6,501,691,261 a change of -12.58%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BT.A British Telecom** **LSE:CASP Caspian** **LSE:FGP Firstgroup** **LSE:GLEN Glencore Xstra** **LSE:SPX Spirax** **LSE:VOD Vodafone** **

********

Updated charts published on : Avacta, Astrazeneca, British Telecom, Caspian, Firstgroup, Glencore Xstra, Spirax, Vodafone,

LSE:AVCT Avacta. Close Mid-Price: 99.6 Percentage Change: + 11.91% Day High: 105.5 Day Low: 90

Target met. In the event of Avacta enjoying further trades beyond 105.5, ……..

</p

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 10930 Percentage Change: + 2.46% Day High: 11000 Day Low: 10718

Target met. All Astrazeneca needs are mid-price trades ABOVE 11000 to imp ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 191 Percentage Change: + 1.35% Day High: 192.7 Day Low: 188.85

Further movement against British Telecom ABOVE 192.7 should improve accel ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 3 Percentage Change: -4.76% Day High: 3.15 Day Low: 2.85

Weakness on Caspian below 2.85 will invariably lead to 2.2 with secondary ……..

</p

View Previous Caspian & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 114.2 Percentage Change: -0.26% Day High: 116.4 Day Low: 113.6

In the event of Firstgroup enjoying further trades beyond 116.4, the shar ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 528 Percentage Change: + 2.58% Day High: 527.7 Day Low: 515.8

Target met. Further movement against Glencore Xstra ABOVE 527.7 should im ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 12710 Percentage Change: -2.19% Day High: 13140 Day Low: 12480

All Spirax needs are mid-price trades ABOVE 13140 to improve acceleration ……..

</p

View Previous Spirax & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 129.28 Percentage Change: + 1.92% Day High: 129.64 Day Low: 127.48

There are some early signs this may be getting ready to move. Above just 1 ……..

</p

View Previous Vodafone & Big Picture ***